- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker (BRKR): A Fresh Look at Valuation After New High-Profile NMR System Orders

Reviewed by Simply Wall St

Bruker (BRKR) has secured fresh orders for its advanced Nuclear Magnetic Resonance systems from top US research organizations, including the first Multifield NMR Relaxometry System in North America. These developments highlight ongoing interest in the company's scientific equipment offerings.

See our latest analysis for Bruker.

Bruker's latest streak of high-profile NMR system sales comes amid noticeable volatility for its stock this year. A sizeable 16.9% share price gain in the past month has helped to offset deeper declines earlier in 2024. Still, the total shareholder return over the last twelve months remains at -35.6%, reflecting both shifting market sentiment and a recent wave of renewed interest tied to these orders and the company’s fundamental strengths.

If Bruker’s recent momentum has you thinking about what else is on the move, consider discovering fast growing stocks with high insider ownership.

With shares still trading well below last year’s highs, and renewed demand for its core products, the question remains whether Bruker is now undervalued or if the market has already priced in the anticipated growth.

Most Popular Narrative: 17% Undervalued

Bruker’s most popular narrative highlights a notable gap between its fair value and the last close, positioning the latest price well below consensus expectations. This presents a scenario where a recovery could be on the horizon as fundamental growth drivers remain in play.

The company's pipeline of recent innovations (e.g., next-generation tims mass spectrometry, spatial biology, automated diagnostics) positions it to benefit from sustained investment in personalized medicine, genomics, and high-throughput scientific R&D, supporting both future revenue expansion and favorable product mix improvements.

Want to uncover what analysts predict for Bruker's next phase? The real story sits in their surprising assumptions about future margins, profit leaps, and product demand. Find out how these bold expectations fuel the price target. Read on to see which assumptions are driving the bullish value call.

Result: Fair Value of $46.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding headwinds and muted demand visibility could challenge Bruker's recovery and put pressure on its future growth assumptions.

Find out about the key risks to this Bruker narrative.

Another View: A Look Through Multiples

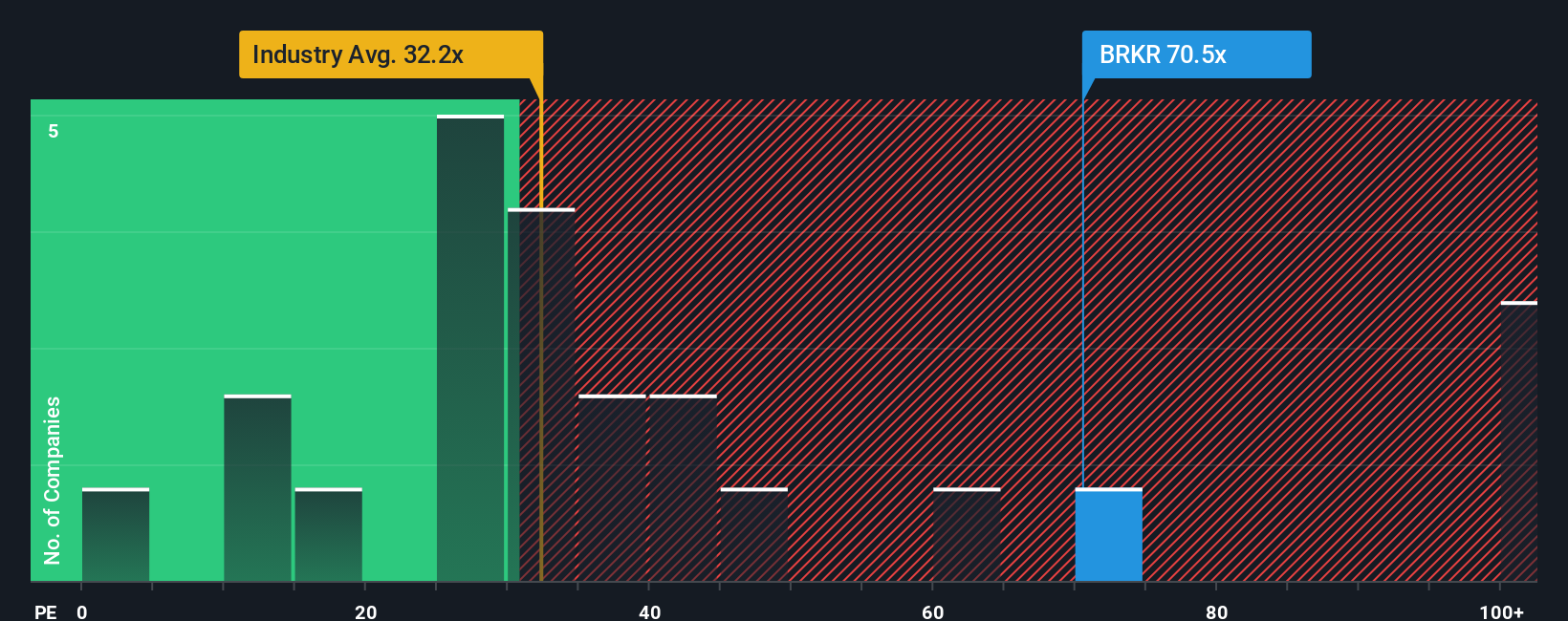

While the fair value estimate suggests Bruker is undervalued, the market is sending a different signal on price-to-earnings. Bruker trades at 73.9x earnings, which is far above the US Life Sciences industry average of 32.5x and even further above the fair ratio of 37x. This premium signals a higher valuation risk if fundamentals disappoint, making the current multiple challenging to justify. Is the market pricing in too much optimism, or is Bruker's edge worth paying up for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bruker Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build your own view using our tools in just a few minutes, Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have their eye on the next opportunity. These handpicked themes let you pinpoint breakout trends and high-potential companies before the crowd catches on.

- Capture high yields and steady cash flow by evaluating these 17 dividend stocks with yields > 3% with strong dividend histories and robust fundamentals.

- Spot rapid innovation and emerging leaders by scanning these 24 AI penny stocks where artificial intelligence is transforming entire industries.

- Start ahead of market rebounds by targeting these 876 undervalued stocks based on cash flows that offer real value based on proven cash flow strength and attractive discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives