- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Crinetics Pharmaceuticals (CRNX) Is Down 8.0% After FDA Approves and Launches PALSONIFY for Acromegaly

Reviewed by Sasha Jovanovic

- Crinetics Pharmaceuticals recently announced the U.S. FDA approval and commercial launch of PALSONIFY (paltusotine) for treating adults with acromegaly, reporting early metrics of prescription uptake and field force coverage.

- This milestone marks Crinetics' transition to a commercial-stage company, supported by a strong cash position expected to fund operations into 2029 and ongoing advances in its clinical pipeline.

- With early signs of PALSONIFY’s market acceptance, we’ll explore how this new product launch shapes Crinetics’ investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Crinetics Pharmaceuticals' Investment Narrative?

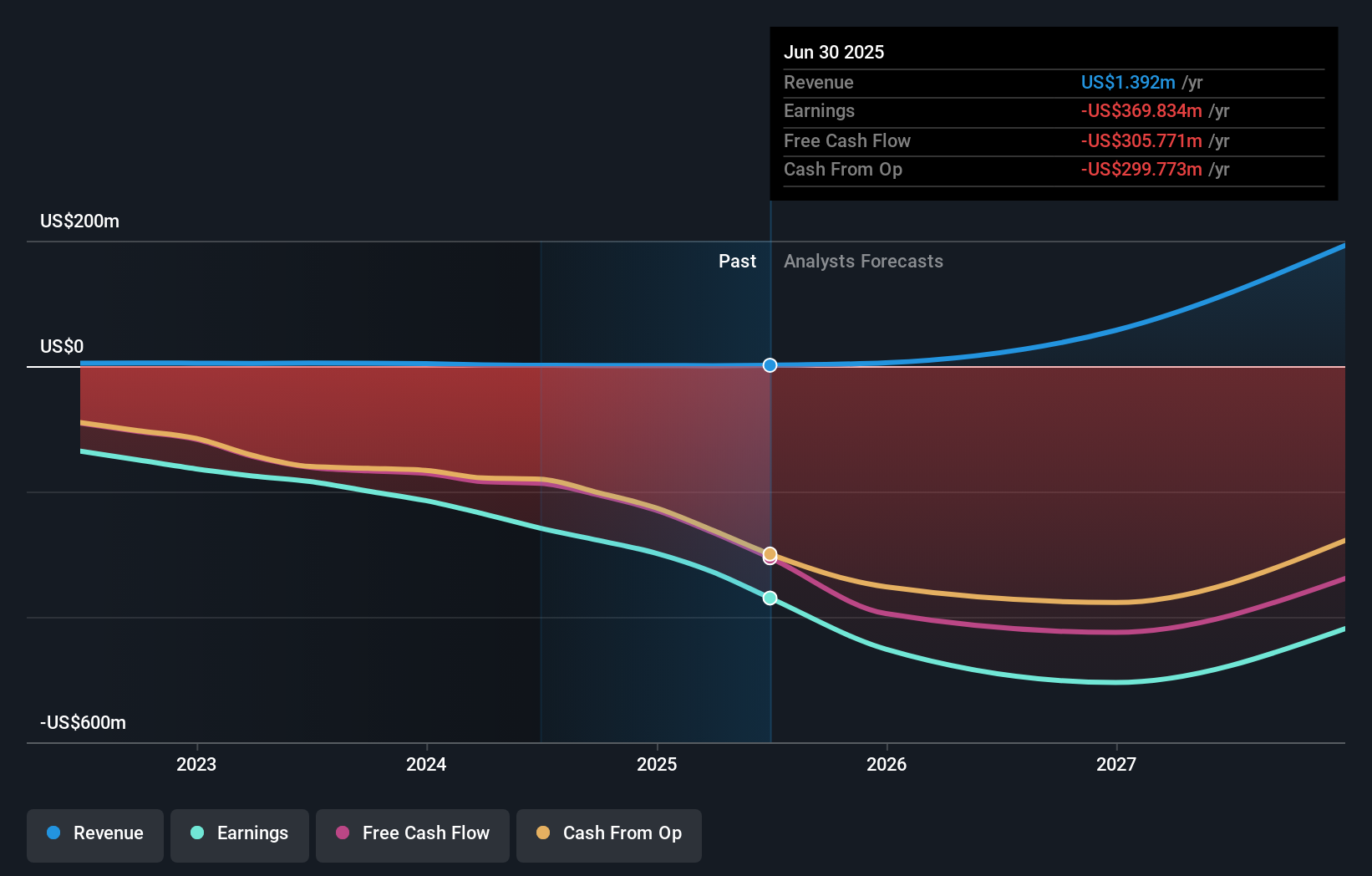

To own shares of Crinetics Pharmaceuticals right now, you need conviction in its ability to turn scientific milestones, like the recent FDA approval and commercial launch of PALSONIFY, into enduring growth. This shift to a commercial-stage company is immediately impactful, introducing new short-term catalysts centered on early prescription uptake, speed of patient and physician adoption, and how efficiently the company executes its commercial rollout. The news of a rapid market entry has lifted one of the biggest uncertainties, yet it doesn’t erase core risks: the company remains unprofitable, with quarterly net losses growing from last year to reach US$130.09 million and intensifying spend on research and commercialization. Now, market execution, pricing power, and ongoing trial outcomes matter more to its trajectory than ever. This reshuffles the risk profile, as initial uptake metrics become a central focus for investors recalibrating expectations.

But investors should be aware: the commercial rollout could face operational challenges that impact near-term expectations. Despite retreating, Crinetics Pharmaceuticals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Crinetics Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Crinetics Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crinetics Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crinetics Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Community Narratives