- United States

- /

- Biotech

- /

- NasdaqGS:BMRN

BioMarin Pharmaceutical (BMRN): Margin Surge Reinforces Bullish Narratives Despite Revenue Lag

Reviewed by Simply Wall St

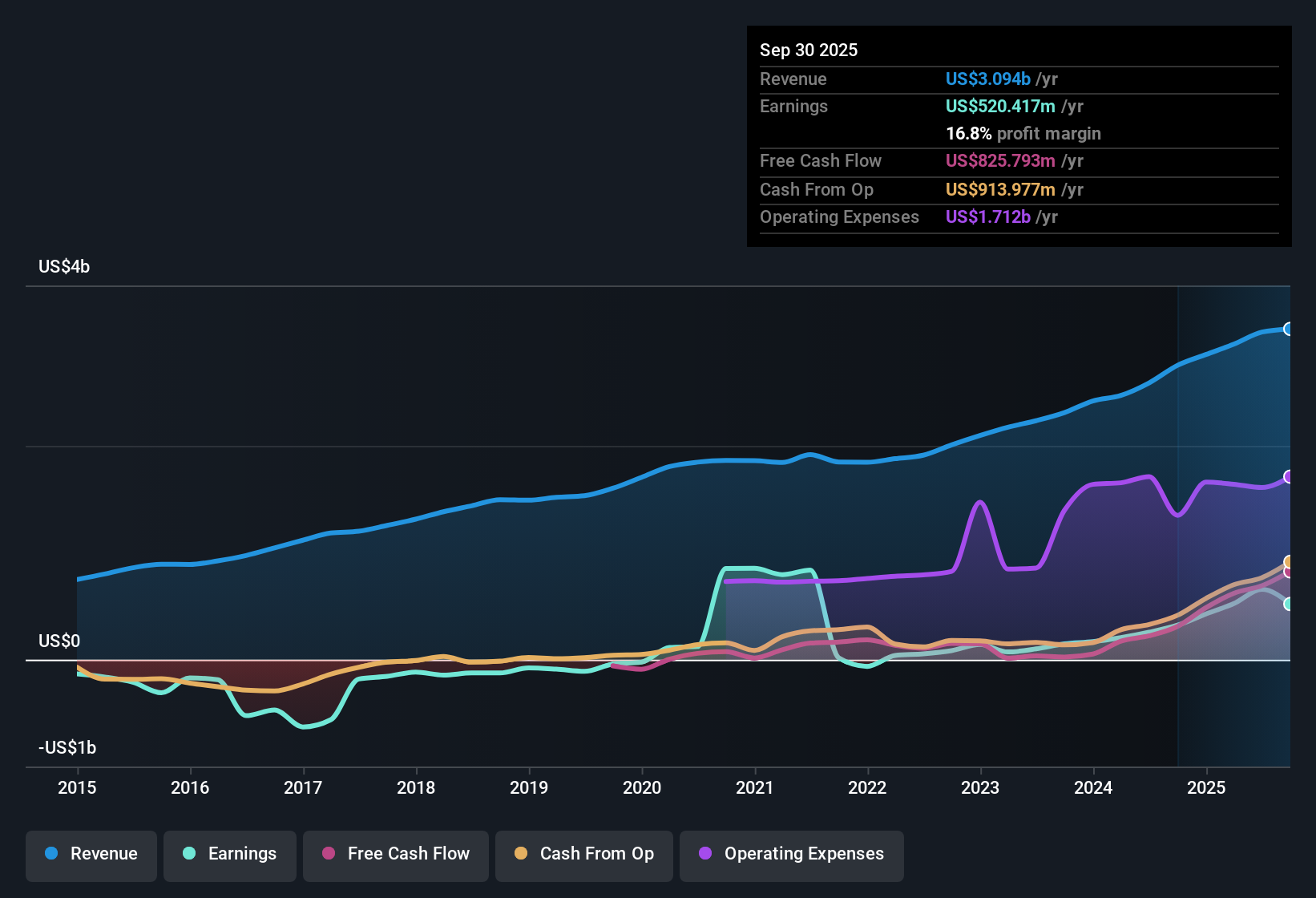

BioMarin Pharmaceutical (BMRN) delivered a net profit margin of 16.8%, up from 11.7% a year ago, with earnings soaring 61.5% over the past twelve months compared to a five-year average annual decline of 8.5%. While revenue is forecast to climb at 6.5% per year, lagging the broader US market’s 10.1% estimate, earnings are expected to accelerate at a 21.3% annual rate, outpacing the market’s 15.6%. The balance of strong profit growth and improved margins, together with a share price of $53.49 well below the estimated fair value, is likely to draw investor attention despite a slower revenue outlook.

See our full analysis for BioMarin Pharmaceutical.Now let's see how this latest set of results matches up with the dominant narratives investors follow, and whether any assumptions get put to the test.

See what the community is saying about BioMarin Pharmaceutical

Margin Expansion Builds Strength

- Profit margins improved from 11.7% to 16.8%, marking a clear turnaround from the five-year average annual earnings decline of 8.5% to robust 61.5% growth over the past year.

- According to the analysts' consensus view, this margin momentum is expected to continue, with profit margins forecast to reach 29.8% over the next three years.

- Consensus narrative highlights that operational efficiency, cost control, and supportive regulatory incentives are creating conditions for long-term margin sustainability.

- However, the reliance on a few key therapies and growing expenses from pipeline development points to ongoing pressure to convert this margin improvement into steady, multi-year profitability.

Consensus sees opportunity and challenge: Will efficiency gains outweigh heavy reinvestment in new therapies? 📊 Read the full BioMarin Pharmaceutical Consensus Narrative.

Revenue Growth Trails US Biotechs

- BioMarin’s projected revenue growth rate of 6.5% per year is slower than the broader US market’s 10.1% estimate and trails the sector’s momentum, putting extra attention on the company’s strategy to reignite top-line progress.

- Consensus narrative flags that even as international expansion and new patient starts support revenue, headwinds like increased competition and global pricing pressures could constrain further acceleration.

- Bulls cite expanding global demand and new indications as key support, but consensus acknowledges that pipeline dependency amplifies downside risk if key launches face delays or setbacks.

- Rising regulatory hurdles and potential product exclusivity losses are highlighted as notable threats, meaning ongoing outperformance will require both successful innovation and robust commercialization.

DCF Valuation Signals Deep Discount

- With a current share price of $53.49 and a DCF fair value of $153.98, BioMarin trades at a steep 65% discount to its estimated intrinsic worth. This is far below its peer average PE of 23.5x, yet still pricier than the US Biotechs industry PE of 17.8x.

- Consensus narrative argues that this wide discount reflects investors’ caution, balancing accelerating profit growth against slower revenue gains and above-industry valuation multiples.

- The gap between share price and fair value could close quickly if BioMarin achieves forecasted earnings milestones. However, consensus warns that disappointment on growth or regulatory fronts could keep the discount anchored.

- Analysts agree that upside potential is real, yet divergent price targets ($60.00 low to $122.00 high) underscore the divided expectations about how much of the story is already priced in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BioMarin Pharmaceutical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the results another way? Share your unique take and build your personal view in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

See What Else Is Out There

While BioMarin’s profit margins are rebounding, its slower revenue growth and reliance on key therapies expose it to competitive threats and unpredictable top-line performance.

If dependable expansion is a priority for you, use our stable growth stocks screener (2115 results) to find companies delivering consistent growth and fewer surprises across each cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioMarin Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMRN

BioMarin Pharmaceutical

A biotechnology company, engages in the development and commercialization of therapies for life-threatening rare diseases and medical conditions in the United States, Europe, Latin America, the Middle East, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives