- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (CRSP): Assessing Valuation After FDA Moves to Accelerate Gene Editing Approvals

Reviewed by Simply Wall St

The US FDA’s announcement to simplify its approval process for gene editing therapies has put CRISPR Therapeutics (CRSP) in the spotlight. Investors anticipate faster product development and potentially stronger sector investment on the horizon.

See our latest analysis for CRISPR Therapeutics.

Following the FDA’s regulatory shift, CRISPR Therapeutics’ share price surged earlier this year but has recently lost momentum, down 16.7% over the last month and 12.1% in the past week. Still, the stock remains up over 36% year-to-date and has delivered a 12% one-year total shareholder return. This suggests momentum may be cooling after a strong run, but longer-term investors have seen decent gains amid ongoing sector optimism.

If the gene editing boom has sparked your curiosity, now is an ideal time to discover other healthcare innovators. See the full list here: See the full list for free.

With analyst targets nearly 47% above the current share price and recent gains giving way to a pullback, the real question is whether CRISPR Therapeutics is trading at a discount or if future growth is already accounted for by the market.

Price-to-Book Ratio of 3x: Is it justified?

CRISPR Therapeutics is trading at a price-to-book ratio of 3x, which is notably lower than its peer average of 6x. However, compared to the US Biotechs sector average price-to-book ratio of 2.4x, CRSP appears somewhat expensive at current levels.

The price-to-book ratio compares a company’s market value to its book value, helping investors gauge whether the stock is priced fairly in relation to its underlying assets. For biotechs, which often have limited profits and focus heavily on asset-driven innovation, this figure can carry special weight.

CRSP's valuation stands out as attractive compared to direct peers, possibly reflecting investor confidence in its technology and future growth prospects. Yet, when considered alongside the broader industry, this premium could signal lofty expectations that may not be fully backed by fundamentals. If a fair ratio becomes a new anchor, the market could move closer to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3x (ABOUT RIGHT)

However, clinical setbacks or slower-than-expected regulatory approvals could challenge positive momentum and may lead to increased volatility for CRISPR Therapeutics.

Find out about the key risks to this CRISPR Therapeutics narrative.

Another View: Discounted Cash Flow Model

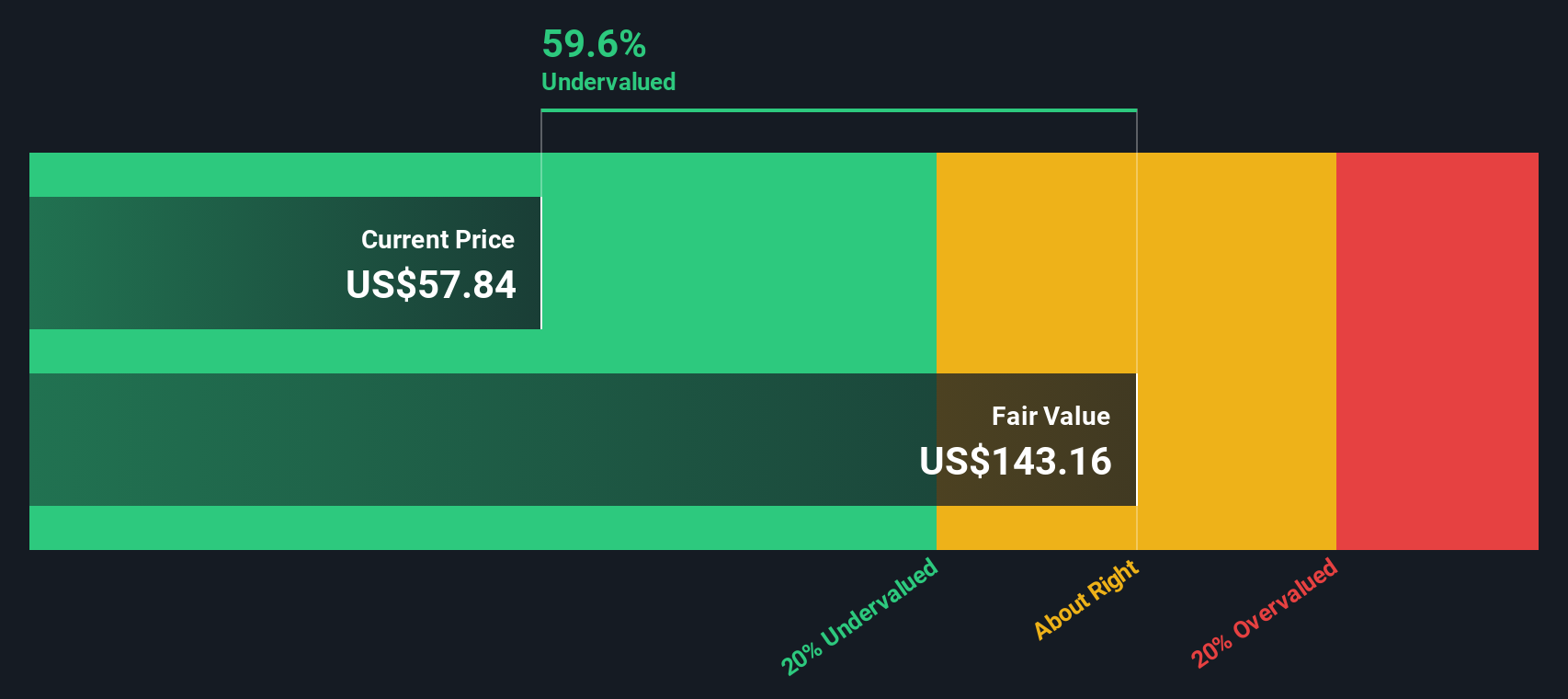

While the price-to-book ratio shows CRISPR Therapeutics trading at a slight premium to the industry, our DCF model offers a different perspective. It suggests shares are actually undervalued by more than 50%, which could mean the market is overlooking substantial future growth potential. Which view better captures reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

If you want a fresh perspective or prefer your independent analysis, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by spotting where the next wave of growth may appear. Let Simply Wall Street’s tools help you seize tomorrow’s opportunities now.

- Capture the momentum in artificial intelligence by checking out these 26 AI penny stocks that are powering innovation across multiple industries.

- Boost your income strategy with these 20 dividend stocks with yields > 3% offering strong yields and reliable payouts.

- Position yourself for long-term gains with these 840 undervalued stocks based on cash flows that are currently flying under the radar despite attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives