- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Patent Uncertainty and Drug Launch Timing Poise a Pivotal Question for Corcept Therapeutics (CORT)

Reviewed by Sasha Jovanovic

- Wolfe Research recently initiated coverage on Corcept Therapeutics with a Peerperform rating, highlighting both the company’s ongoing patent litigation and antitrust concerns, as well as the potential upside from its drug candidate relacorilant ahead of its upcoming PDUFA date for hypercortisolism on December 30, 2025.

- Although Corcept outperformed expectations for earnings per share in the third quarter of 2025, it reported revenue below analyst forecasts, contributing to investor caution given the mix of regulatory anticipation and legal risks now in focus.

- We will explore how ongoing patent litigation, flagged in the analyst coverage, may influence Corcept Therapeutics’ investment narrative from here.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Corcept Therapeutics Investment Narrative Recap

To be a shareholder in Corcept Therapeutics today, you need confidence in its ability to diversify revenues beyond Korlym and manage near-term legal and regulatory obstacles. Wolfe Research’s coverage initiation, while highlighting patent disputes and antitrust worries, does not appear to alter the most important near-term catalyst for Corcept, the pending FDA decision on relacorilant in hypercortisolism, but does reinforce that ongoing patent litigation remains the key risk that could overshadow revenue prospects if outcomes turn negative.

Among recent announcements, Corcept’s latest quarterly results are directly relevant: while the company outperformed on earnings per share, revenue fell short of analyst predictions, prompting a downward revision to full-year guidance. This underscores how legal developments and operational challenges continue to cloud revenue visibility as investors focus on the upcoming relacorilant PDUFA date and the company’s ability to offset Korlym dependency.

Yet, despite optimism about pending product launches, there remains another issue investors should not overlook: if the patent litigation with Teva...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' outlook anticipates $2.0 billion in revenue and $743.0 million in earnings by 2028. This scenario requires 40.7% annual revenue growth and a $611.0 million increase in earnings from the current $132.0 million.

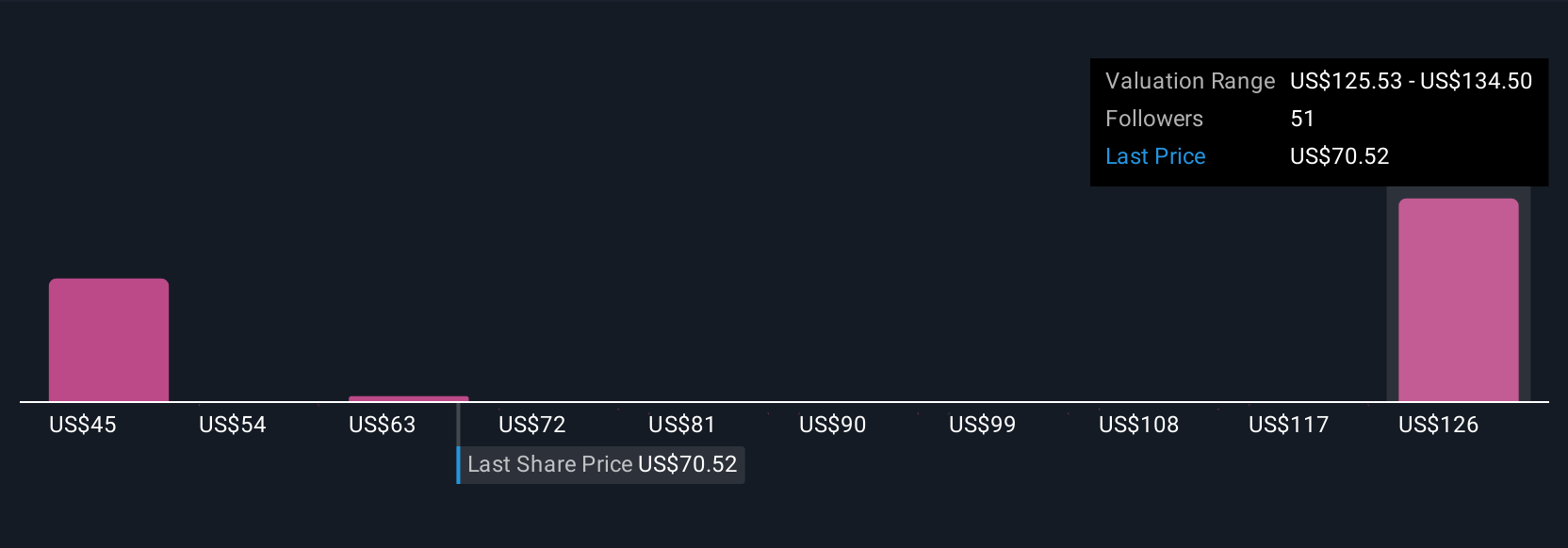

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community set Corcept’s fair value anywhere from US$74.33 to US$259.75 per share. With such varied outlooks, you can see how uncertainty around ongoing patent litigation can shape sharply different expectations for the company’s financial future.

Explore 10 other fair value estimates on Corcept Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives