- United States

- /

- Biotech

- /

- NasdaqCM:CGEN

Improved Revenues Required Before Compugen Ltd. (NASDAQ:CGEN) Shares Find Their Feet

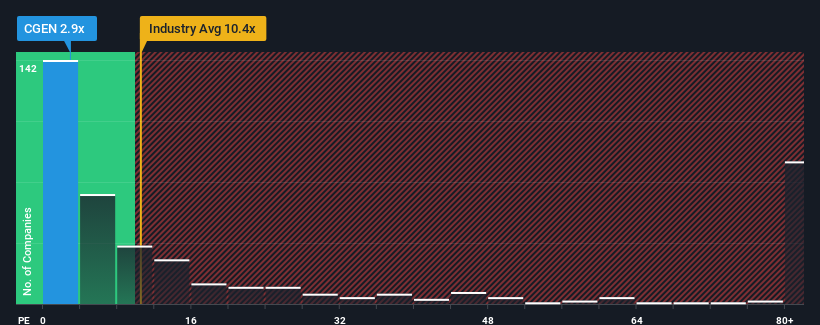

You may think that with a price-to-sales (or "P/S") ratio of 2.9x Compugen Ltd. (NASDAQ:CGEN) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 10.4x and even P/S above 55x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Compugen

How Compugen Has Been Performing

Recent times haven't been great for Compugen as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Compugen.How Is Compugen's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Compugen's to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 9.2% per annum over the next three years. With the industry predicted to deliver 135% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Compugen's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Compugen's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Compugen's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 1 warning sign for Compugen you should be aware of.

If you're unsure about the strength of Compugen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CGEN

Compugen

A clinical-stage therapeutic discovery and development company, engages in the research, development, and commercialization of therapeutics and product candidates in Israel, the United States, and Europe.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives