- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals (CRNX): Valuation in Focus After Key Phase 3 Paltusotine Trial Milestone

Reviewed by Simply Wall St

Crinetics Pharmaceuticals (CRNX) just hit an important milestone in its pipeline, announcing that the first patient has been randomized in the pivotal Phase 3 CAREFNDR trial for paltusotine in carcinoid syndrome.

See our latest analysis for Crinetics Pharmaceuticals.

Crinetics Pharmaceuticals’ momentum seems to be shifting after a challenging start to the year. The company’s recent Phase 3 trial announcement comes on the heels of a 42% share price gain over the past 90 days, helping offset some of the earlier declines and sparking renewed optimism. Its one-year total shareholder return is still down 24%.

If the excitement around rare disease breakthroughs caught your interest, you’ll want to check out other innovators. See the full list of opportunities in our healthcare stocks screener. See the full list for free.

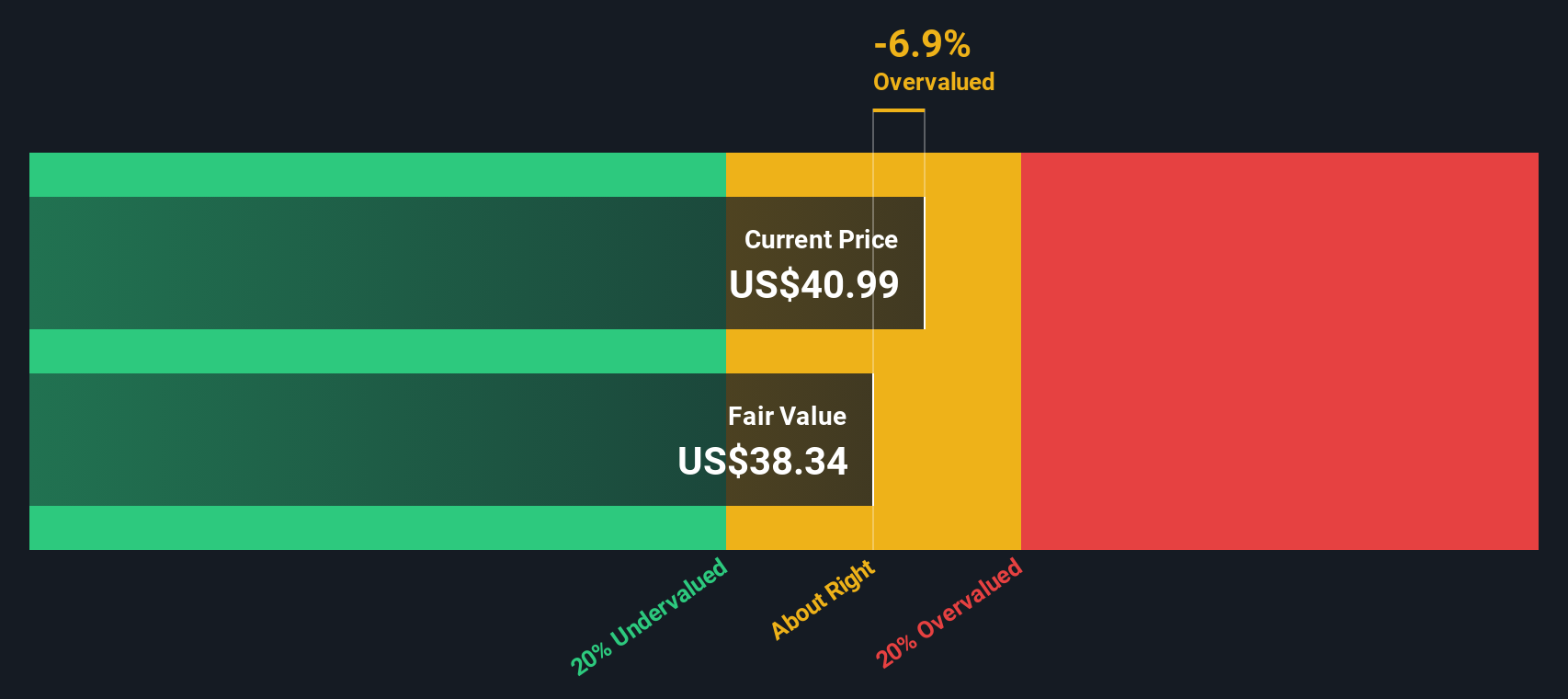

With shares rebounding sharply and new clinical progress on the horizon, the key debate is whether Crinetics Pharmaceuticals is trading at a bargain relative to its long-term potential or if recent optimism has already been fully priced in by the market.

Price-to-Book Ratio of 3.8x: Is it justified?

Crinetics Pharmaceuticals is currently trading at a price-to-book ratio of 3.8x, which is notably higher than the US Pharmaceuticals industry average of 2.3x. This elevated multiple means the market is assigning substantially more value to each dollar of net assets compared to its industry peers.

The price-to-book ratio reflects how much investors are willing to pay for a company’s net assets. For clinical-stage biotech firms like Crinetics Pharmaceuticals, investors often look beyond near-term profits and assign value based on pipeline promise and future growth prospects rather than tangible book value.

While some premium is expected for strong pipelines, Crinetics’ ratio stands out as expensive when compared directly to its industry. Without meaningful revenue or profits, this rich multiple could indicate optimism around pipeline milestones or recent momentum. It also leaves little room for disappointment if results do not materialize as hoped. Although there is insufficient data to judge what a "fair" price-to-book ratio would be for Crinetics, the current valuation far exceeds sector benchmarks and could pose downside risk if expectations reset.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.8x (OVERVALUED)

However, disappointing trial results or a shift in investor sentiment could quickly reverse recent gains and challenge the current valuation premium.

Find out about the key risks to this Crinetics Pharmaceuticals narrative.

Another View: Discounted Cash Flow Tells a Different Story

While the price-to-book ratio emphasizes overvaluation, our SWS DCF model suggests a much more optimistic scenario. By estimating future cash flows, the DCF model indicates shares of Crinetics Pharmaceuticals may actually be trading at a 62.9% discount to their fair value, which hints at significant upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Crinetics Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Crinetics Pharmaceuticals Narrative

If these conclusions differ from your own perspective, or you want to test your own investment thesis, it's simple and quick to create a personalized narrative in just a few minutes. Do it your way

A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunities pass you by. Tap into the latest market trends and upgrade your investment strategy with potential winners beyond Crinetics Pharmaceuticals using the tools below.

- Uncover fast-growing companies shaking up artificial intelligence by starting your search with these 26 AI penny stocks.

- Capture attractive yields by scanning for reliable earners through these 15 dividend stocks with yields > 3% and see which stocks are rewarding investors today.

- Get ahead of the curve and focus on long-term value using these 927 undervalued stocks based on cash flows, a tool designed to surface stocks with solid cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives