- United States

- /

- Biotech

- /

- NasdaqGS:COGT

Cogent Biosciences (COGT) Is Up 7.7% After Bezuclastinib Receives FDA Breakthrough Therapy Status—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Cogent Biosciences recently announced that the U.S. FDA granted Breakthrough Therapy Designation to bezuclastinib for NonAdvanced Systemic Mastocytosis patients previously treated with avapritinib, as well as for patients with Smoldering Systemic Mastocytosis, where no approved standard of care exists.

- This designation, based on statistically significant results from the SUMMIT trial, allows Cogent to expedite regulatory review for bezuclastinib and potentially address critical unmet needs in rare hematologic diseases.

- We'll explore how this regulatory milestone and the SUMMIT trial data strengthen Cogent's investment narrative in rare disease drug development.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Cogent Biosciences' Investment Narrative?

Owning shares in Cogent Biosciences is all about believing in the company's ability to turn innovative rare disease therapies like bezuclastinib into commercially successful products. The recent FDA Breakthrough Therapy Designation is a meaningful shift for the short-term outlook, bringing the prospect of faster regulatory review and improving the chances of near-term approval, a catalyst that could attract further investor interest and heighten expectations for future value. This milestone builds on encouraging SUMMIT trial data and places bezuclastinib firmly in the spotlight, complementing upcoming results from the pivotal PEAK and APEX trials, now even more critical as investors look for proof of sustainable progress. However, Cogent remains deeply unprofitable, with net losses nearly doubling year on year, a relatively high cash burn, and lingering dilution risk following recent equity offerings. The pressure is on for clinical and regulatory wins to translate into commercial realities, especially as current valuation metrics remain stretched after a substantial run-up in the share price. On the flip side, the path to profitability is still uncertain for Cogent, given ongoing losses.

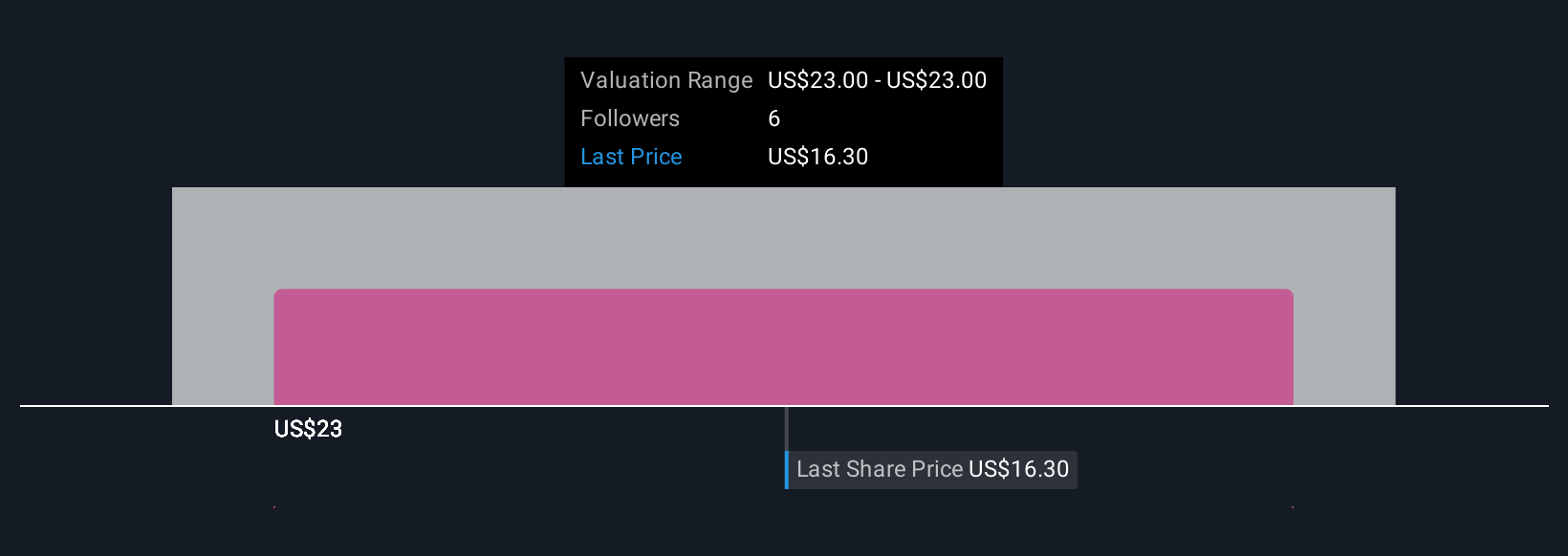

In light of our recent valuation report, it seems possible that Cogent Biosciences is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Cogent Biosciences - why the stock might be worth just $23.00!

Build Your Own Cogent Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cogent Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Biosciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COGT

Cogent Biosciences

A biotechnology company, focuses on developing precision therapies for genetically defined diseases.

Excellent balance sheet with low risk.

Market Insights

Community Narratives