- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals Shares Swing After Data on Paltusotine and Valuation Metrics Scrutinized

Reviewed by Bailey Pemberton

If you have been eyeing shares of Crinetics Pharmaceuticals lately, you are not alone. Investors are wrestling with what to make of this intriguing biotech stock. After a sharp rally that lifted the price by nearly 18% over the last month, Crinetics gave back some ground, down 11% in the past week, and has struggled year to date with a loss of almost 21%. The stock’s one-year return sits at -23%. Looking further back, there are striking long-term gains of 135% over three years and 154% over five years. These dramatic swings reflect not only the volatility often seen in clinical-stage biotechs, but also shifting investor sentiment tied to market-wide moves and ongoing developments within the healthcare sector.

Despite the ups and downs, the big question is straightforward: Is Crinetics Pharmaceuticals undervalued right now, or has the recent enthusiasm already been priced in? According to our current valuation scorecard, Crinetics does not check any of the six boxes that would indicate undervaluation, and its value score sits at 0. For investors looking to make sense of whether the stock is a bargain or not, understanding what drives that score and what it might be missing is key.

Let us walk through the main valuation methods next and explore how they point to opportunity or caution. Stay tuned, as there is a more nuanced way to assess Crinetics’ true worth coming up at the end of the article.

Crinetics Pharmaceuticals scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Crinetics Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model seeks to estimate a company's intrinsic value by forecasting its future cash flows and then discounting those cash flows back to their value today. This method is especially useful for companies like Crinetics Pharmaceuticals that are still ramping up commercial operations, as it allows investors to look beyond current losses and focus on long-term potential.

For Crinetics Pharmaceuticals, analysts currently estimate that the company's Free Cash Flow is negative at about $302 million. Over the next several years, projections suggest that Free Cash Flow will remain negative through 2028 before turning positive in 2029, with roughly $77.7 million expected. Extrapolating even further, future Free Cash Flows continue to grow into the next decade, but all amounts remain well below $1 billion.

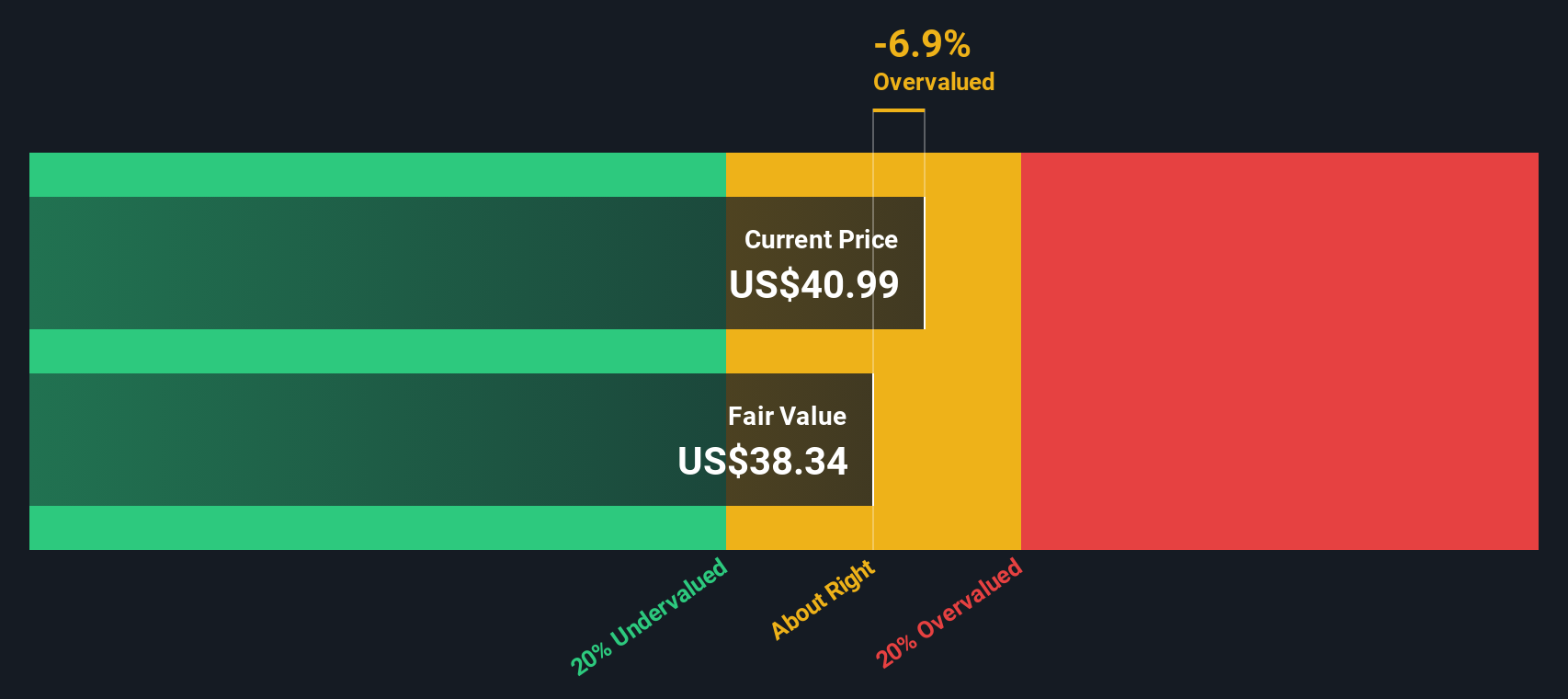

Taking all of these projections into account, the DCF model produces an intrinsic value of $38.34 per share. Comparing this to the current share price, the analysis reveals the stock is about 6.6% overvalued at today's levels. This deviation is small enough that the shares appear reasonably priced rather than clearly expensive or cheap.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Crinetics Pharmaceuticals's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Crinetics Pharmaceuticals Price vs Book

The price-to-book (PB) ratio is commonly used to value companies in the pharmaceutical and biotech sectors, especially when they are not yet profitable. Unlike earnings-focused multiples, PB compares a company's market value to its book value, making it more appropriate for clinical-stage biotechs like Crinetics Pharmaceuticals where profits may still be years away.

In general, higher expected growth or lower risk can support a higher PB ratio. Greater risks or slower anticipated growth should bring a company’s multiple closer to, or below, its industry average. Investors look to these benchmarks to judge whether a stock’s valuation is reasonable given its future potential and risks.

Crinetics currently trades at a PB ratio of 3.28x. This is above the pharmaceutical industry average of 2.23x, and higher than the peer average of 2.30x, which may initially look concerning. However, using Simply Wall St's "Fair Ratio," a proprietary metric that estimates what the PB multiple should be for Crinetics based on factors like projected growth, profit margins, market cap, and industry risk, provides a more nuanced perspective. By considering these company-specific attributes, the Fair Ratio offers a more tailored and meaningful valuation benchmark than simple peer or industry comparisons.

At present, the Fair Ratio for Crinetics is not materially different from its current PB ratio. This indicates that, according to our analysis, the stock is trading at a level that is reasonable when taking into account its unique growth outlook and risk profile.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crinetics Pharmaceuticals Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, intuitive way for you to tell your story about a company by connecting your outlook and assumptions (like fair value, future revenue, earnings, and margins) to a financial forecast. This process then determines what you think a stock is really worth.

Narratives bridge the gap between a company’s story and its numbers, helping you translate your perspective into a fair value and see how it compares to the current market price. With Simply Wall St’s platform, millions of investors are already using Narratives inside the Community page to create, share, and discover these perspectives with ease.

The power of Narratives lies in how quickly and dynamically they adjust as fresh news, earnings, or other major developments emerge. This allows you to make informed decisions about when to buy or sell based on the latest facts and a clear comparison between fair value and current price.

For example, one investor might see Crinetics as highly undervalued based on ambitious growth projections, while another may be far more cautious, assigning a much lower fair value because of regulatory risks.

Do you think there's more to the story for Crinetics Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives