- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Will Strong Q3 Results and Workplace Honors Change Catalyst Pharmaceuticals' (CPRX) Investment Outlook?

Reviewed by Sasha Jovanovic

- Catalyst Pharmaceuticals recently reported its third quarter 2025 financial results, posting revenue of US$148.39 million and net income of US$52.78 million, both higher than the prior year.

- This strong financial performance coincided with the company's recognition as one of BioSpace's Best Places to Work for the second consecutive year, highlighting its commitment to talent development in rare disease treatment.

- With recent earnings growth outpacing prior periods, we'll examine how these results influence the company's investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Catalyst Pharmaceuticals Investment Narrative Recap

To be a shareholder in Catalyst Pharmaceuticals, you need to believe in the company’s ability to expand its rare disease portfolio and grow its patient base, particularly through FIRDAPSE and newer treatments. The most recent earnings report shows solid growth in both revenue and profit, but this strong result does not materially affect the company’s biggest short-term catalyst, broadening FIRDAPSE's use through diagnostic and payer access initiatives, or its most significant risk: ongoing reliance on FIRDAPSE amid patent challenges and generic threats.

Among the latest announcements, Catalyst’s legal settlements over FIRDAPSE patent protection stand out as highly relevant. These agreements push potential generic competition farther into the future, supporting margin stability and giving the company more time to pursue new launches and diversify earnings.

In contrast, investors should be aware that Catalyst’s revenue concentration in FIRDAPSE leaves it exposed if...

Read the full narrative on Catalyst Pharmaceuticals (it's free!)

Catalyst Pharmaceuticals' narrative projects $709.1 million in revenue and $253.5 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $44.8 million earnings increase from $208.7 million.

Uncover how Catalyst Pharmaceuticals' forecasts yield a $34.29 fair value, a 60% upside to its current price.

Exploring Other Perspectives

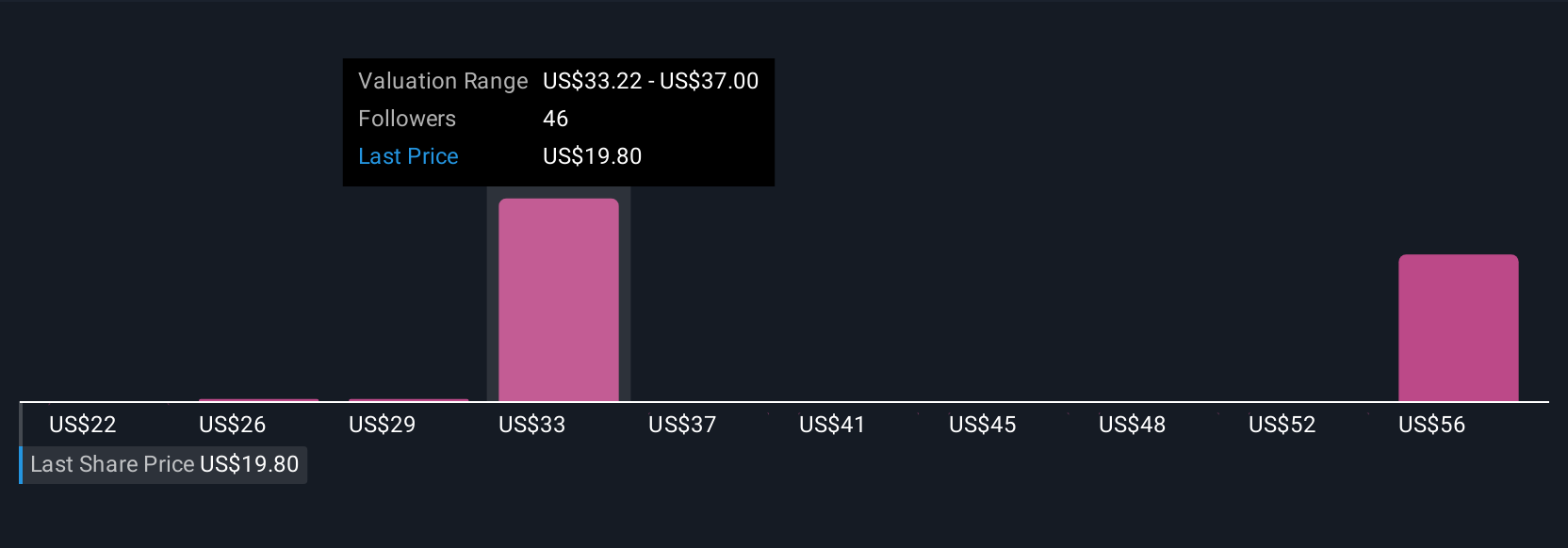

Simply Wall St Community members assigned fair values ranging from US$21.86 to US$59.27, based on 13 distinct estimates. This wide spread reflects how future revenue from expanding rare disease diagnoses and the company’s leadership in patient access could shape performance, but also highlights the need to consider several viewpoints.

Explore 13 other fair value estimates on Catalyst Pharmaceuticals - why the stock might be worth just $21.86!

Build Your Own Catalyst Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catalyst Pharmaceuticals research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Catalyst Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catalyst Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with outstanding track record.

Market Insights

Community Narratives