- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Does Corcept Therapeutics’ Recent 21% Pullback Signal a Fresh Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Corcept Therapeutics is still a smart buy or if the market has gotten ahead of itself? If you’re curious about getting real value from your investments, this could be the stock to watch.

- The past year has been good to Corcept, with the stock climbing 31.1% over 12 months and an eye-catching 42.3% year to date. However, recent weeks have seen a pullback of -20.9% for the month and -1.3% in the past week.

- These price swings come as a result of heightened investor attention, driven by updates in the biotech sector and increased speculation about the company’s pipeline progress. Notably, recent analyst commentaries and sector news have kept market sentiment active, highlighting both optimism and caution around its drug development prospects.

- Corcept currently scores 2 out of 6 on our valuation checks, suggesting only modest undervaluation by standard measures. Let's break down what this score really means, explore different valuation methods, and discuss why there might be an even smarter way to gauge value by the end of this article.

Corcept Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Corcept Therapeutics Discounted Cash Flow (DCF) Analysis

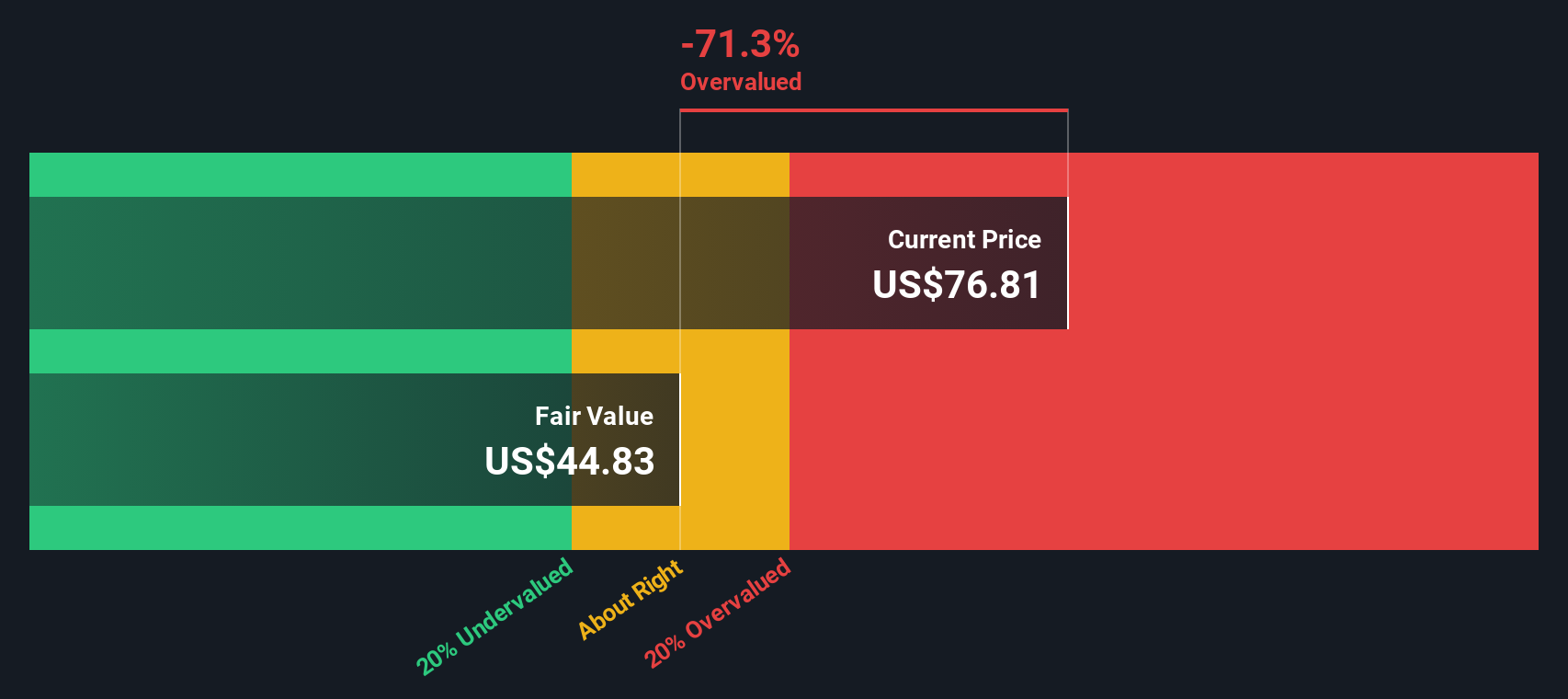

The Discounted Cash Flow (DCF) model is an established way to estimate a company's intrinsic value by projecting its future free cash flows and discounting those amounts back to today. This approach uses both analyst forecasts for the next several years and longer-term assumptions to fill in the gaps where analyst coverage ends.

For Corcept Therapeutics, the most recent reported Free Cash Flow is $181 million. Analysts expect this figure to grow, with projections showing Free Cash Flow in 2026 at around $181.4 million. Beyond the analyst forecast window, further growth is extrapolated. By 2035, ten years from now, the projected Free Cash Flow reaches approximately $223.5 million. All projections are in US dollars and remain well under a billion, which justifies reporting in millions.

After discounting these future cash flows using the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value per share comes out to $43.95. However, based on the current trading price, the DCF analysis suggests the stock is overvalued by 61.8% at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corcept Therapeutics may be overvalued by 61.8%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Corcept Therapeutics Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Corcept Therapeutics. It helps investors gauge how much the market is willing to pay today for a dollar of earnings, making it ideal for companies with consistent profitability.

The “normal” or “fair” PE ratio for any company depends largely on its expected growth rate and level of risk. Generally, companies with strong growth prospects and lower risk profiles tend to justify higher PE ratios, while slower growth or greater risk warrants a lower one.

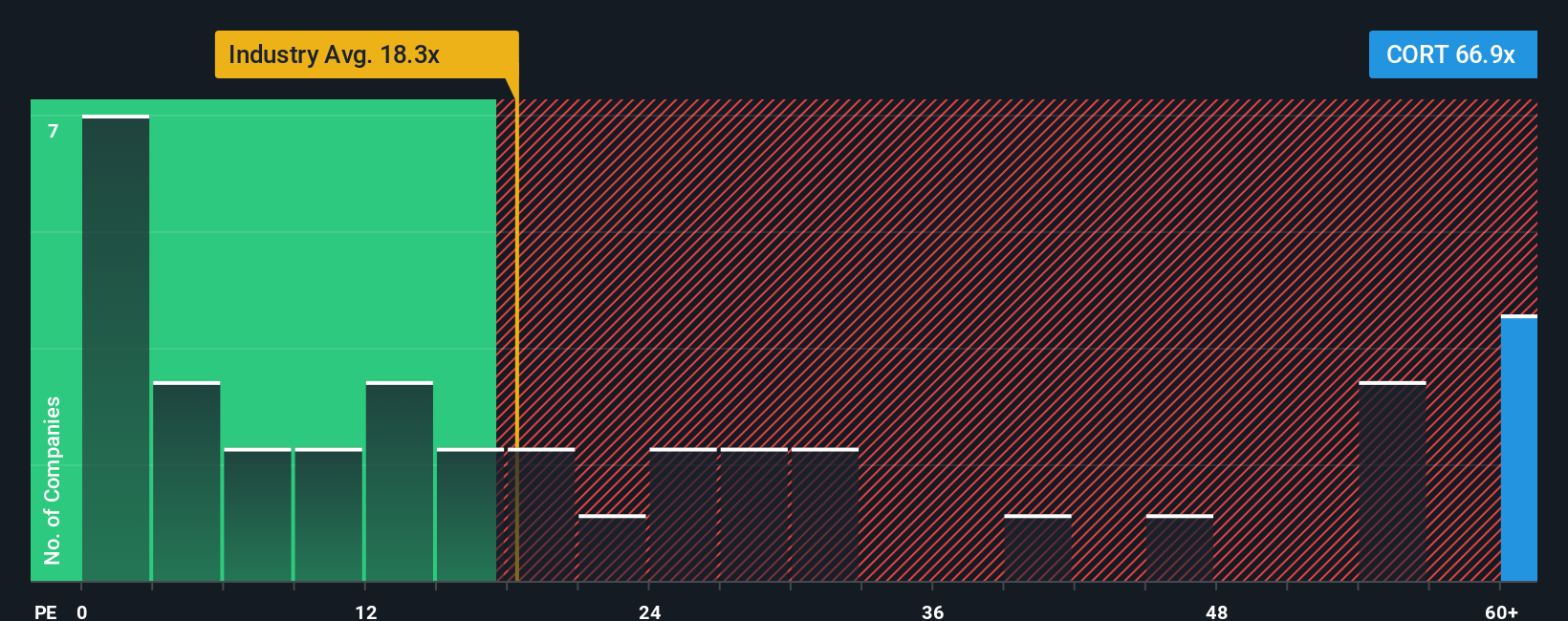

Corcept currently trades at a lofty 56.8x PE ratio, which stands well above the Pharmaceuticals industry average of 17.7x and the average of its peers at 34.1x. This might initially suggest the stock is highly valued, but these simple comparisons may not capture the full story.

That is where the Simply Wall St "Fair Ratio" comes in. This proprietary metric calculates what a fair PE multiple should be by weighing factors like expected earnings growth, risk, profit margins, market cap, and the specific characteristics of Corcept and its industry. Unlike basic industry or peer benchmarks, the Fair Ratio aims for a more individualized and balanced perspective.

For Corcept, the Fair Ratio is set at 62.3x. Compared to its current PE of 56.8x, the stock is trading slightly below its fair valuation, suggesting that, based on these sophisticated factors, the market price is reasonable given the company’s profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corcept Therapeutics Narrative

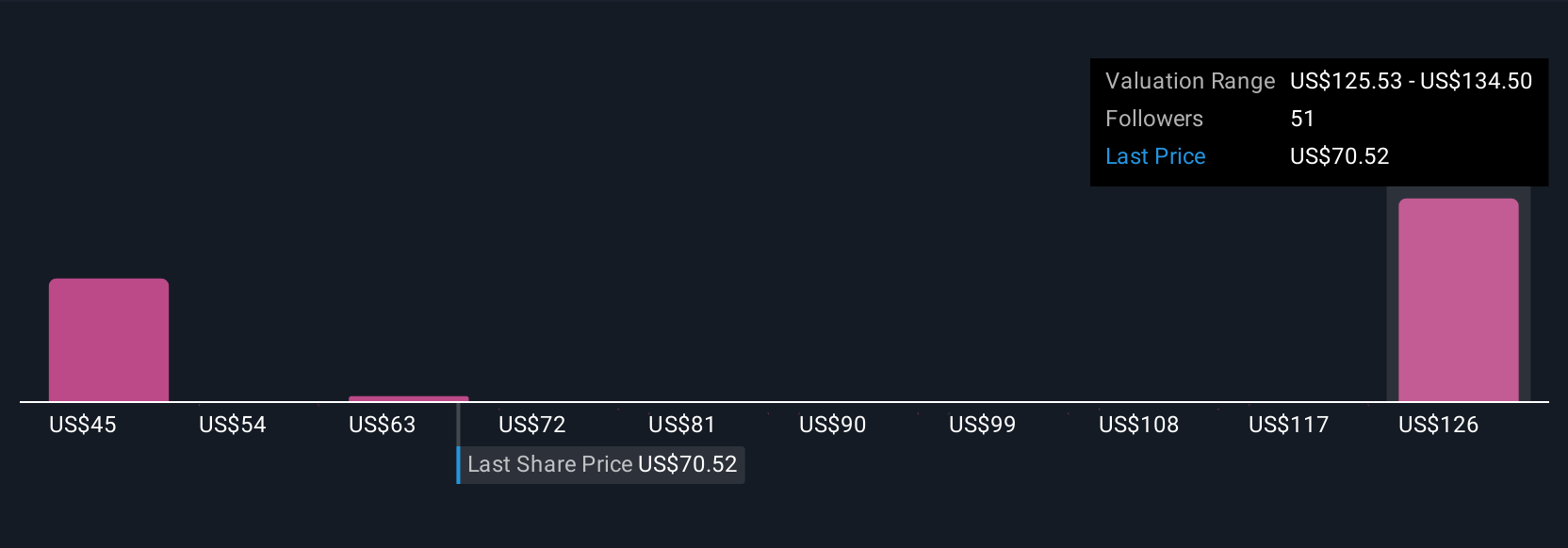

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers—your own reasoned view of a company’s future, supported by your assumptions for future revenue, profits and margins, and the fair value you believe that justifies.

Unlike traditional methods, Narratives connect data directly to real-world events, current news and your beliefs about where a company is headed. They give you a clear framework that links Corcept Therapeutics' story and catalysts to a future forecast, which is then turned into a fair value, all in an easy, accessible tool available right on Simply Wall St’s Community page, used by millions of investors.

Narratives empower you to decide when to buy or sell by showing how your estimate of fair value compares to the latest share price, while automatically staying up-to-date as new information rolls in, such as clinical trial outcomes or regulatory news.

For Corcept, some investors may see a bright future and estimate fair value at $145.0 given global market openings and strong earnings growth, while others may be more cautious, putting fair value as low as $121.0 due to product concentration and regulatory risks.

Do you think there's more to the story for Corcept Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives