- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

Will CytomX Therapeutics' (CTMX) CX-801 Data Deepen Confidence in Its Immunotherapy Platform?

Reviewed by Sasha Jovanovic

- CytomX Therapeutics announced it will present initial translational data from its ongoing Phase 1 study of CX-801 in advanced melanoma at the Society for Immunotherapy of Cancer (SITC) 40th Anniversary Annual Meeting, scheduled for November 7-9, 2025, in National Harbor, MD.

- This upcoming clinical update provides stakeholders with a key opportunity to assess the potential of CytomX's immunotherapy pipeline, possibly shaping future expectations around its development progress and clinical impact.

- With the upcoming clinical data presentation for CX-801, we'll explore how new insights into its immunotherapy platform influence CytomX's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CytomX Therapeutics Investment Narrative Recap

To own shares of CytomX Therapeutics, you need conviction in the company’s ability to deliver successful clinical progress with assets like CX-2051 and CX-801, both still early in development. The upcoming clinical data from the CX-801 study is a focal point and could influence the stock’s short-term catalyst, but the impact won’t be fully understood until results are released; the biggest risk continues to be clinical setbacks and delays affecting R&D costs, revenue timing, and cash runway.

Of recent developments, the company’s May 2025 announcement of dosing the first patient with CX-801 in combination with Merck’s KEYTRUDA stands out. This milestone demonstrates advancement in the immunotherapy pipeline and is highly relevant to the imminent SITC presentation, as any positive signals from those data may influence near-term partnership opportunities, cash flow, or pipeline expansion.

Yet, in contrast, investors should be aware of challenges such as ongoing dependence on successful clinical progression, as...

Read the full narrative on CytomX Therapeutics (it's free!)

CytomX Therapeutics' outlook suggests revenues will decrease to $45.0 million and earnings to $6.4 million by 2028. This corresponds to a -31.7% annual revenue decline and an earnings decrease of $41.6 million from current earnings of $48.0 million.

Uncover how CytomX Therapeutics' forecasts yield a $6.14 fair value, a 56% upside to its current price.

Exploring Other Perspectives

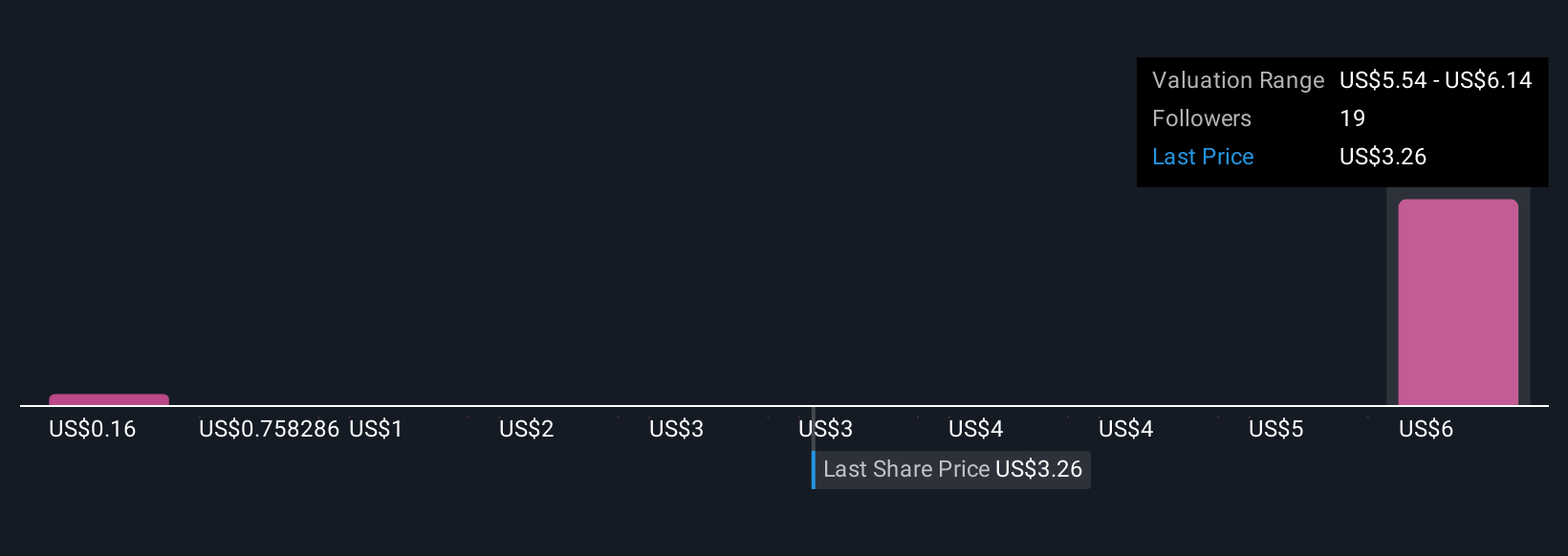

Five private investors in the Simply Wall St Community generated fair value estimates for CytomX ranging from US$0.16 to US$6.14 per share. While opinions are wide-ranging, the upcoming clinical data presentation adds urgency to assessing whether clinical progress can address concerns about revenue declines and funding risk.

Explore 5 other fair value estimates on CytomX Therapeutics - why the stock might be worth less than half the current price!

Build Your Own CytomX Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CytomX Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CytomX Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CytomX Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives