Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics (NASDAQ:CAPR) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Capricor Therapeutics (NASDAQ:CAPR) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Capricor Therapeutics

When Might Capricor Therapeutics Run Out Of Money?

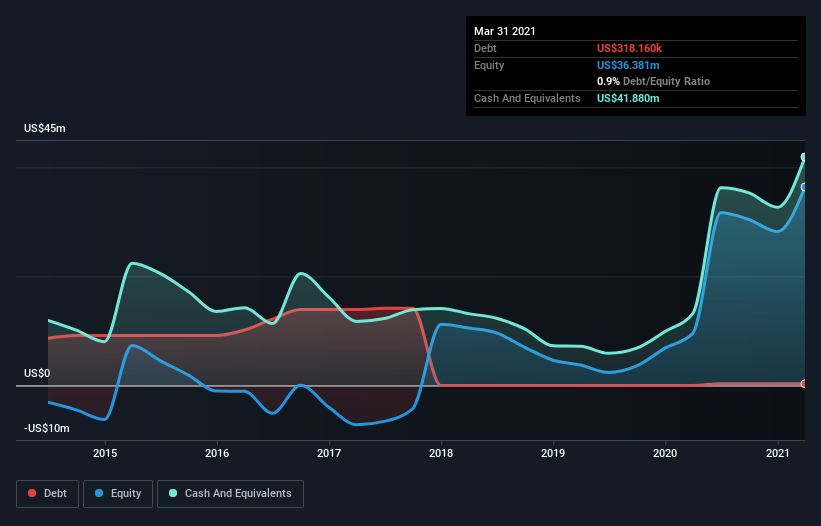

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. Capricor Therapeutics has such a small amount of debt that we'll set it aside, and focus on the US$42m in cash it held at March 2021. Importantly, its cash burn was US$13m over the trailing twelve months. So it had a cash runway of about 3.3 years from March 2021. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Is Capricor Therapeutics' Cash Burn Changing Over Time?

In our view, Capricor Therapeutics doesn't yet produce significant amounts of operating revenue, since it reported just US$165k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Over the last year its cash burn actually increased by a very significant 98%. Oftentimes, increased cash burn simply means a company is accelerating its business development, but one should always be mindful that this causes the cash runway to shrink. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Capricor Therapeutics Raise Cash?

Given its cash burn trajectory, Capricor Therapeutics shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$83m, Capricor Therapeutics' US$13m in cash burn equates to about 15% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Capricor Therapeutics' Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Capricor Therapeutics' cash runway was relatively promising. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Capricor Therapeutics (of which 2 make us uncomfortable!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade Capricor Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, focuses on the development of transformative cell and exosome-based therapeutics for the treatment of duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs.

Excellent balance sheet low.