- United States

- /

- Pharma

- /

- NasdaqCM:BLTE

Belite Bio (BLTE): Evaluating the Stock’s Valuation After China Accepts Tinlarebant for Priority Review

Reviewed by Simply Wall St

Belite Bio (BLTE) is in the spotlight after China's regulatory authority accepted its New Drug Application for Tinlarebant with priority review. This move follows statistically significant Phase 3 trial results and suggests a potential near-term approval.

See our latest analysis for Belite Bio.

Momentum has been steadily building for Belite Bio, with a 32.98% share price return over the past month and a total shareholder return of nearly 39% over the last year. The recent regulatory win in China and a $180 million shelf registration filing have both added fuel to the story. These developments are supporting the perception of real long-term growth potential.

If Belite’s pipeline progress has you thinking about where biotech innovation is heading next, take the opportunity to explore See the full list for free.

With analyst targets sitting just above the current share price and optimism running high after recent regulatory wins, investors are left asking: is there real upside left in Belite Bio, or has the market already priced in its future growth?

Price-to-Book Ratio of 20.3x: Is it Justified?

Belite Bio’s shares are trading at a price-to-book ratio of 20.3x, which is well above its peer group’s average of 3.4x. At the current price of $92.82, this positions BLTE as expensive relative to its sector.

The price-to-book ratio measures a company's market price compared to its net asset value and is often used for biotechs and early-stage healthcare companies with little or negative earnings. For a high-growth drug developer like Belite Bio, investors may pay a premium for the pipeline’s future potential rather than present profits.

The company’s price-to-book ratio significantly exceeds the average across both its direct peers and the broader US pharmaceuticals industry, where the typical ratio is below 3.5x. This valuation indicates that the market is likely factoring in aggressive expectations for clinical success or long-term revenue upside, which may be difficult to justify on fundamentals alone.

With such a high multiple, investors should look for compelling evidence that Belite Bio’s clinical pipeline can deliver the outsized results needed to support this premium. Otherwise, there may be a risk that market sentiment shifts rapidly. See what the numbers say about this price and find out more in our valuation breakdown.

Result: Price-to-Book of 20.3x (OVERVALUED)

However, limited revenue and ongoing net losses highlight execution risks. These risks could quickly reverse sentiment if clinical milestones are missed or delayed.

Find out about the key risks to this Belite Bio narrative.

Another View: What Does Our DCF Model Say?

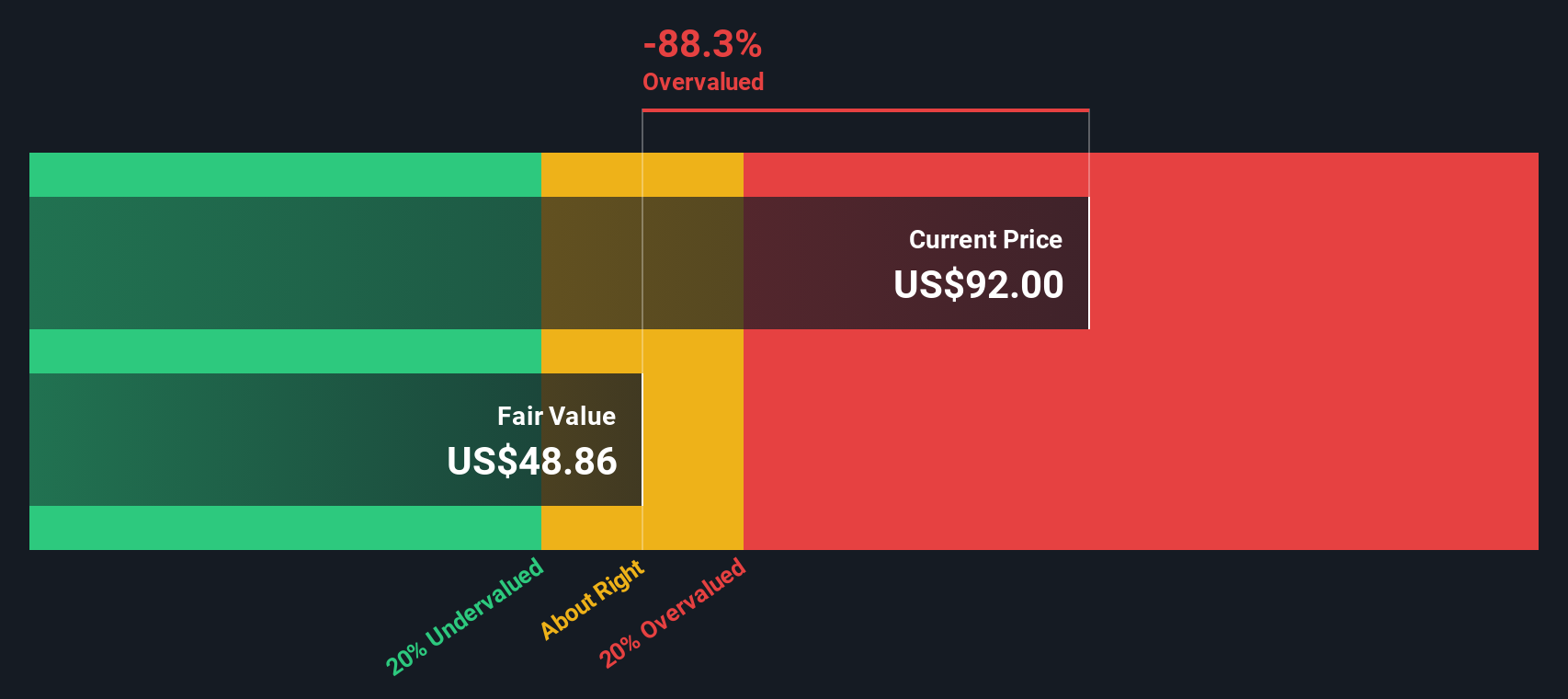

Looking beyond ratios, our DCF model provides a different perspective. It estimates Belite Bio’s fair value at $48.86. The current price of $92.82 is well above this calculated value, so by this measure, the stock appears overvalued. Does this suggest the market is getting ahead of itself, or does it see something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Belite Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Belite Bio Narrative

If you have a different take or want to dig deeper, you can develop your own perspective using our platform in just a few minutes: Do it your way

A great starting point for your Belite Bio research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means spotting trends before the crowd. Let Simply Wall Street point you toward new opportunities you might otherwise miss. Start searching with these handpicked screens:

- Unlock potential growth by targeting value opportunities through these 880 undervalued stocks based on cash flows, where companies may be trading below intrinsic worth based on solid cash flows.

- Capture the momentum of tomorrow’s technology by checking out these 27 AI penny stocks, spotlighting firms advancing artificial intelligence and reshaping entire industries.

- Maximize your passive income with these 17 dividend stocks with yields > 3%, featuring stocks offering strong yields above 3% for more resilient portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belite Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLTE

Belite Bio

A clinical stage biopharmaceutical drug development company, engages in the research and development of novel therapeutics targeting retinal degenerative eye diseases with unmet medical needs in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives