- United States

- /

- Pharma

- /

- NasdaqGS:COLL

A Fresh Look at Collegium Pharmaceutical (COLL) Valuation After Upbeat 2025 Guidance and Strong Q3 Earnings

Reviewed by Simply Wall St

Collegium Pharmaceutical (COLL) has caught investors’ attention after raising its full year 2025 revenue guidance and reporting a sizable increase in third quarter net income and earnings per share compared to last year.

See our latest analysis for Collegium Pharmaceutical.

Excitement around Collegium Pharmaceutical has been building, with stronger-than-expected earnings and an improved sales outlook fueling the narrative in recent weeks. The share price has surged 28% over the past month and is now up more than 55% for the year to date. The 1-year total shareholder return is 48%, and it is over 130% for the past five years, showing momentum certainly favors the bulls.

If this kind of rapid turnaround grabs your attention, it might be a great time to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares now trading near all-time highs and analyst price targets, the pressing question is whether further upside remains or if the market is already pricing in the company’s future growth potential.

Most Popular Narrative: 5% Undervalued

The most widely followed narrative assigns a fair value of $46.80, which is about 5% above the current share price of $44.47. This positions the stock as modestly undervalued, with market expectations not fully keeping pace with projected financial improvements.

Collegium's disciplined capital allocation and ongoing business development (M&A) strategy, including pursuing synergistic pain/CNS assets, is expected to drive portfolio diversification and inorganic growth. This would further reduce revenue concentration risk and provide additional sources of EBITDA and earnings stability.

Targeted investments in sales force expansion and marketing for Jornay PM, coupled with high prescriber intent and broadening awareness, are designed to capitalize on a sizable and still underpenetrated ADHD market. This approach is intended to create significant momentum for above-market revenue acceleration over the next several years.

What bold assumption fuels this upside view? The story centers on strategic moves beyond pain management and a spike in future profits that many might overlook. Ready to see what number-crunching powers this confident price target? Unlock the full narrative to reveal the forecasts and facts shaping this fair value.

Result: Fair Value of $46.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a maturing pain portfolio and sharply rising fixed costs could undermine the company’s momentum if market challenges intensify.

Find out about the key risks to this Collegium Pharmaceutical narrative.

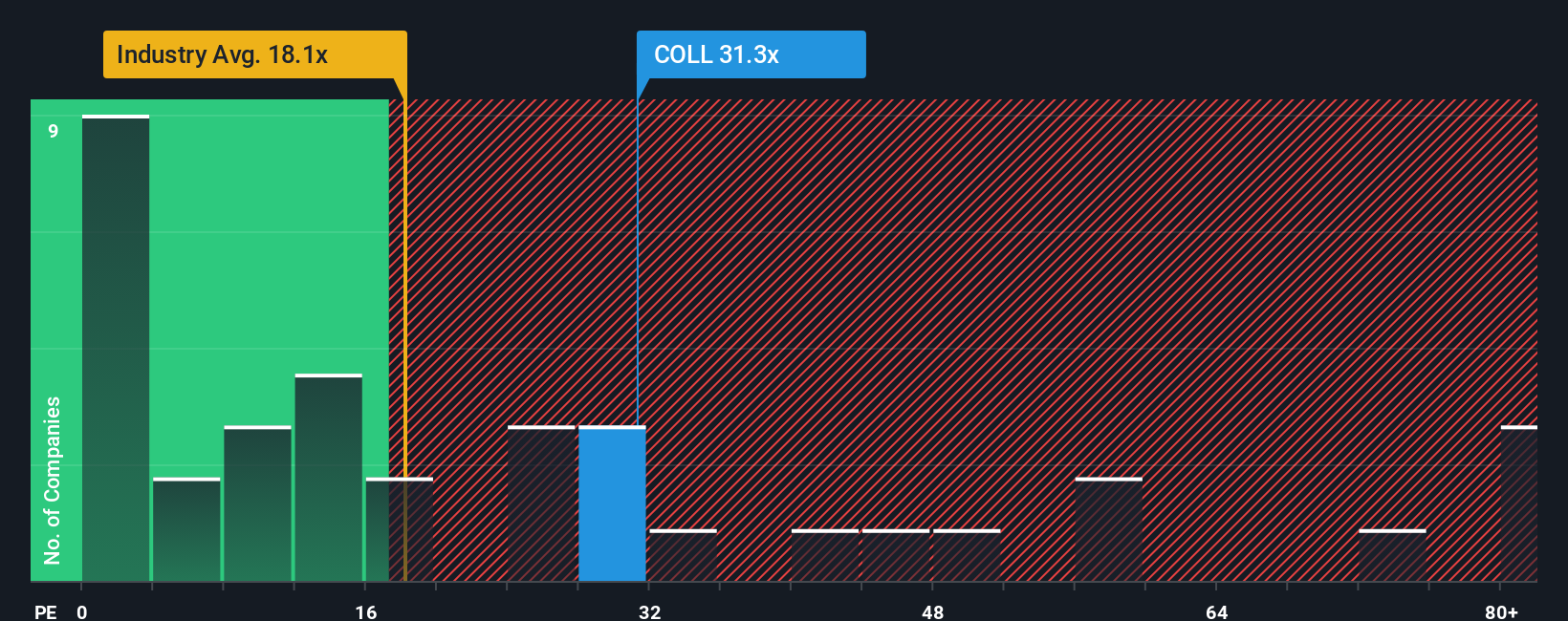

Another View: High Earnings Multiple Suggests a Pricey Stock

Taking a step back from fair value models, analysts often look at the current price-to-earnings ratio to gauge valuation. Collegium Pharmaceutical trades on a P/E of 24.1x, which is significantly above both its peer average of 14.5x and the industry’s 19.4x. Even our fair ratio estimate is lower, at 22.8x. This suggests that the market expects continued strong profit growth or is simply willing to pay a premium for the stock. Is this confidence justified, or is it a sign that expectations could be getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Collegium Pharmaceutical Narrative

If you prefer to dig deeper and draw your own conclusions, you can craft a unique narrative in just minutes. Do it your way

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by tapping into fresh investment opportunities that fit your interests and risk comfort. Let Simply Wall Street's screeners spotlight where strong potential lies. These picks could be tomorrow's winners, so don't let them pass you by.

- Unlock the chance for market-beating returns with these 898 undervalued stocks based on cash flows, where undervalued companies stand ready for savvy investors to make their move.

- Accelerate your growth strategy by targeting these 27 AI penny stocks, packed with companies at the forefront of artificial intelligence innovation and disruption.

- Secure your passive income goals with these 15 dividend stocks with yields > 3%, featuring stocks offering impressive dividend yields to help build a resilient financial future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives