- United States

- /

- Pharma

- /

- NasdaqCM:BFRI

Benign Growth For Biofrontera Inc. (NASDAQ:BFRI) Underpins Its Share Price

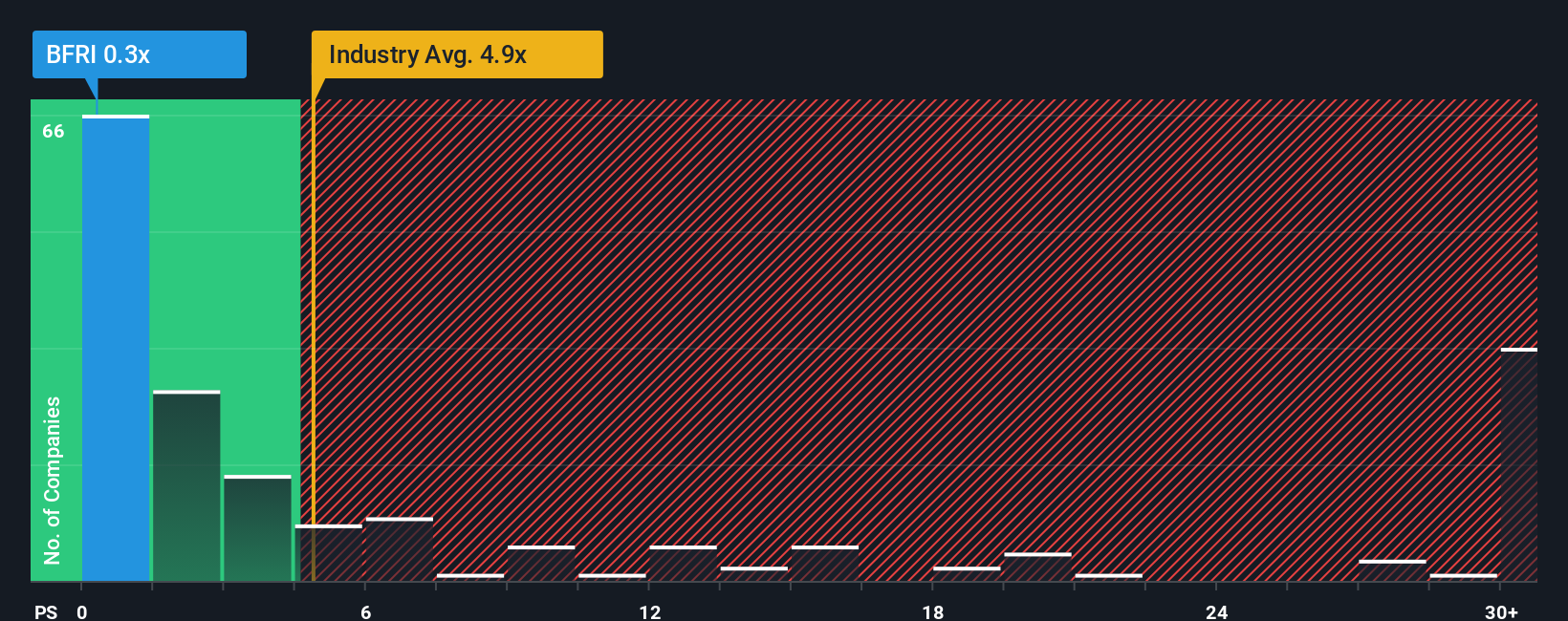

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Biofrontera Inc. (NASDAQ:BFRI) is definitely a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 4.9x and even P/S above 19x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Biofrontera

What Does Biofrontera's Recent Performance Look Like?

Biofrontera could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Biofrontera will help you uncover what's on the horizon.How Is Biofrontera's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Biofrontera's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 21% per annum over the next three years. With the industry predicted to deliver 28% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Biofrontera's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Biofrontera's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Biofrontera's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Biofrontera (3 are a bit concerning!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Biofrontera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BFRI

Biofrontera

A biopharmaceutical company, engages in the commercialization of pharmaceutical products for the treatment of dermatological conditions in the United States.

Reasonable growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success