- United States

- /

- Biotech

- /

- NasdaqGS:CGEM

Why Cullinan Therapeutics (CGEM) Is Up 38.1% After FDA Filing for EGFR-mutant Lung Cancer Drug

Reviewed by Sasha Jovanovic

- Taiho Oncology, Taiho Pharmaceutical, and Cullinan Therapeutics recently announced the initiation of a rolling New Drug Application submission to the U.S. FDA for accelerated approval of zipalertinib, targeting EGFR exon 20 insertion-mutated non-small cell lung cancer after chemotherapy.

- This milestone builds on zipalertinib’s Breakthrough Therapy Designation and leverages data from the REZILIENT1 Phase 1/2 trial involving previously treated patients.

- We'll explore how progress toward FDA accelerated approval for zipalertinib could influence Cullinan Therapeutics' investment narrative and future opportunities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Cullinan Therapeutics' Investment Narrative?

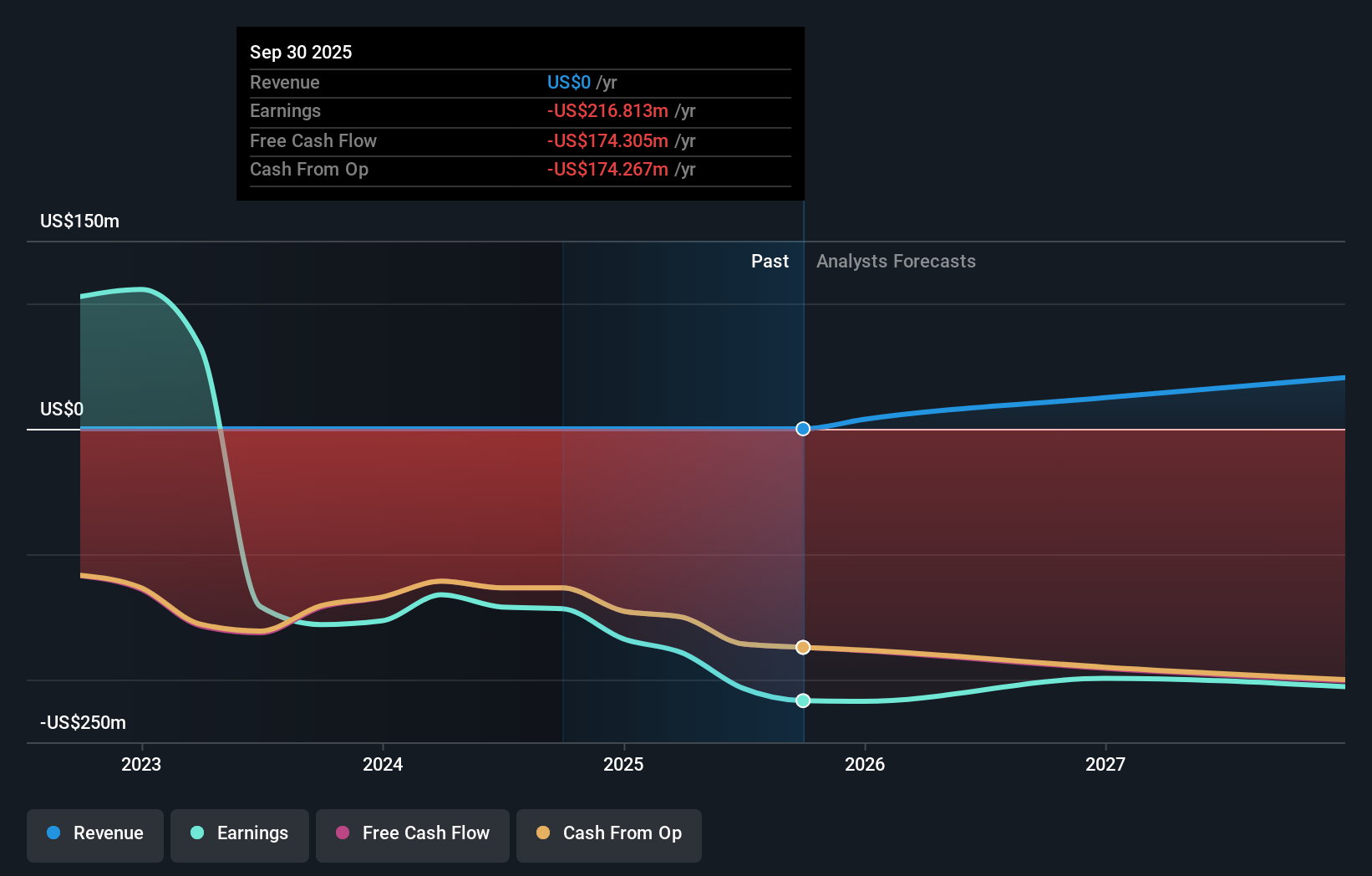

For investors considering Cullinan Therapeutics, the main thesis is rooted in the success or failure of its late-stage clinical assets, particularly zipalertinib. The recent rolling New Drug Application (NDA) filing with the FDA for zipalertinib marks a potentially significant catalyst, as it could accelerate the path to market and shift attention to upcoming regulatory milestones. This step may drive near-term sentiment, as reflected in the strong price move following the announcement. However, major risks remain: the company is still unprofitable, its revenue is essentially zero, and it is not forecast to reach profitability in the next three years. Ongoing clinical and regulatory outcomes are now even more tightly linked to valuation. For shareholders, this FDA submission slightly raises expectations for short-term clinical news while also raising the stakes, if approval or trial results disappoint, the risk of further losses grows. Yet, tighter board independence and persistent losses are factors investors should weigh carefully.

According our valuation report, there's an indication that Cullinan Therapeutics' share price might be on the expensive side.Exploring Other Perspectives

Explore another fair value estimate on Cullinan Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Cullinan Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cullinan Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Cullinan Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cullinan Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGEM

Cullinan Therapeutics

A clinical-stage biopharmaceutical company, develops therapies for autoimmune diseases and cancer in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success