- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Could Capricor Therapeutics' (CAPR) Next-Gen Delivery Tech Offset Uncertainty Around Its DMD Program?

Reviewed by Sasha Jovanovic

- Capricor Therapeutics recently announced new data revealing a scalable framework for loading therapeutic siRNA and PMO into exosomes, sharing this breakthrough at the 2025 American Association for Extracellular Ventures Annual Meeting in Salt Lake City.

- This disclosure comes as the company addresses heightened scrutiny of its lead candidate, Deramiocel, following both a high-profile short position and an FDA refusal to approve its therapy for Duchenne muscular dystrophy due to insufficient evidence.

- We'll examine how the regulatory pushback and public criticism of Deramiocel influences Capricor's investment narrative and future prospects.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Capricor Therapeutics Investment Narrative Recap

To own Capricor Therapeutics, investors must believe in the company’s ability to deliver late-stage clinical success with Deramiocel in Duchenne muscular dystrophy, while weathering regulatory setbacks and short seller scrutiny. The recent announcement about scalable exosome technology has not materially changed the most immediate catalyst or the principal risk, both of which remain centered on the forthcoming HOPE-3 study results and FDA approval process for Deramiocel. The core challenge continues to be whether Capricor can provide compelling efficacy evidence to regulators before the company’s cash position is tested by ongoing losses and industry competition.

Among recent company announcements, the September 2025 regulatory update stands out as especially relevant: Capricor will submit HOPE-3 trial results to the FDA as the requested data package, potentially re-opening the path to approval after the earlier refusal. This step is closely tied to the near-term catalyst for shareholders and highlights the importance of regulatory engagement in shaping Capricor’s future, as clinical outcomes and agency guidance continue to dictate the investment narrative for now.

On the flip side, with Capricor’s late-stage pipeline still highly concentrated around Deramiocel and regulatory unpredictability on the rise, it’s important for investors to recognize that if approval is delayed further, the risk of dilution...

Read the full narrative on Capricor Therapeutics (it's free!)

Capricor Therapeutics is projected to reach $134.4 million in revenue and $14.4 million in earnings by 2028. This outlook assumes 115.7% annual revenue growth and a $84.4 million increase in earnings from the current level of -$70.0 million.

Uncover how Capricor Therapeutics' forecasts yield a $20.60 fair value, a 344% upside to its current price.

Exploring Other Perspectives

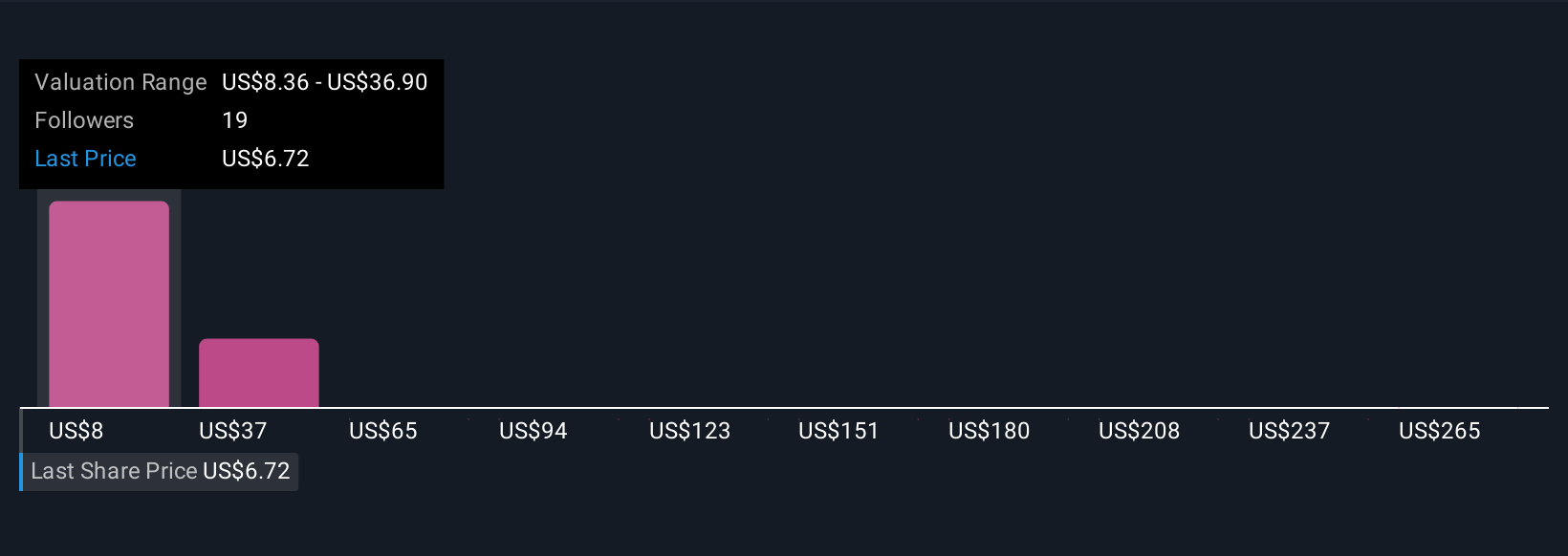

Eight members of the Simply Wall St Community provided fair value estimates for Capricor ranging from US$8.36 to US$293.74 per share. With regulatory challenges front and center, opinions vary widely on Capricor's future, so consider multiple viewpoints before forming your outlook.

Explore 8 other fair value estimates on Capricor Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Capricor Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capricor Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capricor Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capricor Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success