- United States

- /

- Biotech

- /

- NasdaqCM:CDMO

Avid Bioservices, Inc. (NASDAQ:CDMO) Surges 43% Yet Its Low P/S Is No Reason For Excitement

Avid Bioservices, Inc. (NASDAQ:CDMO) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

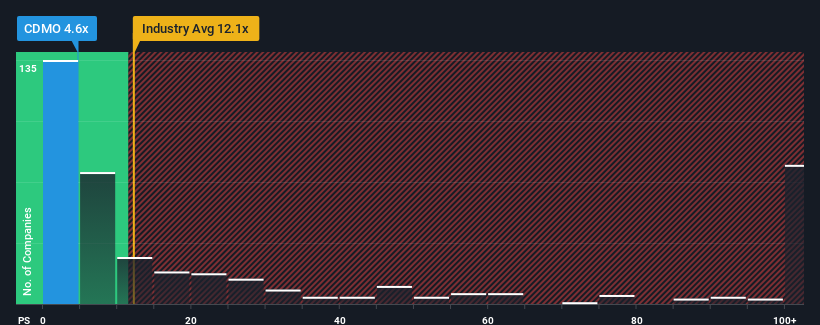

Although its price has surged higher, Avid Bioservices may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.6x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.1x and even P/S higher than 64x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Avid Bioservices

How Avid Bioservices Has Been Performing

While the industry has experienced revenue growth lately, Avid Bioservices' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Avid Bioservices.Do Revenue Forecasts Match The Low P/S Ratio?

Avid Bioservices' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. Still, the latest three year period has seen an excellent 46% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 20% each year over the next three years. That's shaping up to be materially lower than the 181% per year growth forecast for the broader industry.

With this information, we can see why Avid Bioservices is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Avid Bioservices' P/S

Avid Bioservices' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Avid Bioservices maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Avid Bioservices that you should be aware of.

If these risks are making you reconsider your opinion on Avid Bioservices, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDMO

Avid Bioservices

Operates as a contract development and manufacturing organization for the biotechnology and biopharmaceutical industries in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives