- United States

- /

- Biotech

- /

- NasdaqGS:BPMC

Some Confidence Is Lacking In Blueprint Medicines Corporation's (NASDAQ:BPMC) P/S

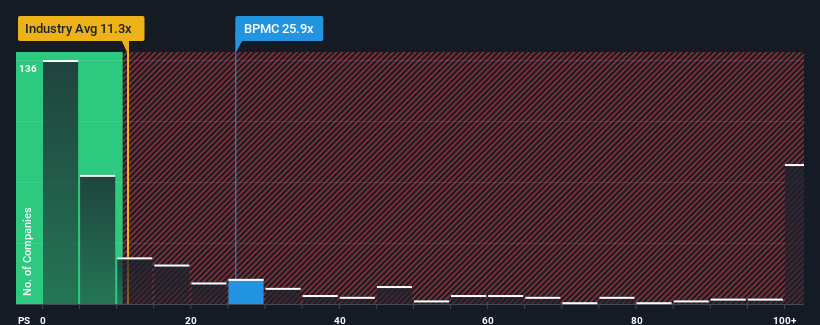

With a price-to-sales (or "P/S") ratio of 25.9x Blueprint Medicines Corporation (NASDAQ:BPMC) may be sending very bearish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios under 11.3x and even P/S lower than 4x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Blueprint Medicines

How Has Blueprint Medicines Performed Recently?

Blueprint Medicines could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Blueprint Medicines.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Blueprint Medicines would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. Still, revenue has fallen 65% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 50% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 203% per annum, which is noticeably more attractive.

In light of this, it's alarming that Blueprint Medicines' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Blueprint Medicines, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Blueprint Medicines that you need to be mindful of.

If you're unsure about the strength of Blueprint Medicines' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Blueprint Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BPMC

Blueprint Medicines

A precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives