- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma Soars 135% as FDA Milestones Spark Valuation Debate for 2025

Reviewed by Bailey Pemberton

- Ever wondered if BridgeBio Pharma's wild ride means it's a smart buy or just hyped up? This article takes a closer look at the real value, so you know what you’re really getting into.

- The stock has soared with a jaw-dropping 135.4% gain so far this year and is up an incredible 179.9% over the past year, making many investors take a closer look.

- Headlines have focused on BridgeBio's clinical trial successes and fresh partnerships, fueling optimism and driving the stock higher. Excitement over recent FDA-related milestones continues to bolster the narrative around breakthrough therapies and future opportunities.

- When looking at the numbers, BridgeBio scores a 2 out of 6 on our undervaluation checks. This is not the most compelling, but numbers can sometimes miss the full picture. Up next, the article unpacks the valuation methods themselves and, at the end, suggests a smarter way to put it all in context.

BridgeBio Pharma scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BridgeBio Pharma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. For BridgeBio Pharma, the most recent reported Free Cash Flow (FCF) is -$597 million. While negative right now, analysts forecast a turnaround, with FCF climbing steadily over the coming decade.

By 2029, BridgeBio’s annual FCF is projected to reach roughly $1.52 billion, according to analyst consensus and extended estimates. These figures reflect both analyst outlooks for the next five years and longer-term growth rates extrapolated by valuation models. The jump from negative cash flows to strong positive figures highlights BridgeBio's high-risk, high-reward profile, which is typical of the biotech sector.

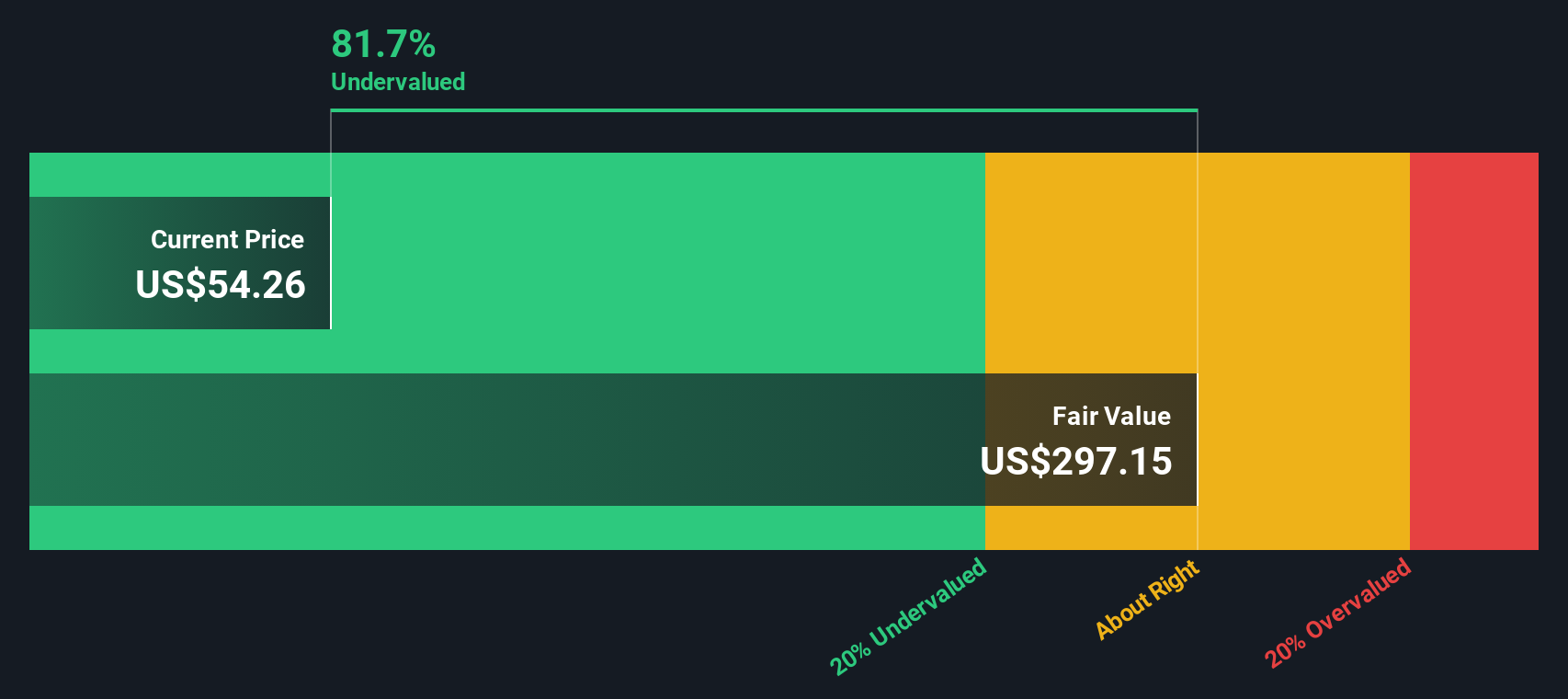

Based on these cash flow projections, the DCF intrinsic value estimate comes in at $338.52 per share. Compared to the current price, this suggests BridgeBio is trading at an 80.4% discount to its calculated fair value, indicating it may be significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BridgeBio Pharma is undervalued by 80.4%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: BridgeBio Pharma Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation metric, especially for biotech companies like BridgeBio Pharma that are not yet profitable. This measure is well-suited here because it allows investors to assess value based on revenue potential rather than earnings, which can be negative or volatile for companies in high-growth sectors.

Growth expectations and risk levels greatly influence what a "normal" P/S ratio should be. Companies with strong anticipated revenue growth or lower perceived risks often command higher ratios, while those facing uncertainty or slower trajectories tend to trade at lower multiples.

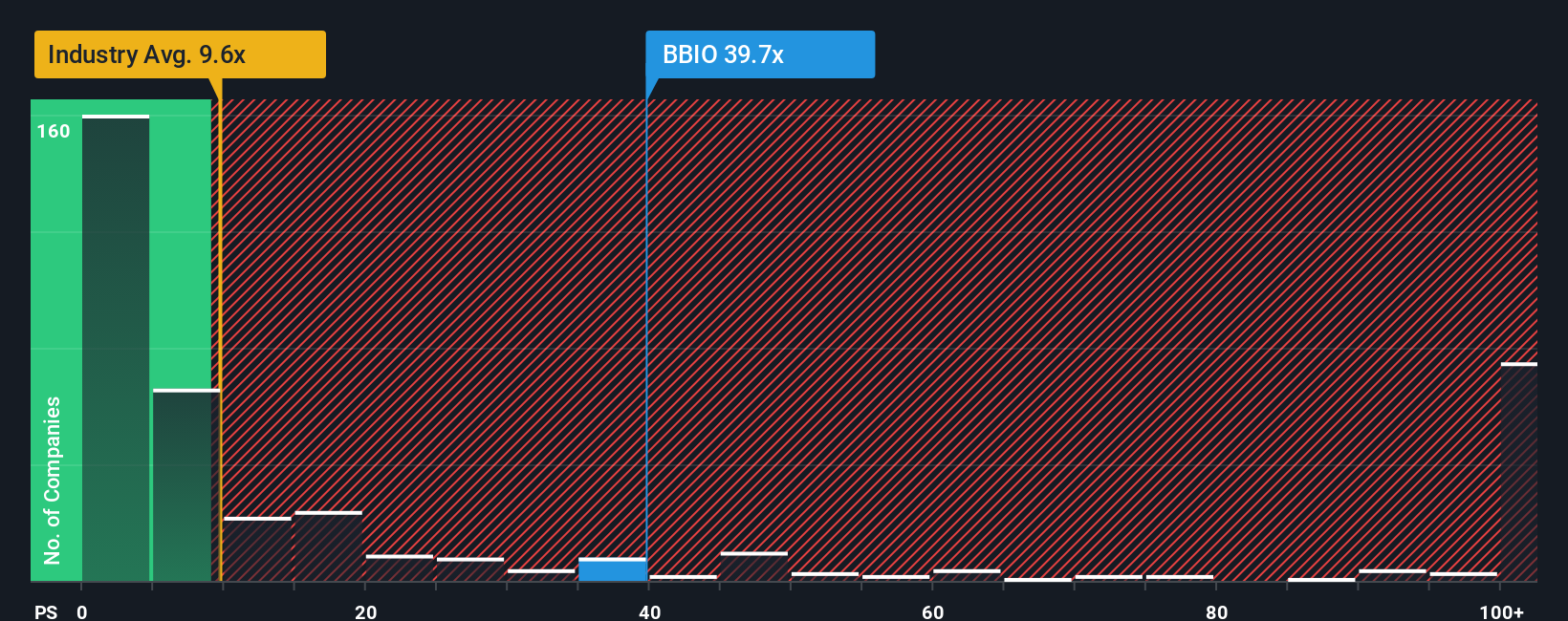

Currently, BridgeBio trades at a lofty P/S ratio of 36.16x. For context, the biotech industry average sits at just 10.88x, and peers average 21.53x. At first glance, this could make BridgeBio look expensive when measured against standard benchmarks.

However, Simply Wall St’s Fair Ratio is calculated specifically for BridgeBio based on its growth outlook, profitability prospects, industry landscape, size, and related risks. This method indicates a more tailored fair value multiple of 24.44x. Unlike basic peer and industry comparisons, this proprietary metric incorporates factors such as future revenue trajectories, margins, and market cap to produce a more holistic valuation guide.

Comparing the Fair Ratio (24.44x) with BridgeBio’s actual P/S (36.16x) suggests the stock is likely overvalued at current levels based on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BridgeBio Pharma Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal investment story, a framework that connects what you believe about a company’s opportunities and challenges to a clear forecast for its future revenue, profits, and ultimately, its fair value. Instead of just following static numbers, Narratives let you build or adopt a perspective that explains why BridgeBio Pharma might thrive or struggle, tying together everything from new drugs and market potential to regulatory hurdles and competition.

Simply Wall St’s Narratives tool, found on the Community page used by millions of investors, makes this approach accessible to everyone. It helps you see how your expectations (or those of other investors and analysts) turn real-world developments into financial outcomes, so you can decide if the current share price looks attractive or not based on your unique outlook.

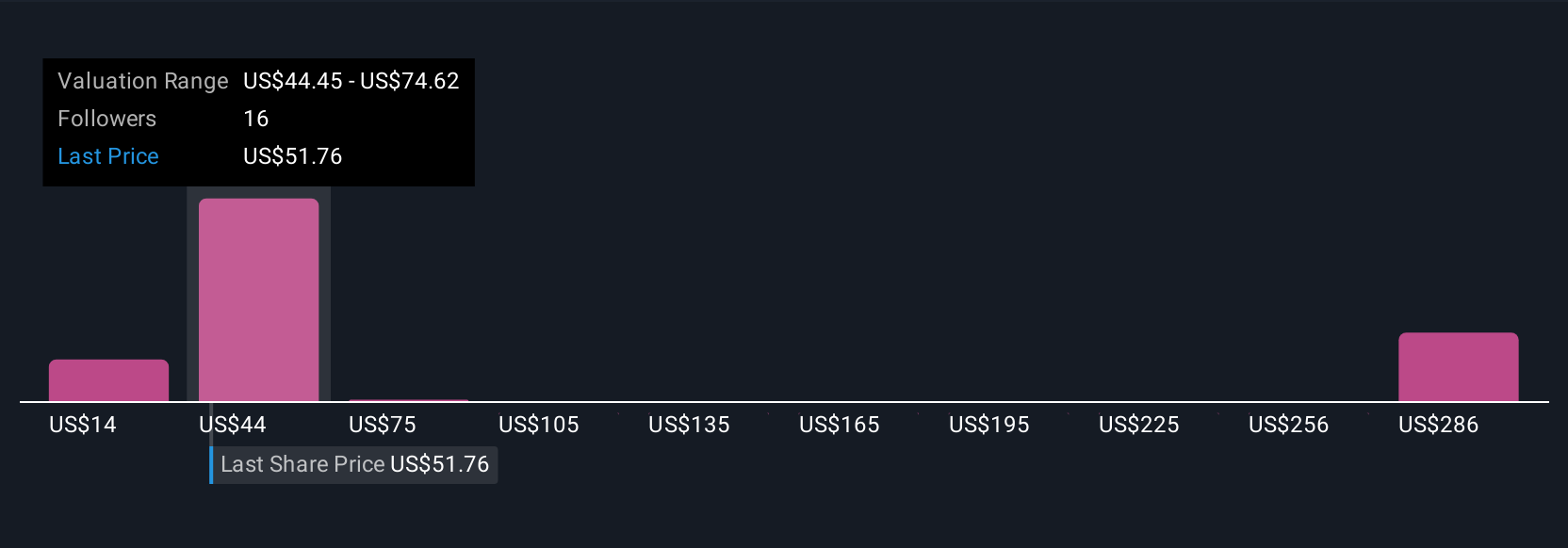

Narratives are dynamic and automatically update as news, clinical trial results, or financial reports emerge, ensuring your view and your fair value estimate stay current. For BridgeBio Pharma, for example, some investors are extremely bullish with fair values as high as $95, seeing major upside from blockbuster drugs and pipeline wins. More cautious Narratives lean bearish, with fair values closer to $41, reflecting risks from high spending and regulatory uncertainty.

Do you think there's more to the story for BridgeBio Pharma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives