- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

A Fresh Look at Bruker (BRKR) Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

Bruker (BRKR) recently saw a moderate uptick in its share price over the past month. This has prompted some investors to take a fresh look at the company’s fundamentals and recent financial performance.

See our latest analysis for Bruker.

The sharp 24.7% 1-month share price return for Bruker stands out against a tough backdrop, as the stock is still down over 34% year-to-date and has delivered a -32.98% total return over the past year. While recent momentum suggests shifting sentiment, perhaps as investors reassess growth and risk, the jury is still out on long-term trends.

If the latest rally has you rethinking your portfolio mix, now is the perfect time to discover fast growing stocks with high insider ownership.

With shares still trading below analyst targets and recent gains reducing a steep yearly loss, the real question is whether Bruker is undervalued at current levels or if the market is already pricing in all future growth.

Most Popular Narrative: 17.1% Undervalued

Bruker's latest close of $38.72 sits well below the fair value implied by the most popular narrative, hinting at upside potential if projections come to fruition. The outlook now depends on strategic changes and new market catalysts, which could drive meaningful change.

The expected stabilization and eventual recovery of research and biopharma funding in both the US and China, along with global settlements on tariffs, could trigger a rebound in demand for Bruker's advanced life science and drug discovery instruments. This could support renewed top-line revenue growth post-2025.

Curious how rising demand, bold cost-saving initiatives, and innovation could transform Bruker's future? The full narrative reveals the pivotal assumptions behind this valuation change and the specific financial turning points that could move the stock. Don’t miss the details savvy investors are already discussing.

Result: Fair Value of $46.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in research funding and additional delays in stimulus spending could quickly challenge this positive outlook for Bruker.

Find out about the key risks to this Bruker narrative.

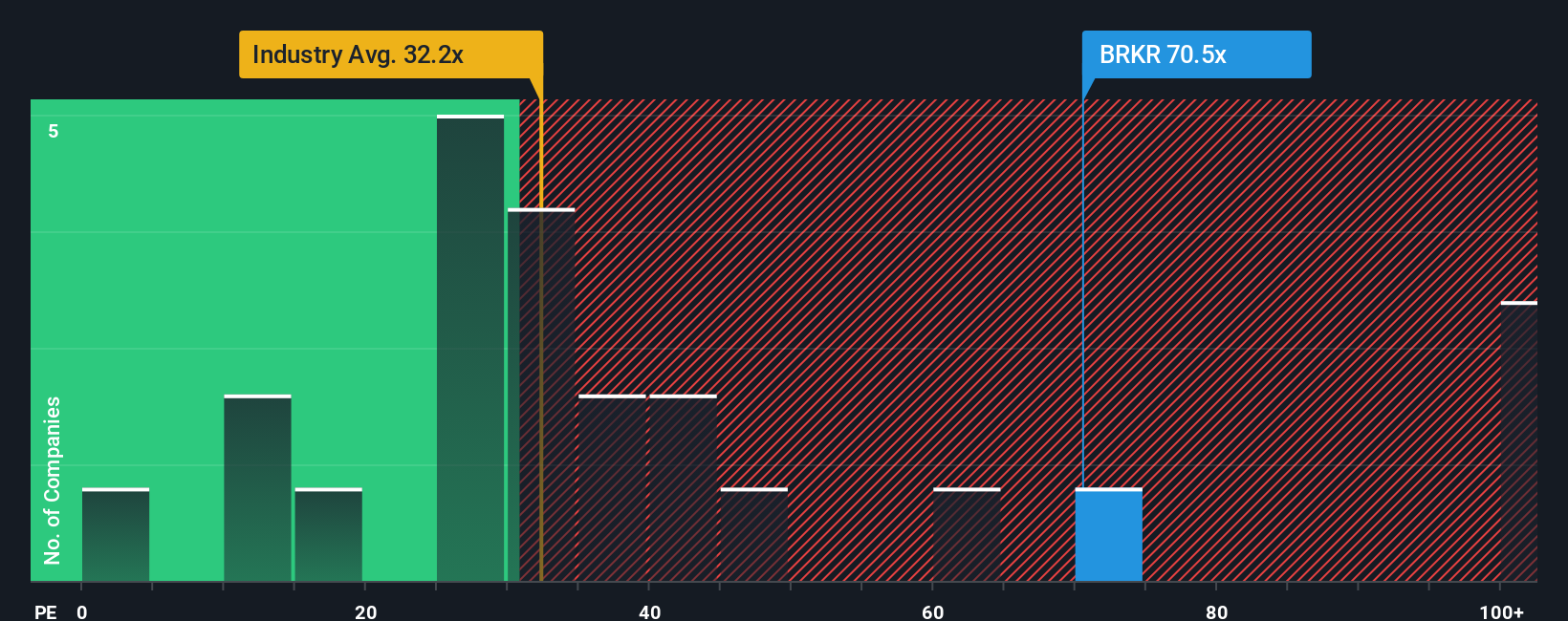

Another View: The Price-to-Earnings Perspective

Looking at Bruker’s valuation through the lens of its price-to-earnings ratio provides a different picture. At 73.8x, Bruker trades far above both the US Life Sciences industry average of 34.1x and its own fair ratio of 37.1x. This significant premium can signal high investor expectations and increases the risk that any disappointment could trigger a sharp selloff. Could Bruker’s market optimism withstand a slowdown, or does this set up a valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bruker Narrative

If you see the story differently, or you prefer to dive into your own research, it takes less than three minutes to craft your own narrative and see what you discover. Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let your next great opportunity slip by. Use the Simply Wall Street Screener to find innovative companies and trends that match your investment goals.

- Grow your portfolio with high-yield picks by checking out these 21 dividend stocks with yields > 3% offering attractive returns above 3%, making it a suitable option for steady income.

- Unlock new frontiers in computing by reviewing these 28 quantum computing stocks which is set to shape tomorrow's technology landscape with practical breakthroughs and advanced research.

- Tap into market potential with these 3575 penny stocks with strong financials backed by strong financials that could become the next hidden gems before they hit the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives