- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Evaluating Biogen’s Prospects After Recent FDA Approval Boosts Shares by 6%

Reviewed by Simply Wall St

If you have been watching Biogen's stock lately, you are probably asking yourself the big question: is now a smart time to buy, sell, or just wait it out? It's not always easy to figure out what the numbers are telling us, especially when the biotech sector is so full of ups and downs. Just in the past year, shares of Biogen have dropped more than 34%, and the return over five years is down more than 50%. At first glance, those numbers might look discouraging, but context is everything, especially for a company navigating competitive markets, new drug launches, and regulatory changes.

Digging deeper, there have actually been some encouraging moves under the surface. Over the last month, Biogen shares are up more than 8%, with a noticeable 6% jump just in the past seven days. That's a big swing considering the lengthy downtrend that came before. These gains have been helped along by positive updates around pipeline drugs, shifts in risk perception among big investors, and some market optimism about the broader pharma sector. There is definitely potential for a turnaround, and Wall Street analysts seem to agree: Biogen's stock currently trades at about a 24% discount to the consensus price target, and a full 63% discount if you believe the intrinsic value models.

That brings us to Biogen's value score: a solid 5 out of 6, based on several established checks for undervaluation. With so much noise around the latest headlines and price charts, it pays to focus on what really matters, such as valuation. Next, let's break down Biogen's stock using the main valuation methods, and later, I will show you a more nuanced way to gauge whether the company is trading at a bargain.

Biogen delivered -34.0% returns over the last year. See how this stacks up to the rest of the Biotechs industry.Approach 1: Biogen Cash Flows

A Discounted Cash Flow (DCF) model estimates what a company’s stock should be worth today by projecting how much cash it will generate in the future, then “discounting” that stream of money back to its present value. The idea is to figure out if the market price reflects the true, long-term value found in a company’s financials.

For Biogen, the latest twelve months’ Free Cash Flow stands at $1.85 billion. Looking further down the road, analysts project that by 2029, Biogen’s annual Free Cash Flow could reach $2.64 billion, with amounts expected to remain strong through 2035. These ongoing, robust cash flows are used in the 2 Stage Free Cash Flow to Equity model, which incorporates both near-term growth and longer-term stability.

Applying these projections to the DCF model results in an intrinsic fair value of $368.50 per share. Comparing this to Biogen’s current share price suggests the stock is approximately 63.1% undervalued, indicating that the market is pricing it well below what steady future cash flows might support.

Result: UNDERVALUED

Approach 2: Biogen Price vs Earnings (P/E)

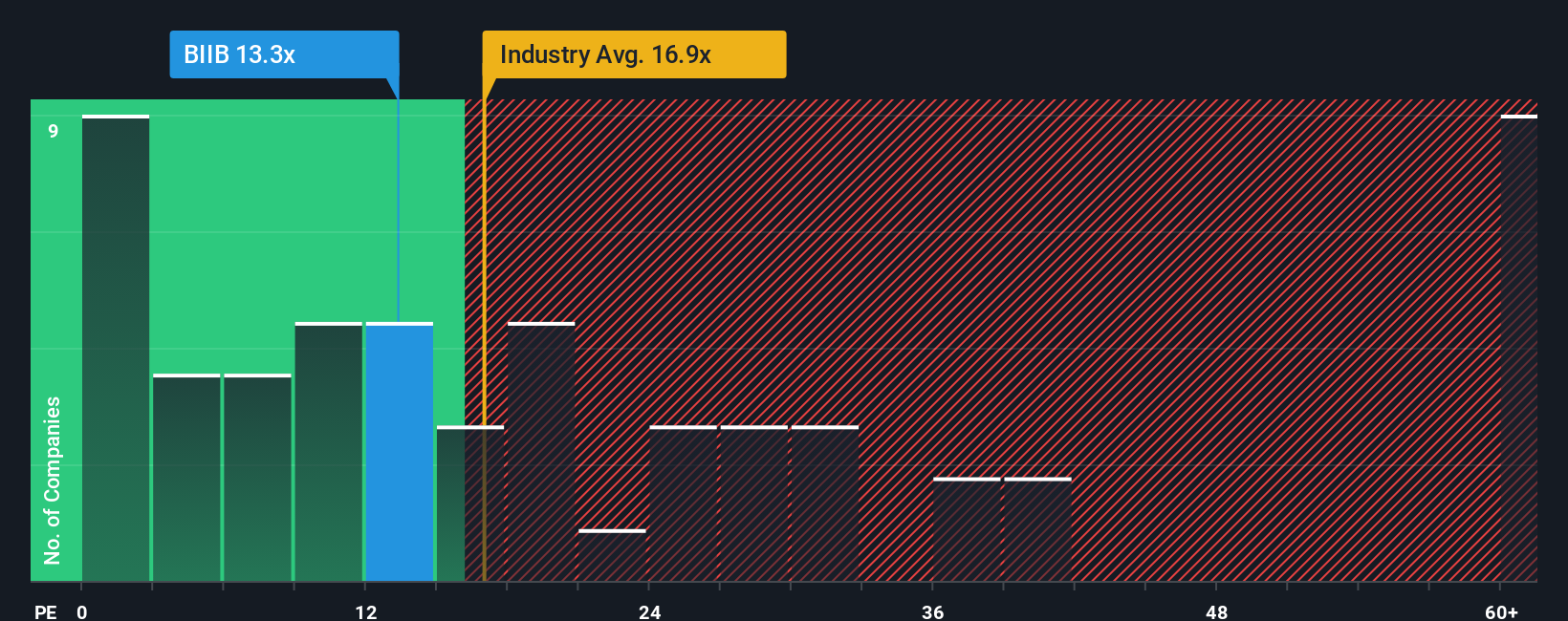

Another widely used method for valuing established, profitable companies like Biogen is the Price-to-Earnings (P/E) ratio. This metric is particularly suitable because it tells us how much investors are willing to pay for a dollar of the company's earnings. This makes it a quick way to compare profit expectations against both peers and the market as a whole.

Of course, a “normal” or “fair” P/E ratio will depend on several factors, including future growth expectations, risk profile, and how the industry is evolving. Companies with higher anticipated growth and lower risk tend to justify higher P/E ratios, while those facing uncertainty or stagnant earnings typically see a lower multiple.

Biogen's current P/E sits at 13.02x. For context, that is below both the biotechs industry average of 15.61x and the average for its closest peers, which is 21.29x. Meanwhile, Simply Wall St's proprietary Fair Ratio for Biogen is 17.84x. This incorporates factors like Biogen's historic and expected growth, profit margins, and risks unique to its business size and profile.

Since Biogen’s P/E is meaningfully below both the Fair Ratio and external benchmarks, the stock appears undervalued on this metric as well.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Biogen Narrative

While numbers tell part of the story, a narrative helps you see the bigger picture by connecting your view of Biogen’s business, such as assumptions about future growth, margins, and the competitive landscape, to a financial forecast and ultimately to a fair value estimate.

In plain terms, a narrative is your unique “investment story,” making it easier to support your outlook on a company with actual numbers and to see how your expectations compare with reality. The Simply Wall St platform makes this approach practical for everyone, helping millions of investors clarify their thinking and compare stories right alongside the latest company updates.

When you use narratives, you can quickly spot when the current share price is above or below your calculated fair value. This makes it easier to decide if now is an appropriate time to buy, sell, or hold. Narratives are dynamic, as they automatically update with new information such as earnings, product launches, or news, so your view on Biogen remains current.

For example, one investor might be optimistic and estimate a high future earnings target for Biogen, which could result in a fair value of $260.00 per share. Another, more cautious investor might see risks and set a fair value as low as $118.00, showing how your narrative really does drive your decision.

Do you think there's more to the story for Biogen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives