- United States

- /

- Life Sciences

- /

- NasdaqGS:CTKB

Revenues Tell The Story For Cytek Biosciences, Inc. (NASDAQ:CTKB) As Its Stock Soars 43%

The Cytek Biosciences, Inc. (NASDAQ:CTKB) share price has done very well over the last month, posting an excellent gain of 43%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

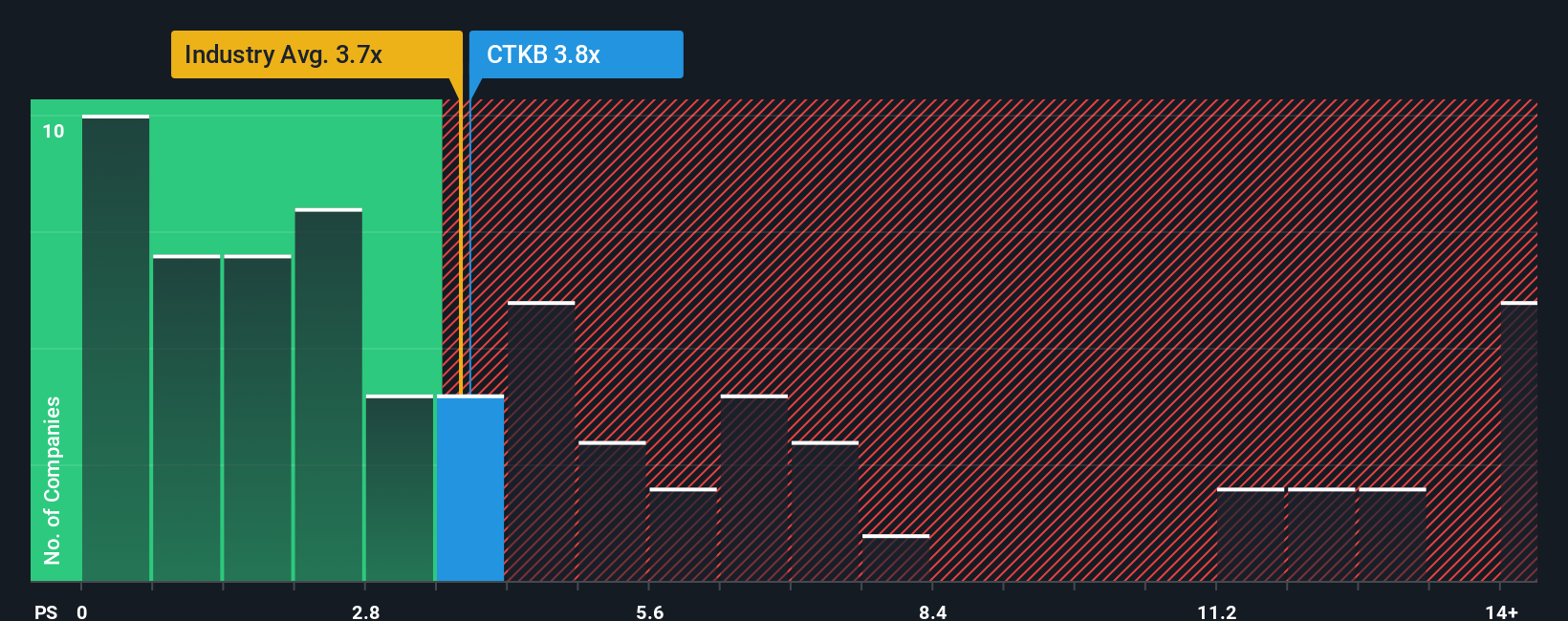

In spite of the firm bounce in price, there still wouldn't be many who think Cytek Biosciences' price-to-sales (or "P/S") ratio of 3.8x is worth a mention when the median P/S in the United States' Life Sciences industry is similar at about 3.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Cytek Biosciences

What Does Cytek Biosciences' Recent Performance Look Like?

Cytek Biosciences could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cytek Biosciences will help you uncover what's on the horizon.How Is Cytek Biosciences' Revenue Growth Trending?

Cytek Biosciences' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.2%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 27% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 6.8% per year as estimated by the five analysts watching the company. With the industry predicted to deliver 6.6% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why Cytek Biosciences is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Cytek Biosciences' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Cytek Biosciences' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for Cytek Biosciences that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTKB

Cytek Biosciences

A cell analysis solutions company, provides cell analysis tools that facilitates scientific advances in biomedical research and clinical applications.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives