- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Is Catalyst Pharmaceuticals a Bargain After Regulatory Milestones and a 10% Share Price Jump?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Catalyst Pharmaceuticals could be great value or are curious what lies beneath the surface, you are definitely not alone.

- The stock has seen impressive short-term momentum, climbing 4.8% over the past week and up 10.3% in the last month. This adds to its strong multi-year track record.

- Analysts and investors have been paying close attention recently as ongoing progress in the company's rare disease drug portfolio and recent regulatory milestones have sparked fresh discussions about the business’s long-term outlook and its ability to deliver sustained growth. This context helps explain some of the renewed interest in Catalyst’s shares.

- On a numerical basis, Catalyst Pharmaceuticals scores a 6 out of 6 on our valuation checks, which hints at considerable value. Next, let’s break down what goes into these valuation metrics and later look at a more nuanced way of deciding if it’s really undervalued.

Find out why Catalyst Pharmaceuticals's 5.6% return over the last year is lagging behind its peers.

Approach 1: Catalyst Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future free cash flows and discounting them to reflect their present value. This method helps investors gauge what a business is truly worth today based on its future profit potential.

For Catalyst Pharmaceuticals, the latest reported Free Cash Flow is $151.7 million. Analysts have provided estimates for the next several years, with projections extending further by extrapolation. According to these forecasts, Free Cash Flow is expected to reach $298 million by 2029. The underlying DCF valuation uses a "2 Stage Free Cash Flow to Equity" model, which starts with a period of strong cash flow growth and then transitions to a more stable, mature phase.

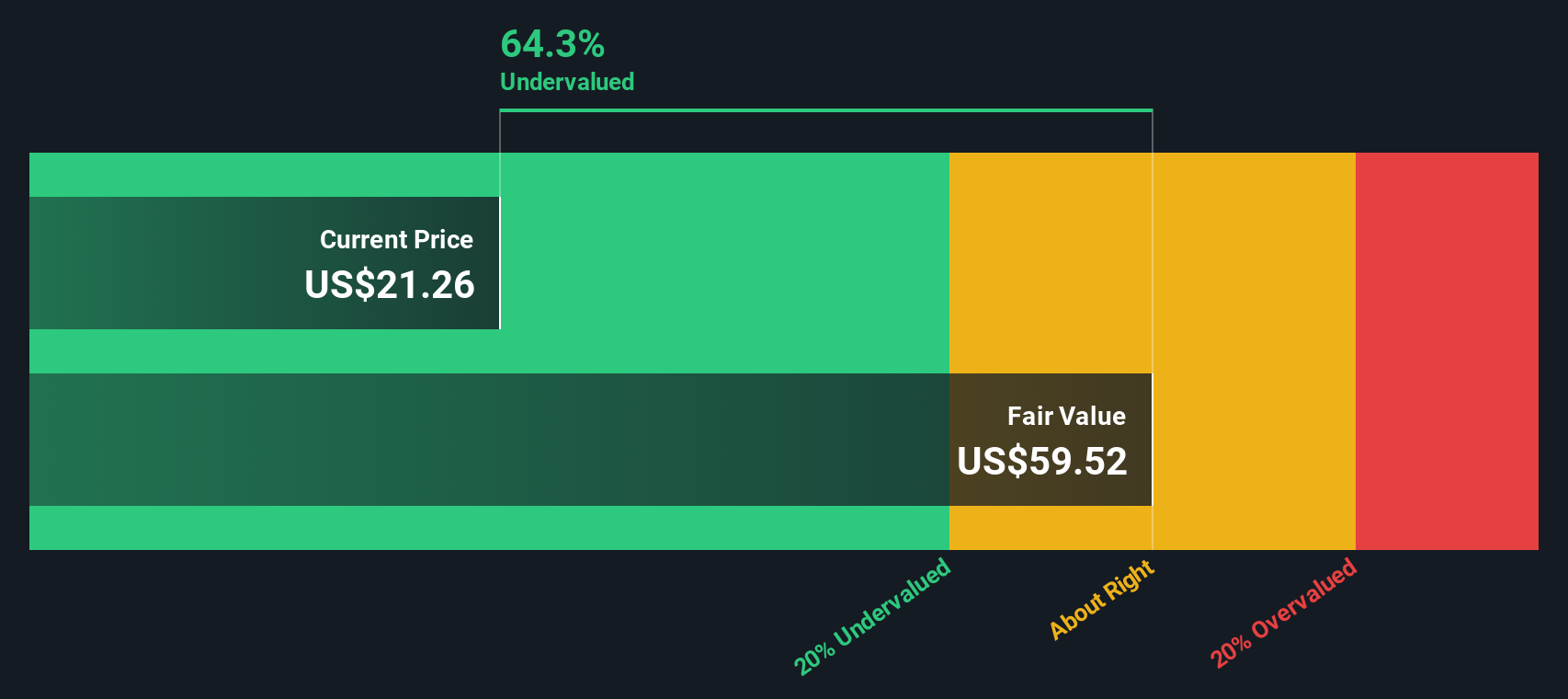

Based on these calculations, the estimated intrinsic value per share stands at $59.91. With the DCF model indicating the stock trades at a 60.6% discount to its assessed fair value, Catalyst Pharmaceuticals appears to be significantly undervalued relative to its projected cash generation capabilities.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Catalyst Pharmaceuticals is undervalued by 60.6%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Catalyst Pharmaceuticals Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Catalyst Pharmaceuticals. This ratio tells investors how much they are paying for each dollar of the company’s earnings, making it a straightforward tool for comparing stocks within the same sector.

What constitutes a "normal" or "fair" PE ratio can vary. Generally, a higher PE suggests the market expects higher future earnings growth or perceives lower risk, while a lower PE can indicate the opposite. Context matters because growth prospects, profit margins, and industry risks all influence what investors consider a reasonable multiple.

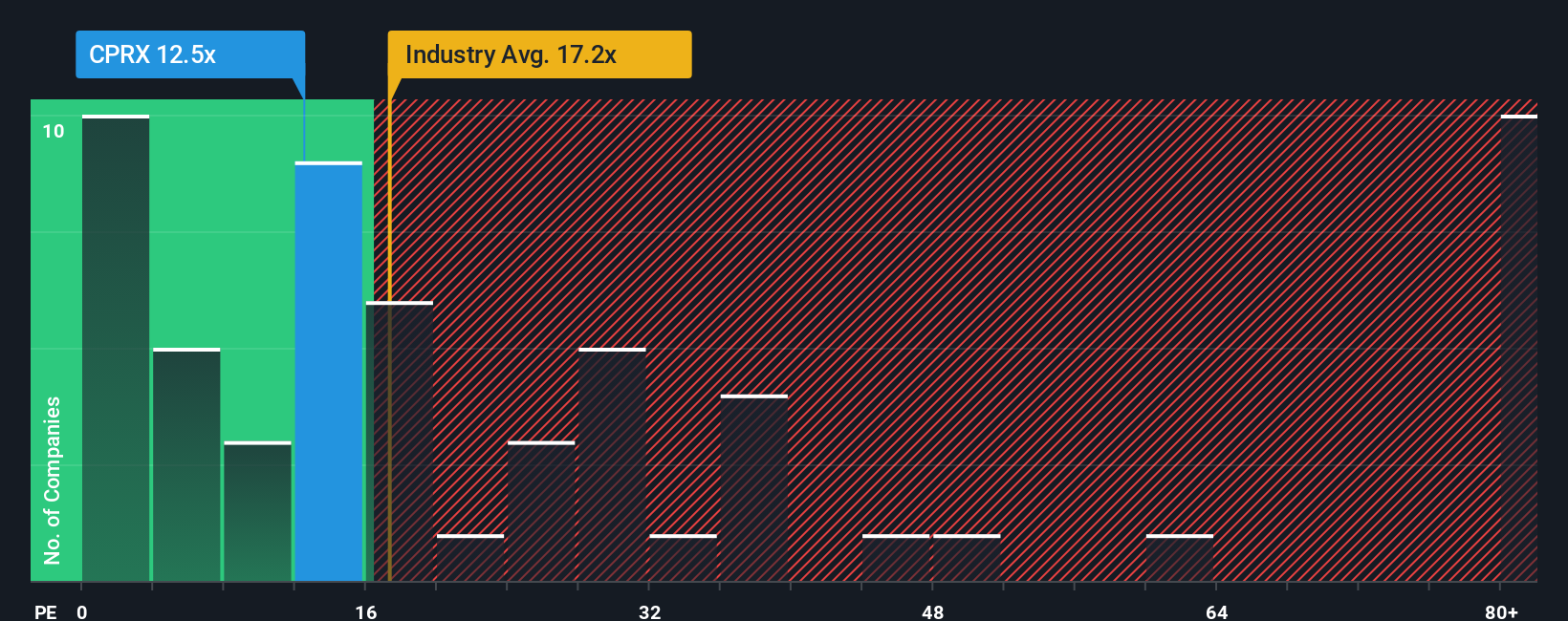

Catalyst Pharmaceuticals currently trades at a PE ratio of 13.3x. For comparison, the average PE across its Biotechs industry peers is 18.8x, and the peer group average is much higher at 64.1x. On the surface, Catalyst appears attractively valued compared to its direct competitors and the broader sector.

However, Simply Wall St's "Fair Ratio" offers a more nuanced benchmark. The Fair Ratio, which calculates a PE multiple tailored to Catalyst's own growth outlook, risk profile, profit margins, market cap, and industry context, stands at 17.4x. This proprietary figure goes beyond basic peer or industry averages by customizing the expected multiple specifically for the company’s situation.

Comparing Catalyst's actual PE of 13.3x to the Fair Ratio of 17.4x highlights that the stock trades below what would be fair given its fundamentals. This reinforces the idea that it is undervalued based on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Catalyst Pharmaceuticals Narrative

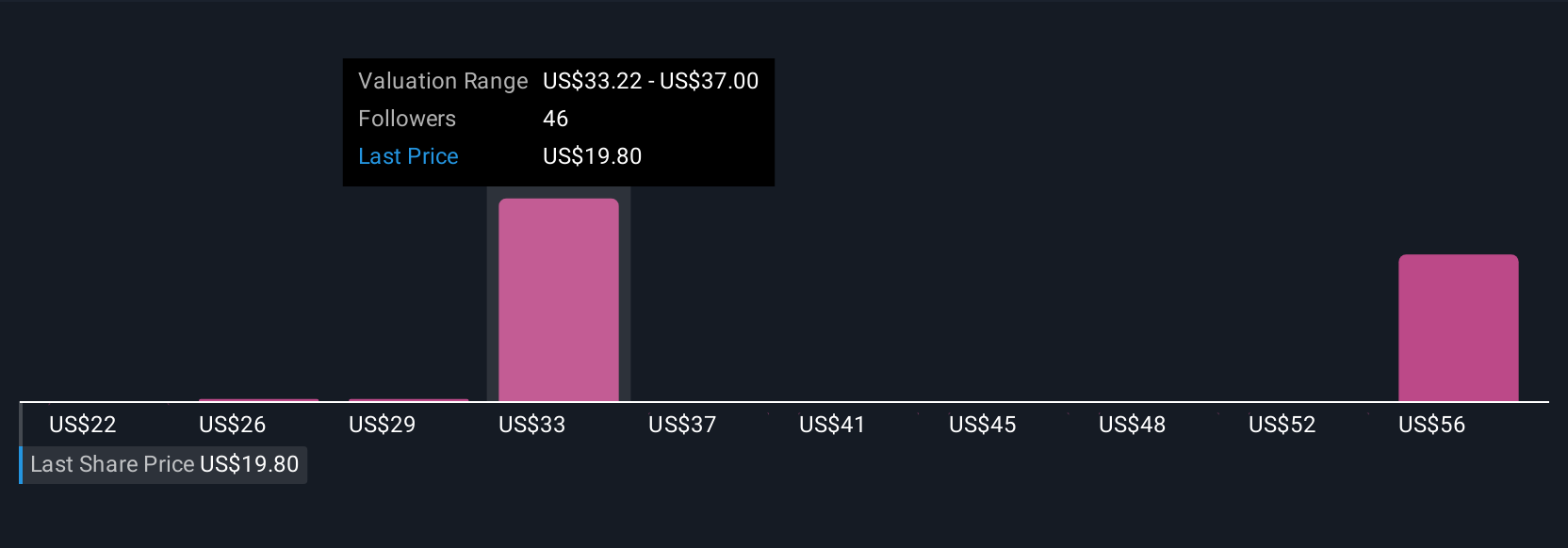

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable way for you to connect a company's story with your insights and beliefs about its future prospects, alongside financial forecasts and a fair value estimate.

Rather than just relying on numbers or static models, Narratives let you frame “why” you think Catalyst Pharmaceuticals is worth more or less. This approach ties together business changes, growth potential, risks, and industry trends into a coherent forecast. This story-driven method is easy to use and available to everyone on Simply Wall St's Community page, where millions of investors share and update ideas.

The power of Narratives comes from linking a company’s latest developments with your own expectations for revenue, profits, or market share, so you can decide when the fair value signals it’s time to buy or sell. Narratives update as new news or earnings are released, allowing your thesis and targets to stay fresh and relevant.

For example, some investors construct bullish Narratives around Catalyst’s expanding patient reach and strong product launches, while others see risks from dependence on a few key drugs and potential generic competition. Narratives can flexibly support both high and low fair value perspectives, with the numbers and reasoning visible in one place.

Do you think there's more to the story for Catalyst Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success