- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC): Exploring Valuation as FDA Reviews Gedatolisib Application Under Expedited Program

Reviewed by Simply Wall St

Celcuity (CELC) has just completed its New Drug Application submission to the FDA for gedatolisib, an investigational therapy for advanced breast cancer. This move, under the FDA’s Real-Time Oncology Review program, could accelerate the potential approval process.

See our latest analysis for Celcuity.

The recent New Drug Application is the latest in a streak of milestones for Celcuity. This comes just days after its quarterly earnings report. With its share price rallying more than 42% in the past month and delivering a remarkable 670% year-to-date return, momentum is clearly building for the stock.

If Celcuity’s rapid rise got your attention, now is the perfect moment to explore promising names in the sector through our See the full list for free..

With shares surging and analyst targets not far above current levels, investors are left to wonder if Celcuity’s explosive growth is already reflected in the price or if there is still a buying opportunity ahead.

Price-to-Book of 40x: Is it justified?

Celcuity is currently trading at a price-to-book ratio of 40x, while its most recent closing price was $101.15. This places the company well above both its peers and the broader US Biotech sector.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets. In the context of biotechs, a high ratio often signals investor anticipation of future growth, but it can also reflect excessive optimism if fundamentals are not yet established. For Celcuity, this metric highlights the tension between rapid recent gains and the fact that it remains unprofitable and pre-revenue.

Notably, Celcuity’s 40x price-to-book far exceeds the US Biotech average of just 2.6x and even its peer group, which averages 6.6x. This substantial premium leaves little room for disappointment and indicates that market expectations are very high compared to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 40x (OVERVALUED)

However, with no current revenue and reliance on FDA approval, any setback could quickly cool investor enthusiasm for Celcuity’s high-flying shares.

Find out about the key risks to this Celcuity narrative.

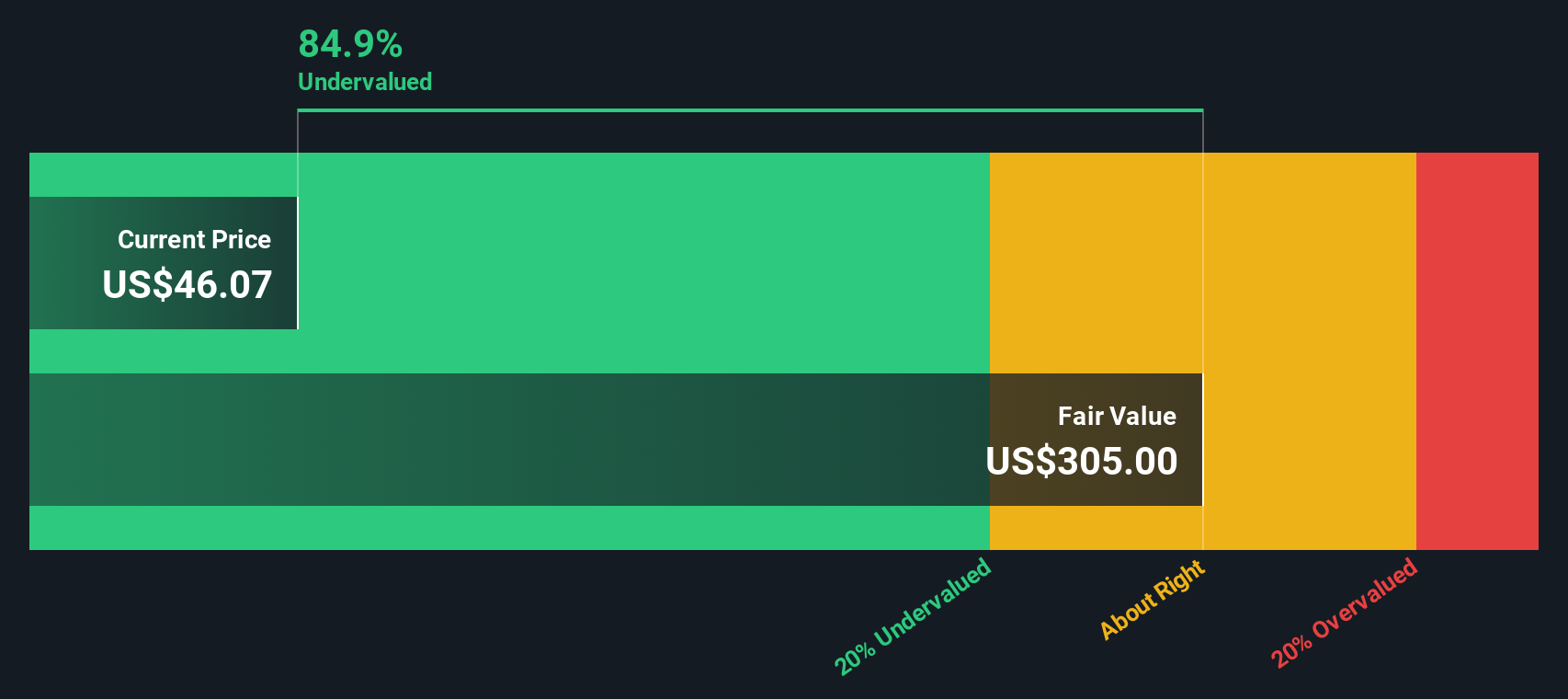

Another View: Is Celcuity Actually Undervalued?

Despite its sky-high price-to-book, our DCF model paints a very different story for Celcuity. Based on future cash flow estimates, the SWS DCF model suggests the stock could be trading at nearly 80% below its fair value of $494.04. That is a huge gap from current levels. Could the market be missing something, or are the risks too great?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you see the story differently or want to dig into the data yourself, you can build your own view of Celcuity’s potential in just a few minutes. Do it your way

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

If you want to stay ahead, the right stocks could be just a few clicks away. Uncover your next smart investment by checking out these handpicked, high-potential ideas.

- Maximize your returns with stable cashflow by uncovering value-packed picks in these 924 undervalued stocks based on cash flows before the market catches on.

- Tap into new breakthroughs and get a front-row seat to transformative trends by exploring these 30 healthcare AI stocks shaping the future of medicine.

- Lock in higher income by searching for leading stocks from these 14 dividend stocks with yields > 3% offering strong yields and proven financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success