- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Can Multiple Early-Stage Trials Accelerate Beam Therapeutics' (BEAM) Path to Gene-Editing Leadership?

Reviewed by Sasha Jovanovic

- Beam Therapeutics recently announced updates on three key Phase 1/2 clinical trials: BEAM-302 for Alpha-1 Antitrypsin Deficiency, BEAM-301 for Glycogen Storage Disease Type Ia, and BEAM-101 for severe sickle cell disease, each aimed at evaluating safety and efficacy of precision gene-editing therapies.

- These simultaneous developments reflect significant progress in Beam Therapeutics’ genetic therapy pipeline and highlight the company’s efforts to address rare and serious diseases through base editing technology.

- We'll explore how these clinical milestones, and particularly Beam's progress across multiple early-stage trials, shape the evolving investment narrative for the company.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Beam Therapeutics Investment Narrative Recap

To be a shareholder in Beam Therapeutics, you need to believe in the potential of base editing to transform genetic medicine, particularly in rare disorders. The recent clinical trial updates boost optimism around Beam’s pipeline progression but do not meaningfully shift the most important near-term catalyst: clinical validation and safety results for BEAM-101, while continued risk centers on the safety profile of preconditioning regimens. Among the latest announcements, the BEAM-302 trial update is particularly relevant. With positive interim safety and efficacy signals reported, and dose selection advancing, investors have a fresh datapoint as Beam aims for a potential registrational path, which connects directly to the broader catalyst of expanding its rare disease portfolio. In contrast to the promising clinical advancements, investors should remain alert to ongoing concerns about the conditioning regimen and its implications for patient safety...

Read the full narrative on Beam Therapeutics (it's free!)

Beam Therapeutics' outlook anticipates $89.1 million in revenue and $14.3 million in earnings by 2028. This scenario requires 13.9% annual revenue growth and an earnings increase of $412.9 million from current earnings of -$398.6 million.

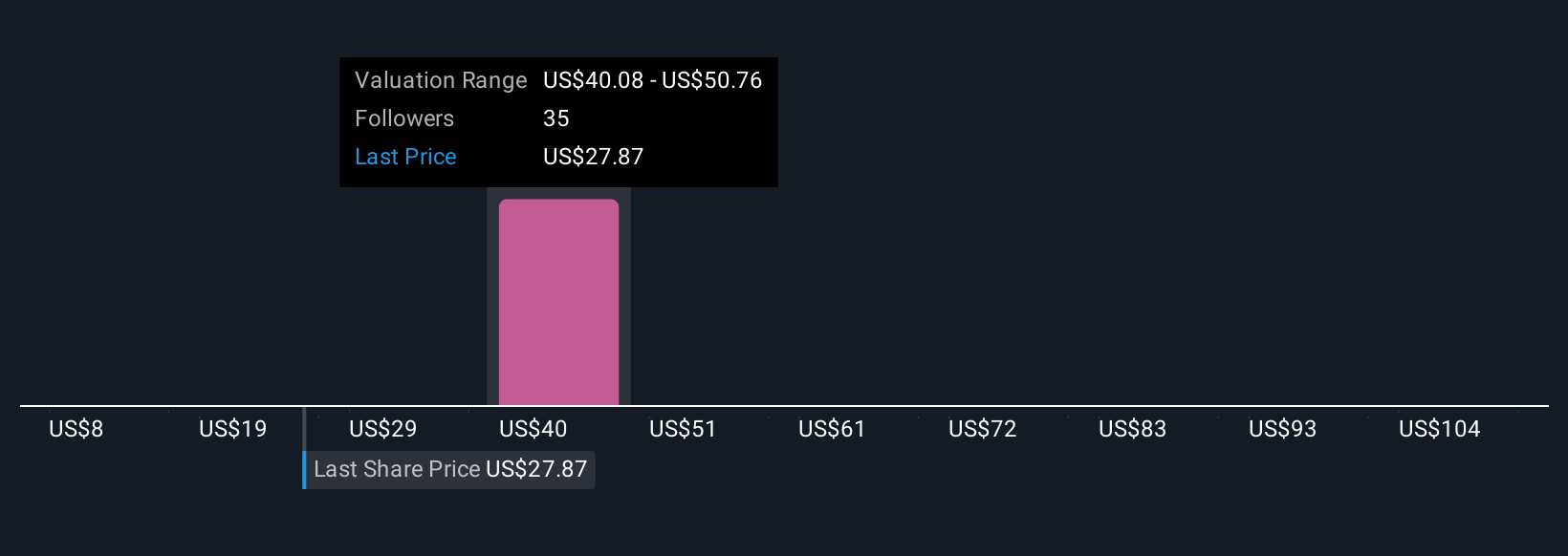

Uncover how Beam Therapeutics' forecasts yield a $45.92 fair value, a 72% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$35.77 to US$65.01 per share, showing significant variance in market expectations. While optimism about BEAM-302 trial progress persists, opinions differ widely and you should compare these perspectives with the persistent risk of delayed approvals or safety setbacks.

Explore 4 other fair value estimates on Beam Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Beam Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Beam Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beam Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives