- United States

- /

- Biotech

- /

- NasdaqGS:CABA

Cabaletta Bio (CABA): Evaluating Valuation After Positive Clinical Data at ACR Convergence 2025

Reviewed by Simply Wall St

Cabaletta Bio (CABA) gained traction after sharing positive updates on its lead therapy, rese-cel, at the American College of Rheumatology Convergence 2025. The company outlined clinical progress in autoimmune disease trials for myositis, systemic sclerosis and lupus.

See our latest analysis for Cabaletta Bio.

The buzz from Cabaletta Bio’s clinical updates comes after a remarkable stretch for the stock, with a 23% gain in the past month and a significant 94% share price return over 90 days. While the short-term rally has caught attention, the total shareholder return over the past year is still down nearly 25%, reflecting prior volatility. However, the company’s recent momentum is hard to ignore as optimism builds on trial progress.

If the rapid shift in sentiment around Cabaletta Bio has you wondering which other healthcare names are making waves, check out the latest discoveries in our See the full list for free..

With Cabaletta Bio’s shares rebounding on promising trial news but still trading below past highs, the real question is whether markets are undervaluing future breakthroughs or if investors have already accounted for the next phase of growth.

Price-to-Book Ratio of 1.5x: Is it justified?

With Cabaletta Bio trading at a price-to-book ratio of 1.5x compared to peer averages of 2.7x and 2.5x, its shares appear attractively valued on this measure at the recent close of $3.01.

The price-to-book ratio compares a company’s market value to the net value of its assets. For biotech firms like Cabaletta Bio, which are still in the clinical stage and not yet profitable, this multiple helps investors gauge potential downside protection and market expectations relative to tangible resources.

Given Cabaletta Bio's ratio is lower than both its direct peer group and the broader US biotech sector, investors may be underpricing the company’s longer-term prospects or factoring in clinical risks. The market is not assigning the same premium as it does to other biotechs, possibly reflecting this company’s early-stage profile and a lack of near-term profitability. If that risk perception changes in light of clinical success, the multiple could move closer to industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 1.5x (UNDERVALUED)

However, clinical setbacks or delays in trial readouts could quickly dampen optimism and put renewed pressure on Cabaletta Bio’s share price.

Find out about the key risks to this Cabaletta Bio narrative.

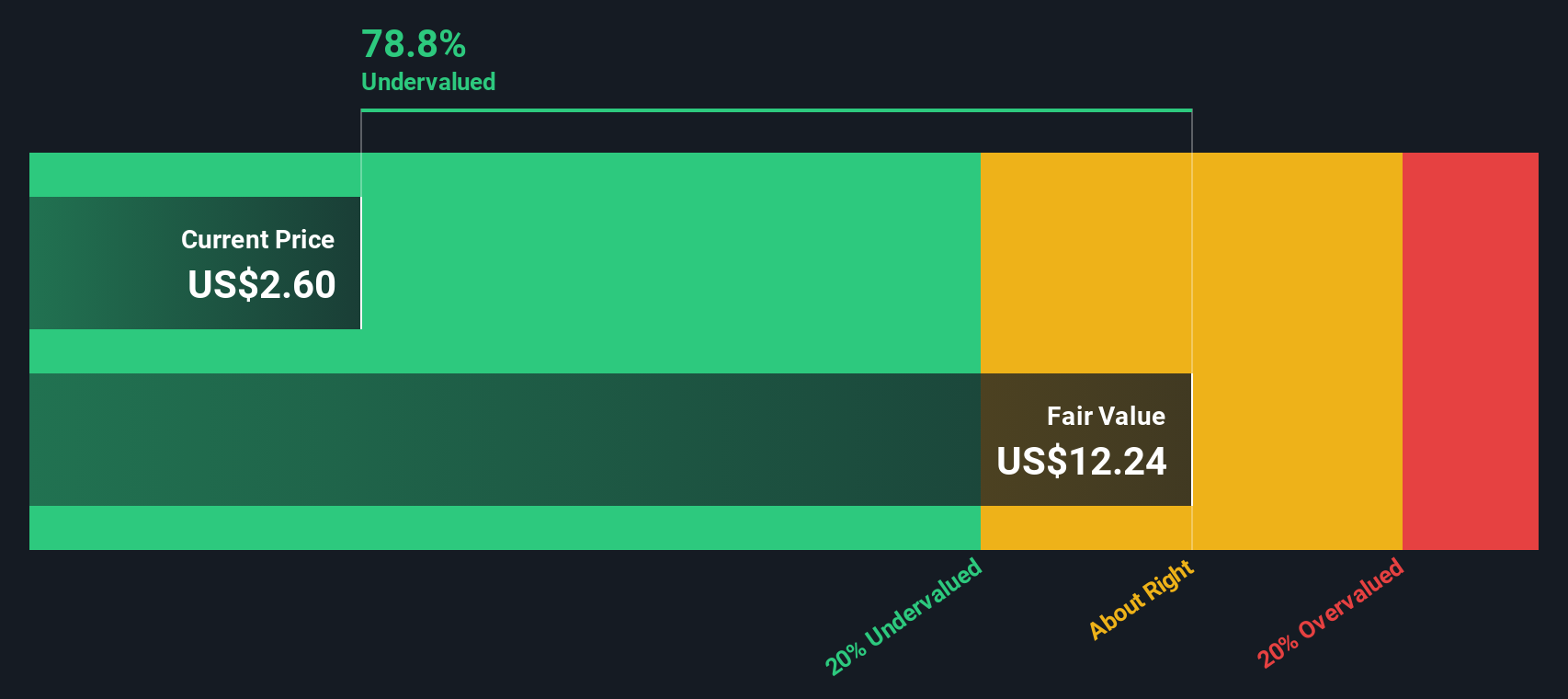

Another View: Discounted Cash Flow Signals Bigger Upside

Looking beyond multiples, our DCF model offers another angle. According to this approach, Cabaletta Bio's shares, recently at $3.01, trade at a steep discount to the DCF estimate of $11.91. This suggests the stock could be significantly undervalued. Could this wide gap reflect real opportunity, or does it highlight the risk in such early-stage forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cabaletta Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cabaletta Bio Narrative

If our outlook leaves you wanting a closer look or you prefer hands-on research, crafting your own narrative is simple and takes just a few minutes. Do it your way.

A great starting point for your Cabaletta Bio research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more promising investment ideas?

No savvy investor settles for just one opportunity when there are so many bold moves to make. Let Simply Wall Street’s screeners help you spot your next winner.

- Tap into strong income potential by checking out these 18 dividend stocks with yields > 3%, offering yields above 3% for reliable returns.

- Uncover tomorrow’s healthcare disruptors by reviewing these 33 healthcare AI stocks, which is reshaping patient care and diagnostics through advanced technology.

- Seize undervalued opportunities now with these 843 undervalued stocks based on cash flows and position yourself ahead as these stocks catch the market’s attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CABA

Cabaletta Bio

A clinical-stage biotechnology company, focuses on the discovery and development of engineered T cell therapies for patients with autoimmune diseases.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives