- United States

- /

- Biotech

- /

- NasdaqGS:COGT

Why Cogent Biosciences (COGT) Is Up 18.9% After Positive Phase 3 GIST Trial Results

Reviewed by Sasha Jovanovic

- Cogent Biosciences recently announced positive results from its Phase 3 PEAK trial, showing that bezuclastinib combined with sunitinib significantly improved progression-free survival for gastrointestinal stromal tumor (GIST) patients resistant or intolerant to imatinib.

- The company plans to submit a new drug application to the FDA for bezuclastinib in GIST during the first half of 2026, highlighting its potential as a new second-line treatment standard.

- We'll explore how the successful Phase 3 trial data may influence Cogent Biosciences' position in the oncology treatment landscape.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Cogent Biosciences' Investment Narrative?

At its core, owning shares in Cogent Biosciences is about believing that targeted oncology developments can disrupt the GIST and systemic mastocytosis treatment space. The recent Phase 3 PEAK trial results and analyst reactions are a real shift, likely amplifying short-term catalysts as the new data are digested and the anticipated FDA application in 2026 becomes a concrete milestone. Previous risks, such as uncertain trial outcomes or lack of clinical momentum, now seem less prominent, with focus shifting toward regulatory and commercialization challenges. However, profitability remains a hurdle as losses mount and share dilution continues. The big gains in share price make expectations higher and could increase volatility as investors debate future approvals, launches, and how much value is already priced in. Yet, the company’s persistent net losses and dilution risks should not be overlooked.

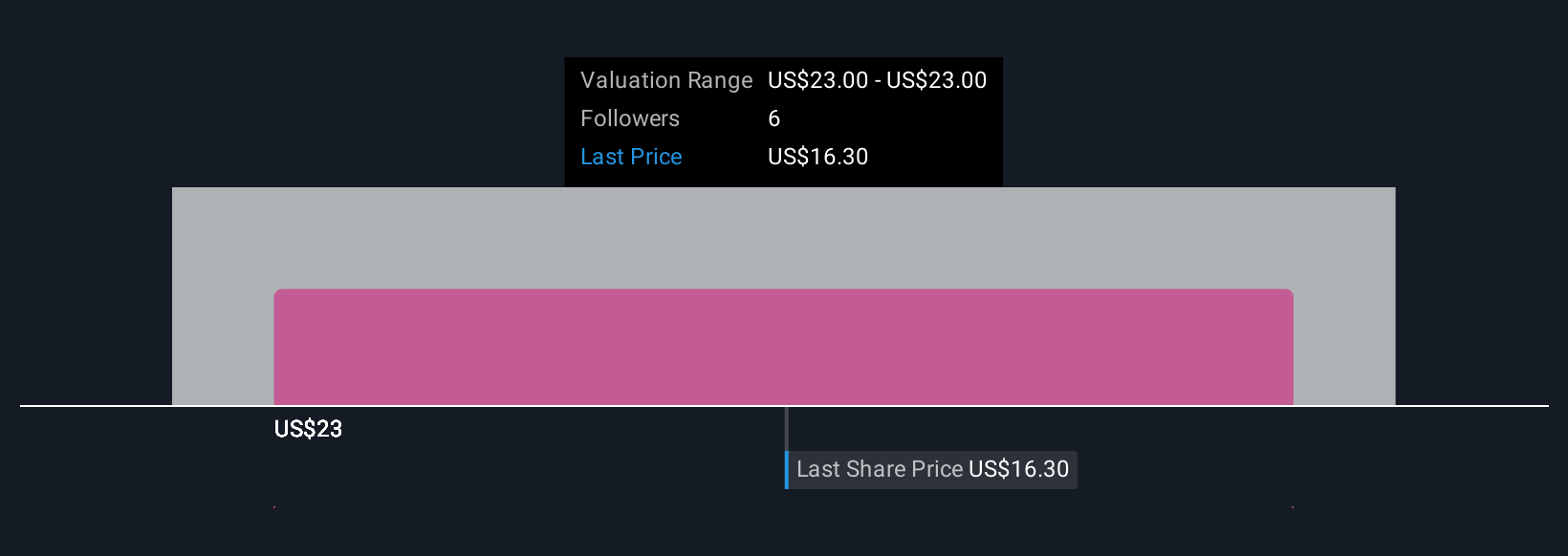

In light of our recent valuation report, it seems possible that Cogent Biosciences is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Cogent Biosciences - why the stock might be worth as much as 19% more than the current price!

Build Your Own Cogent Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cogent Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Biosciences' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COGT

Cogent Biosciences

A biotechnology company, focuses on developing precision therapies for genetically defined diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success