- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM) Gains Analyst Support After Strong BEAM-302 Data Spotlighted by Evercore ISI

Reviewed by Sasha Jovanovic

- In November 2025, Evercore ISI Group initiated coverage on Beam Therapeutics with an "Outperform" rating, recognizing the potential of its precision genetic medicine programs, including BEAM-101 for sickle cell disease and BEAM-302 for alpha-1 antitrypsin deficiency.

- This new analyst coverage emphasized especially strong early data from BEAM-302 and drew attention to the critical data readout expected in early 2026.

- We'll examine how Evercore ISI's focus on BEAM-302's early data impacts Beam Therapeutics' investment narrative and outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Beam Therapeutics Investment Narrative Recap

Shareholders in Beam Therapeutics need confidence in the promise of its precision genetic medicine, particularly BEAM-302, where positive early data has become central to the current investment narrative. Evercore ISI's recent "Outperform" rating brings renewed focus to BEAM-302, but the near-term outlook remains anchored to the anticipated data readout in early 2026. Market attention on safety and durability of these results continues to be the biggest risk, while progress with BEAM-101 is also closely watched.

Among recent updates, the August 2025 announcement of strong safety and efficacy data for BEAM-302 stands out, as it confirmed clinical proof-of-concept for treating alpha-1 antitrypsin deficiency. This aligns with Evercore ISI’s optimism and helps reinforce BEAM-302 as a key catalyst, reflecting the significance of upcoming clinical milestones for Beam’s future prospects.

However, in contrast to the optimism surrounding BEAM-302, investors should be mindful that the durability and consistency of early clinical data still leave important unanswered questions, especially if…

Read the full narrative on Beam Therapeutics (it's free!)

Beam Therapeutics' outlook anticipates $89.1 million in revenue and $14.3 million in earnings by 2028. This implies annual revenue growth of 13.9% and an earnings increase of $412.9 million from current earnings of -$398.6 million.

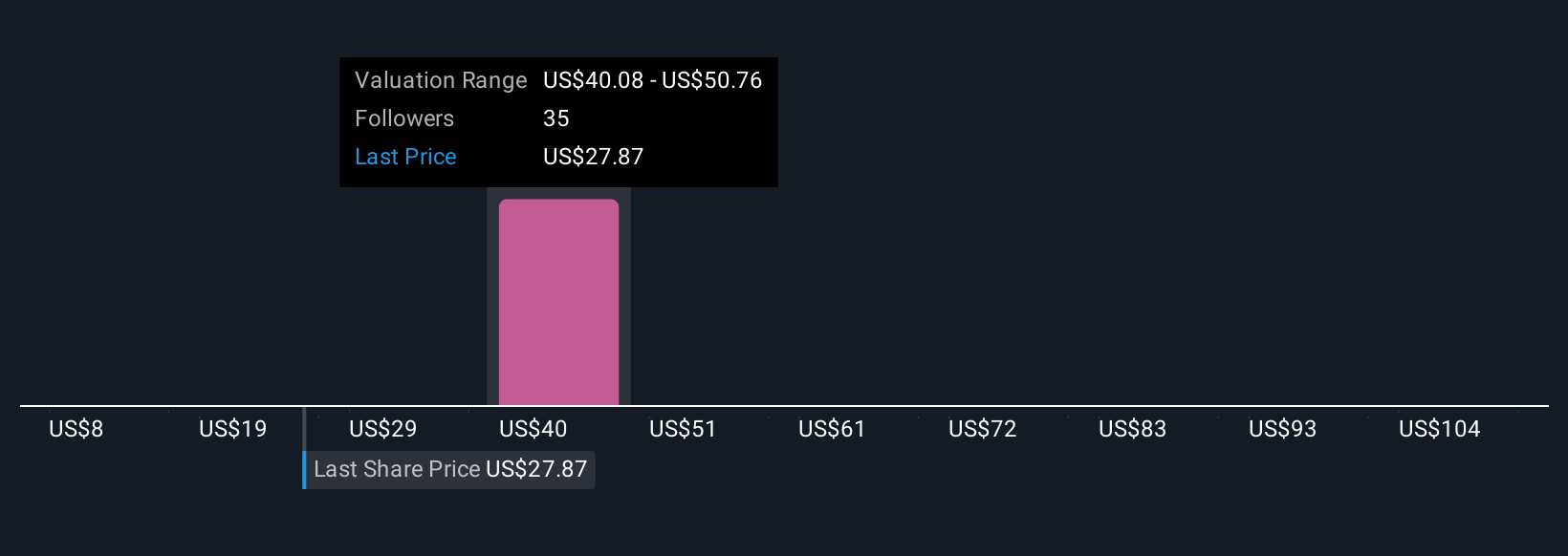

Uncover how Beam Therapeutics' forecasts yield a $45.92 fair value, a 83% upside to its current price.

Exploring Other Perspectives

Three community members have estimated Beam’s fair value from US$45.92 up to US$95. While hope centers on BEAM-302’s positive data, uncertainty around long-term safety could weigh on future results. See how other investors view Beam’s outlook.

Explore 3 other fair value estimates on Beam Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own Beam Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Beam Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beam Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success