- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (BBIO) Is Up 18.7% After Strong Phase 3 Data for Rare Disease Therapies - What's Changed

Reviewed by Sasha Jovanovic

- In recent days, BridgeBio Pharma announced highly positive topline results from two pivotal Phase 3 trials: BBP-418 for limb-girdle muscular dystrophy type 2I/R9 and encaleret for autosomal dominant hypocalcemia type 1, both meeting key clinical endpoints and supporting plans for regulatory submissions in 2026.

- The successful outcomes across these rare disease programs highlight BridgeBio's expanding late-stage pipeline and the company's growing potential to impact multiple underserved patient populations.

- We'll explore how the strong Phase 3 clinical trial successes for BBP-418 and encaleret may reshape BridgeBio's investment case and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

BridgeBio Pharma Investment Narrative Recap

To be a shareholder in BridgeBio Pharma, one must believe in the company's ability to transform its heavy reliance on Attruby by successfully bringing late-stage pipeline therapies, like BBP-418 and encaleret, toward approval and commercial launch. The latest positive Phase 3 results for these programs increase visibility for regulatory filings planned in 2026, supporting a key near-term catalyst of future approvals, while the most important risk remains BridgeBio’s ongoing net losses and potential need for dilutive financing if cash burn persists.

Of the recent announcements, the release of strong topline data from the FORTIFY Phase 3 study for BBP-418 is especially relevant, demonstrating both statistically significant improvements in clinical outcomes for patients with limb-girdle muscular dystrophy and the drug’s favorable safety, which underpins the company’s plans to submit a New Drug Application to the FDA in the first half of 2026 as a pivotal inflection point for the business.

Yet, in contrast to this momentum, investors should be aware that persistent net losses and a need for future funding could...

Read the full narrative on BridgeBio Pharma (it's free!)

BridgeBio Pharma's outlook points to $1.7 billion in revenue and $297.7 million in earnings by 2028. This scenario assumes annual revenue growth of 92.3% and a $1.07 billion increase in earnings from the current level of -$776.4 million.

Uncover how BridgeBio Pharma's forecasts yield a $66.47 fair value, a 3% upside to its current price.

Exploring Other Perspectives

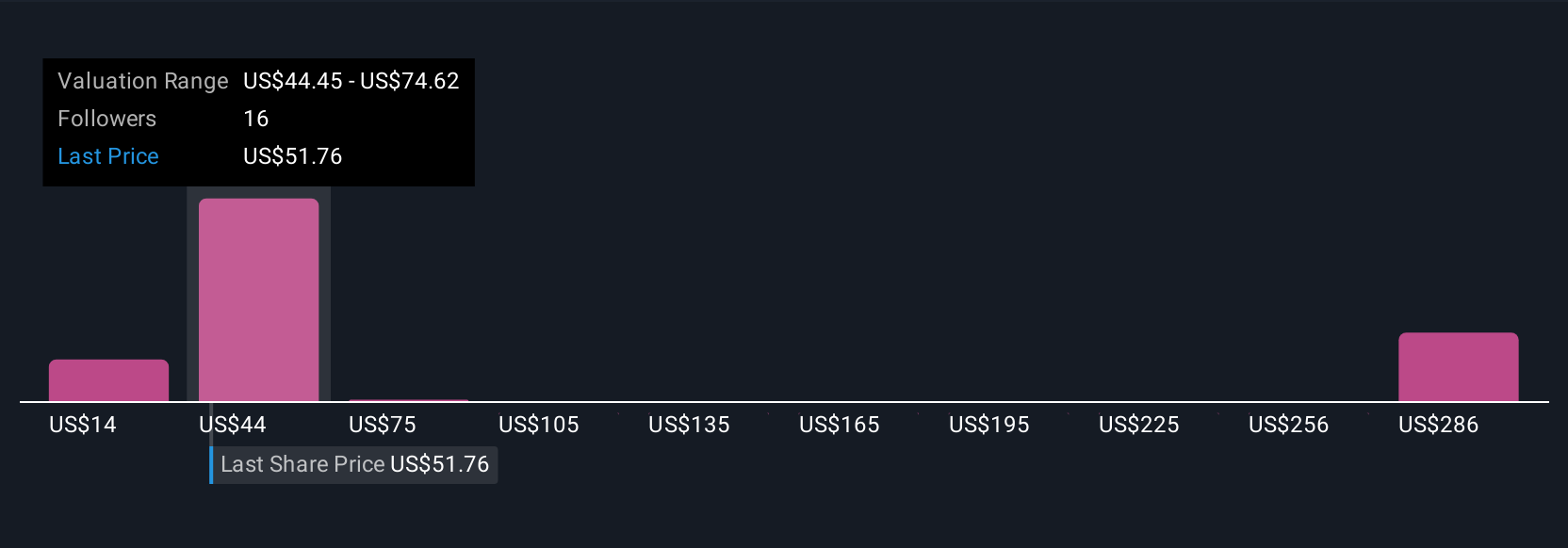

Simply Wall St Community fair value estimates for BridgeBio Pharma span from US$14.28 to US$314.84 across 9 individual viewpoints. With upcoming late-stage milestones critical for future revenue, opinions on long-term success can differ greatly, take the time to explore multiple perspectives.

Explore 9 other fair value estimates on BridgeBio Pharma - why the stock might be worth less than half the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives