- United States

- /

- Pharma

- /

- NasdaqGS:COLL

Collegium Pharmaceutical (COLL): Examining the Stock’s Valuation After Recent Gains

Reviewed by Simply Wall St

See our latest analysis for Collegium Pharmaceutical.

After a sustained climb over the past quarter, Collegium Pharmaceutical’s 20.2% 3-month share price return has helped drive a more robust year-to-date move. However, the 1-year total shareholder return is a more modest 7%. The latest momentum suggests investors are looking past short-term swings and seeing potential for further progress.

If you’re curious about finding other breakthrough opportunities in health and biotech, you can discover See the full list for free.

With shares still trading at a meaningful discount to analyst price targets, but following impressive recent gains, the key question now emerges: is there more upside left for Collegium Pharmaceutical, or has the market already priced in this growth?

Most Popular Narrative: 19.8% Undervalued

Collegium Pharmaceutical’s most widely followed narrative places fair value at $44.60, notably above its recent close at $35.76. This suggests market sentiment is not fully accounting for the company’s projected growth trajectory and future profit potential.

Collegium's differentiated pain portfolio, notably with products featuring proprietary abuse-deterrent and extended-release technologies (such as Xtampza ER's DETERx platform), is supported by industry and regulatory trends that increasingly favor safer opioid options. This is likely to enhance market share, pricing power, and sustain net margins as regulatory emphasis on abuse deterrence grows.

Want to understand what’s fueling this number? This narrative is built on far-reaching projections for margins, profit, and a future valuation multiple that’s rarely seen in the pharmaceutical world. The real surprise is just how ambitious the assumptions are, and how much room the model suggests there could be. Tempted to see what drives that call?

Result: Fair Value of $44.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming patent expirations and rising commercialization costs could quickly shift the outlook and present challenges to Collegium’s current strong momentum.

Find out about the key risks to this Collegium Pharmaceutical narrative.

Another View: Price Ratios Tell a Different Story

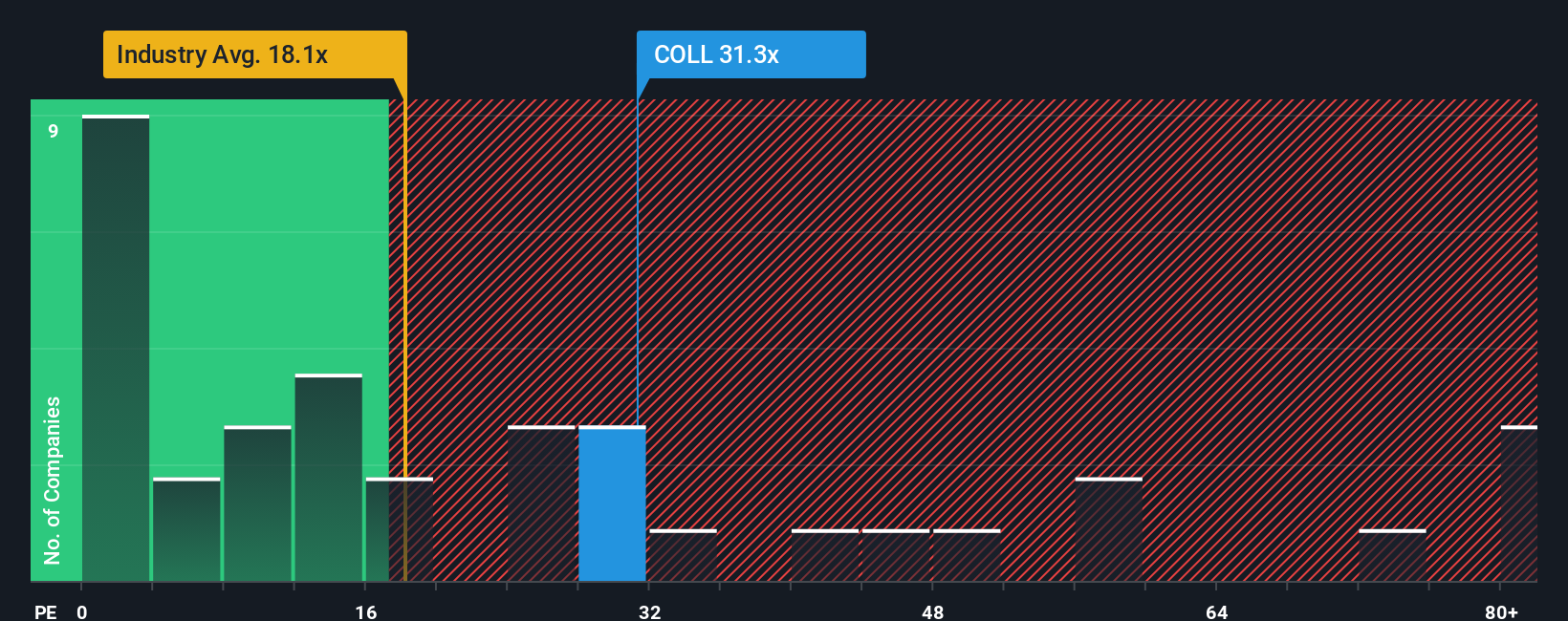

While analyst projections highlight upside, a different perspective comes from market price ratios. Collegium Pharmaceutical trades at a price-to-earnings ratio of 31.1x, well above the US Pharmaceuticals industry average of 17.9x and its estimated fair ratio of 21.9x. This means investors are paying a premium for growth, which could add risk if future results fall short. With valuation looking stretched versus the sector, is the optimism already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Collegium Pharmaceutical Narrative

If you want to dive into the numbers yourself or see things from a different angle, it's easy to build your own take in just a few minutes. Do it your way

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Waiting could mean missing out on the hottest market themes right now. Give yourself an edge with wider potential by targeting stocks others might overlook using the powerful Simply Wall Street Screener.

- Grow your portfolio income with ease by scanning these 20 dividend stocks with yields > 3% yielding over 3% and uncover stocks designed for solid cash returns.

- Catch the next wave of digital innovation, as these 27 AI penny stocks spotlight companies reshaping entire industries with artificial intelligence breakthroughs.

- Step ahead of the crowd and spot deep value by searching these 844 undervalued stocks based on cash flows for shares trading below intrinsic cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives