- United States

- /

- Life Sciences

- /

- NasdaqGS:CTKB

Cytek Biosciences, Inc.'s (NASDAQ:CTKB) Shares Not Telling The Full Story

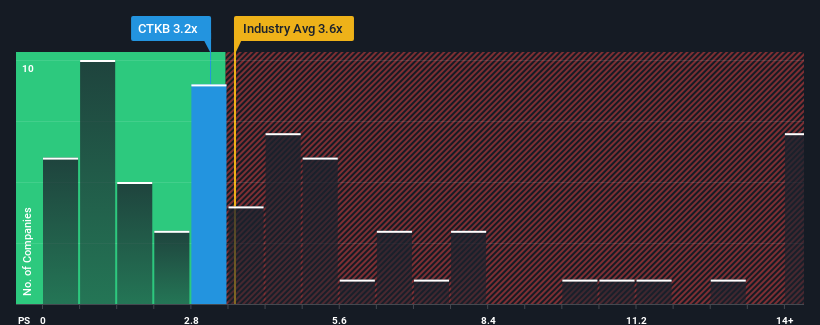

With a median price-to-sales (or "P/S") ratio of close to 3.6x in the Life Sciences industry in the United States, you could be forgiven for feeling indifferent about Cytek Biosciences, Inc.'s (NASDAQ:CTKB) P/S ratio of 3.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Cytek Biosciences

How Cytek Biosciences Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Cytek Biosciences has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Cytek Biosciences will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Cytek Biosciences will help you uncover what's on the horizon.How Is Cytek Biosciences' Revenue Growth Trending?

In order to justify its P/S ratio, Cytek Biosciences would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 79% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 11% over the next year. That's shaping up to be materially higher than the 5.3% growth forecast for the broader industry.

In light of this, it's curious that Cytek Biosciences' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Cytek Biosciences' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Cytek Biosciences currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Cytek Biosciences with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTKB

Cytek Biosciences

A cell analysis solutions company, provides cell analysis tools that facilitates scientific advances in biomedical research and clinical applications.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives