- United States

- /

- Biotech

- /

- NasdaqGS:BGNE

3 US Stocks That May Be Undervalued According To Estimates

Reviewed by Simply Wall St

As the U.S. stock market stabilizes following a turbulent week, investors are closely monitoring upcoming economic data releases and Federal Reserve comments for further direction. Amid this cautious environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential market opportunities. In this article, we will explore three U.S. stocks that may be undervalued according to estimates, offering insights into why these companies could present attractive investment opportunities in the current market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| KE Holdings (NYSE:BEKE) | $14.80 | $29.48 | 49.8% |

| SouthState (NYSE:SSB) | $87.13 | $173.07 | 49.7% |

| Eastern Bankshares (NasdaqGS:EBC) | $14.79 | $29.12 | 49.2% |

| Pinnacle Financial Partners (NasdaqGS:PNFP) | $87.72 | $173.57 | 49.5% |

| Avidbank Holdings (OTCPK:AVBH) | $18.75 | $37.15 | 49.5% |

| CrowdStrike Holdings (NasdaqGS:CRWD) | $239.34 | $474.21 | 49.5% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $59.62 | $117.67 | 49.3% |

| Envela (NYSEAM:ELA) | $4.89 | $9.60 | 49.1% |

| Enphase Energy (NasdaqGM:ENPH) | $109.11 | $213.87 | 49% |

| Live Nation Entertainment (NYSE:LYV) | $91.60 | $182.07 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

BeiGene (NasdaqGS:BGNE)

Overview: BeiGene, Ltd., an oncology company with a market cap of $19.39 billion, focuses on discovering and developing cancer treatments for patients in the United States, China, Europe, and internationally.

Operations: The company's revenue from pharmaceutical products is $3.10 billion.

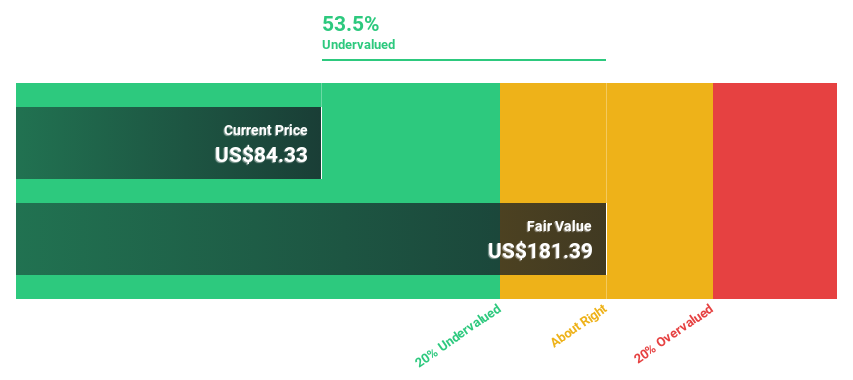

Estimated Discount To Fair Value: 44%

BeiGene, Ltd. appears undervalued based on cash flows, trading at US$190.03 per share against an estimated fair value of US$339.57. Recent earnings show significant revenue growth to US$929.17 million for Q2 2024 with a reduced net loss of US$120.41 million, reflecting improved financial health and operational efficiency. The opening of a new U.S facility and the appointment of Aaron Rosenberg as CFO further strengthen its strategic position in oncology innovation and financial management.

- The growth report we've compiled suggests that BeiGene's future prospects could be on the up.

- Navigate through the intricacies of BeiGene with our comprehensive financial health report here.

BioMarin Pharmaceutical (NasdaqGS:BMRN)

Overview: BioMarin Pharmaceutical Inc. develops and commercializes therapies for serious and life-threatening rare diseases and medical conditions, with a market cap of $16.88 billion.

Operations: The company's revenue segment focuses on the development and commercialization of innovative therapies, generating $2.59 billion.

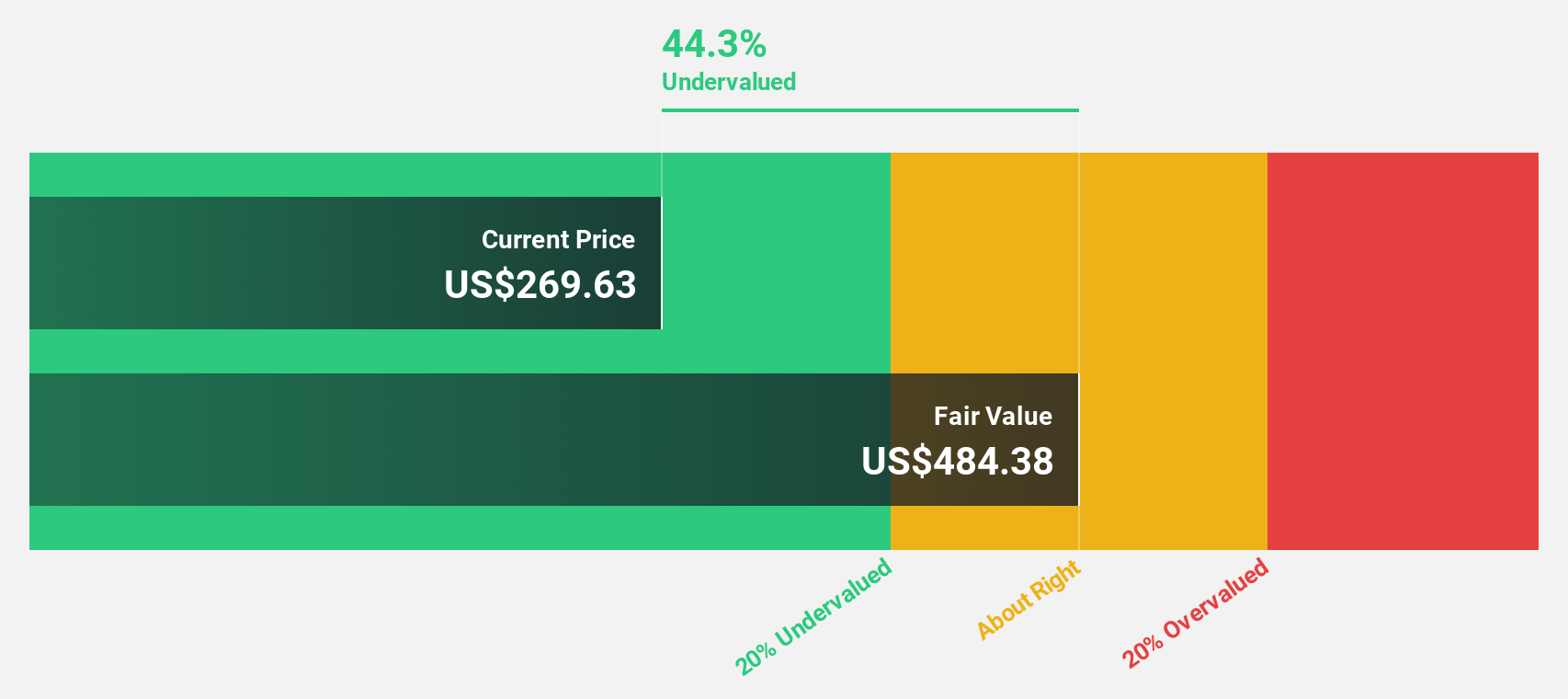

Estimated Discount To Fair Value: 44.3%

BioMarin Pharmaceutical, trading at US$89.03, appears significantly undervalued with an estimated fair value of US$159.75. Recent Q2 2024 earnings show revenue growth to US$712.03 million and net income doubling to US$107.17 million year-over-year, highlighting robust cash flows and operational efficiency. The FDA's expanded approval for BRINEURA® further strengthens its market position in rare diseases, potentially driving future revenue growth and supporting the stock's undervaluation based on discounted cash flow analysis.

- In light of our recent growth report, it seems possible that BioMarin Pharmaceutical's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of BioMarin Pharmaceutical.

KeyCorp (NYSE:KEY)

Overview: KeyCorp, with a market cap of $13.78 billion, operates as the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services in the United States.

Operations: KeyBank National Association generates revenue primarily from its Consumer Bank segment ($3.08 billion) and Commercial Bank segment ($2.76 billion).

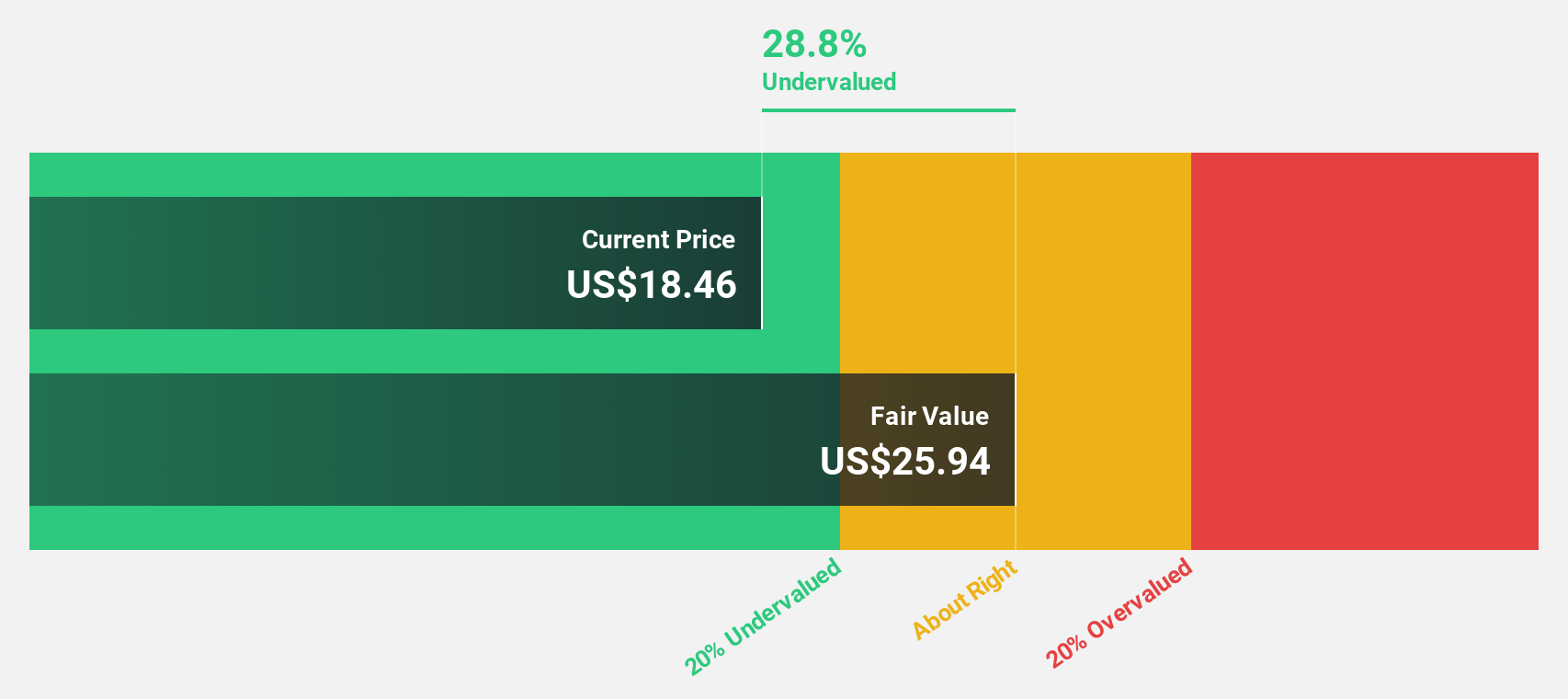

Estimated Discount To Fair Value: 38.9%

KeyCorp, trading at US$15.94, is significantly undervalued with an estimated fair value of US$26.09. Despite a decline in net interest income and net income for Q2 2024, the company's earnings are expected to grow substantially over the next three years. The recent strategic investment by Scotiabank, amounting to approximately US$2.8 billion, should bolster KeyCorp’s financial position and potentially enhance its cash flow profile, making it an attractive option based on discounted cash flow analysis.

- Insights from our recent growth report point to a promising forecast for KeyCorp's business outlook.

- Click to explore a detailed breakdown of our findings in KeyCorp's balance sheet health report.

Summing It All Up

- Access the full spectrum of 178 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeiGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGNE

BeiGene

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with reasonable growth potential.