- United States

- /

- Biotech

- /

- NasdaqGM:BCAX

How Bicara's Dual Biotech Index Additions Will Impact Bicara Therapeutics (BCAX) Investors

Reviewed by Sasha Jovanovic

- Earlier in December 2025, Bicara Therapeutics Inc. was added to both the NASDAQ Biotechnology Index and the S&P Biotechnology Select Industry Index, marking its inclusion in two widely followed biotech benchmarks.

- This dual index inclusion can enhance Bicara’s visibility among institutional investors and index-tracking funds, potentially broadening its shareholder base and liquidity profile.

- We’ll now examine how Bicara’s entry into major biotechnology indices shapes its investment narrative, particularly through increased visibility with institutional investors.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Bicara Therapeutics' Investment Narrative?

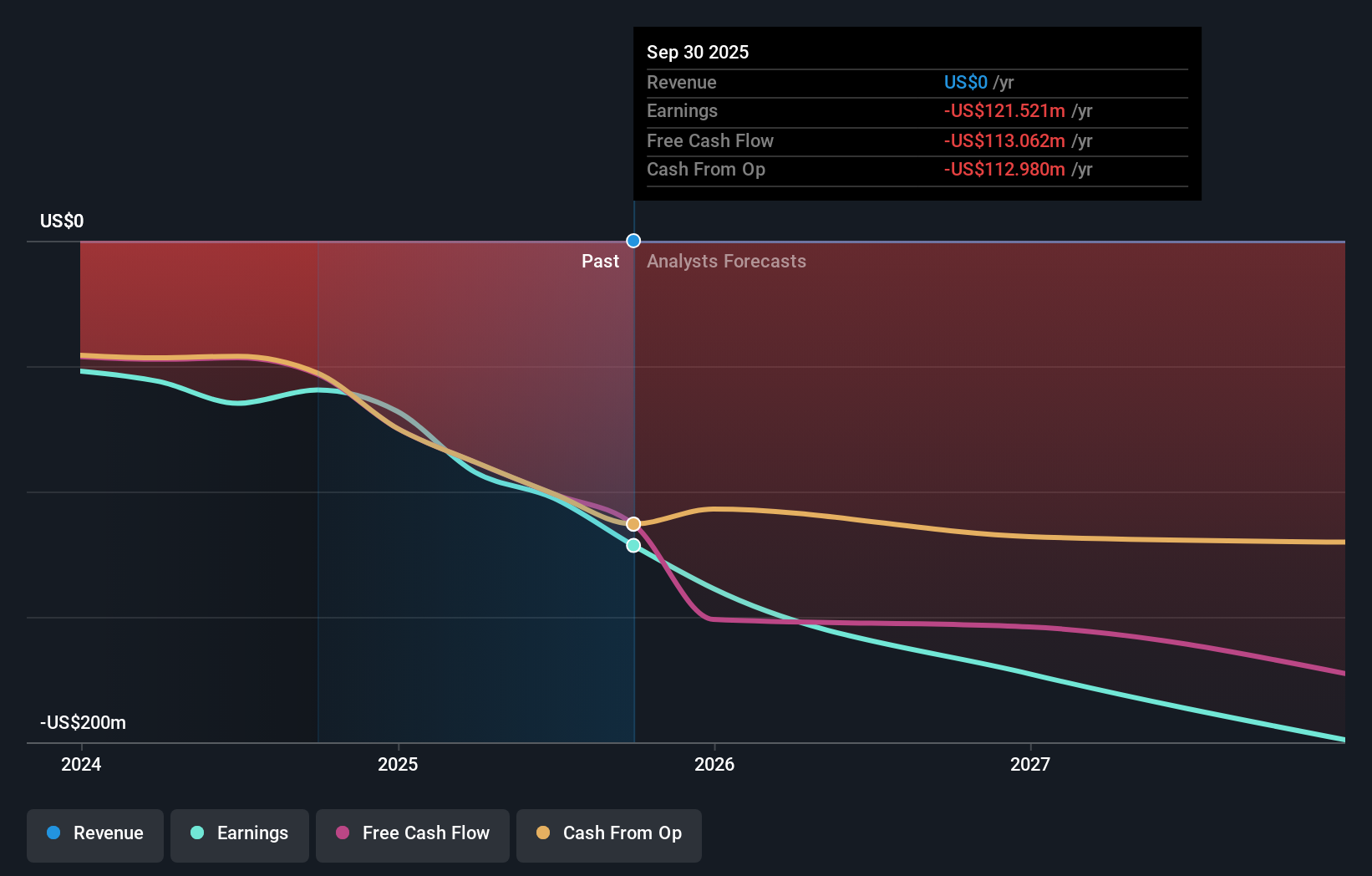

For someone considering Bicara, the big picture is simple: you have to believe that ficerafusp alfa can convert promising early and Breakthrough-designation data in head and neck cancer into a viable commercial franchise, before the company’s rising losses and funding needs bite too hard. The most important near term catalysts still sit squarely with the FORTIFI-HN01 pivotal trial readouts, additional clinical updates, and any regulatory interactions, not with recent index additions. That NASDAQ Biotech and S&P Biotech inclusion may modestly improve liquidity and institutional awareness, but on its own it does not change Bicara’s core binary setup around clinical success, regulatory outcomes and future capital raises. If anything, the sharper spotlight could amplify market reactions, both to good news and to setbacks.

However, investors should also be aware of Bicara’s growing losses and the potential for ongoing dilution. In light of our recent valuation report, it seems possible that Bicara Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Bicara Therapeutics - why the stock might be worth just $30.75!

Build Your Own Bicara Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bicara Therapeutics research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Bicara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bicara Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bicara Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BCAX

Bicara Therapeutics

A clinical-stage biopharmaceutical company, engages in the development of bifunctional therapies for solid tumors.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion