- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Is Axsome Therapeutics Set for More Gains After Promising Clinical Trial News in 2025?

Reviewed by Bailey Pemberton

- Wondering if Axsome Therapeutics is a smart buy right now? You're not alone, as plenty of investors are asking what the current price really gets them.

- This biotech stock has been on a tear, jumping 4.2% in just the last week and up a remarkable 54.6% year-to-date. This performance is sure to catch the eye of growth-focused investors.

- Recent news around promising clinical trial updates and expansion of its approved treatments has been fueling optimism and pushing Axsome’s stock price even higher. The buzz in healthcare circles centers on whether these latest developments signal a new era for the company or just a short-term spike.

- On the surface, Axsome scores a solid 4 out of 6 on key valuation checks, which suggests there may still be value on the table. Next, we’ll examine how different valuation models interpret the numbers. There is also an even more insightful way to cut through the noise coming later in this article.

Approach 1: Axsome Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today. This gives an idea of what the business might be worth based on its potential to generate cash.

For Axsome Therapeutics, the latest data shows the company generated a Free Cash Flow (FCF) of -$121.4 Million last year. Despite this negative starting point, analyst forecasts and model extrapolations expect FCF to improve rapidly, with projections reaching $950.5 Million by December 2029. Over a 10-year period, further extrapolations see annual FCF climbing even higher, all in US dollars.

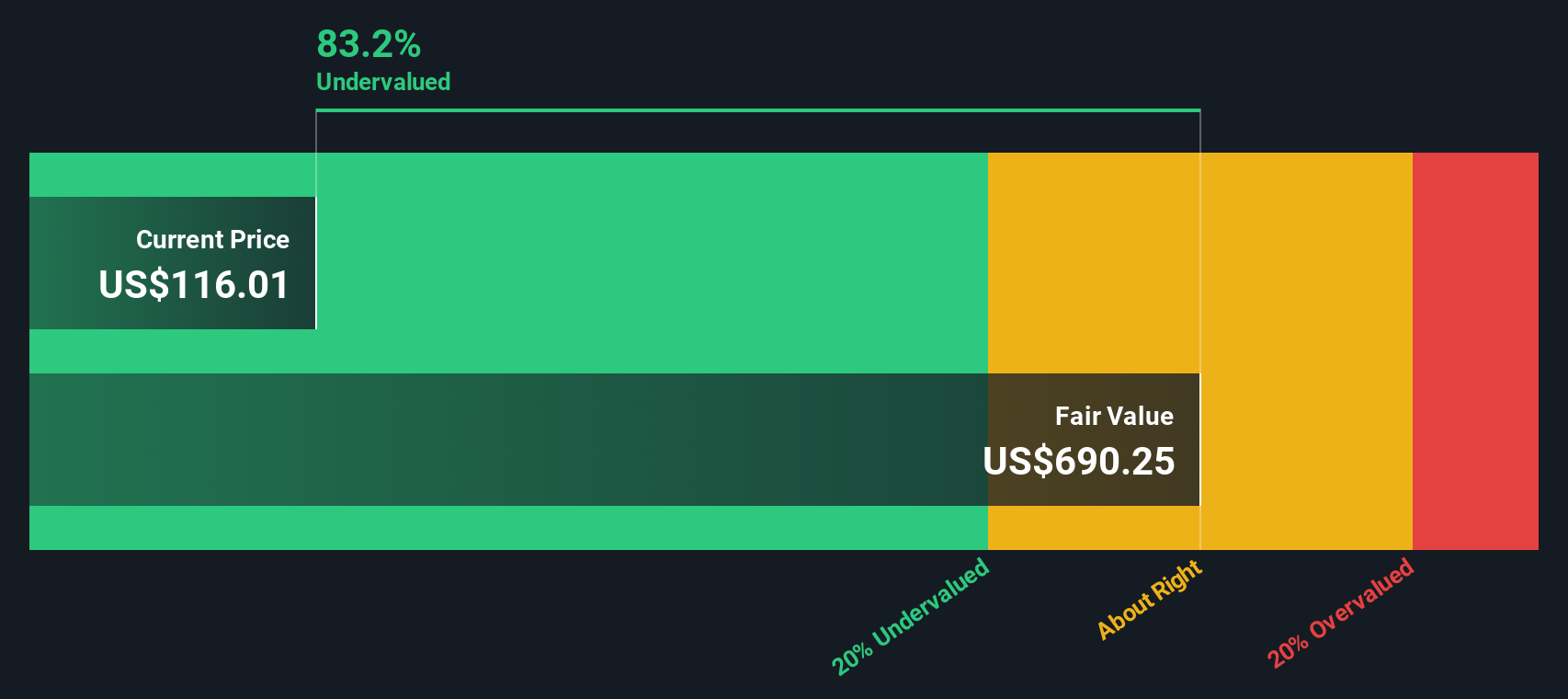

The DCF model used here, a two-stage Free Cash Flow to Equity approach, suggests Axsome’s intrinsic value is $758.62 per share. Notably, the model indicates the stock is trading at an 82.2% discount to this estimated fair value, making it appear very undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axsome Therapeutics is undervalued by 82.2%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Axsome Therapeutics Price vs Sales

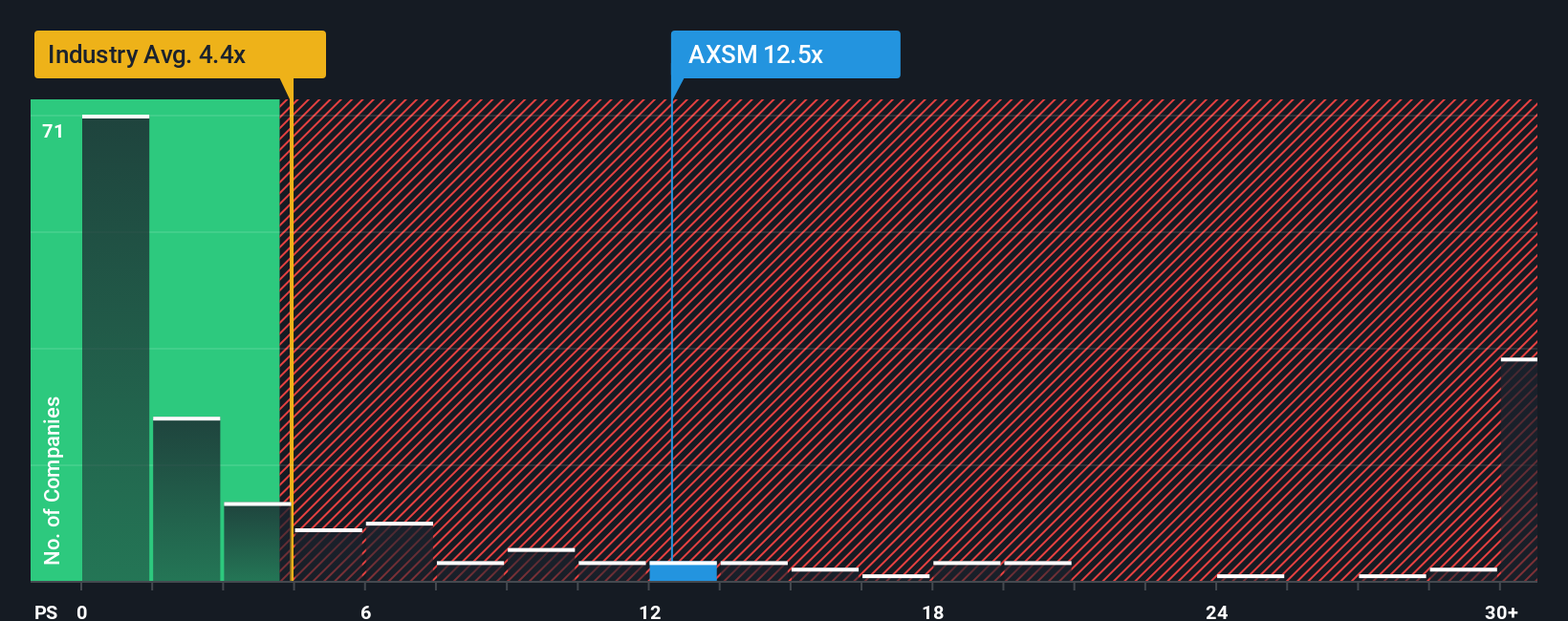

For companies like Axsome Therapeutics that are not yet profitable but exhibit significant revenue growth, the price-to-sales (P/S) ratio is a popular metric for valuation. The P/S ratio helps investors gauge how much they are paying for each dollar of sales, making it particularly useful for biotech firms still in their growth and investment-heavy stages.

It is important to remember that expectations of rapid revenue expansion and business risks can push a “normal” or fair P/S ratio higher or lower. When companies are anticipated to grow quickly, investors may be willing to pay a premium, resulting in an elevated multiple. Conversely, higher risk or sluggish growth typically justifies a lower figure.

Axsome currently trades at a P/S ratio of 13.61x. For context, the Pharmaceuticals industry average sits at 4.24x, while direct peers average around 5.96x. This suggests the company is commanding a hefty premium versus both its sector and comparable businesses.

To dig deeper, it is helpful to consider Simply Wall St’s proprietary Fair Ratio calculation, which weighs not only industry trends and peer comparisons, but also factors in Axsome’s unique growth outlook, profit profile, market capitalization, and specific risks. This approach goes beyond surface-level multiples and adds valuable nuance to the analysis. In Axsome’s case, the Fair Ratio comes in at 15.36x, slightly above its current P/S value.

Given that the actual P/S ratio and the Fair Ratio are very close, Axsome looks fairly valued on this metric at the moment.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axsome Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a more powerful and flexible approach to making investment decisions.

A Narrative is simply your story about a company: the numbers you believe in, like future revenue and profits, paired with your reasoning about a company's growth, risks, and industry trends. Instead of just relying on formulas, Narratives connect a company's real-world situation to a financial forecast, ultimately calculating a fair value based on your unique perspective.

On Simply Wall St’s platform, millions of investors use Narratives within the Community page, making it easy and accessible to create or browse a wide variety of viewpoints. Narratives are especially useful because they link your expectations to numbers, show how your fair value compares to today’s share price, and refresh automatically whenever new news or results arrive.

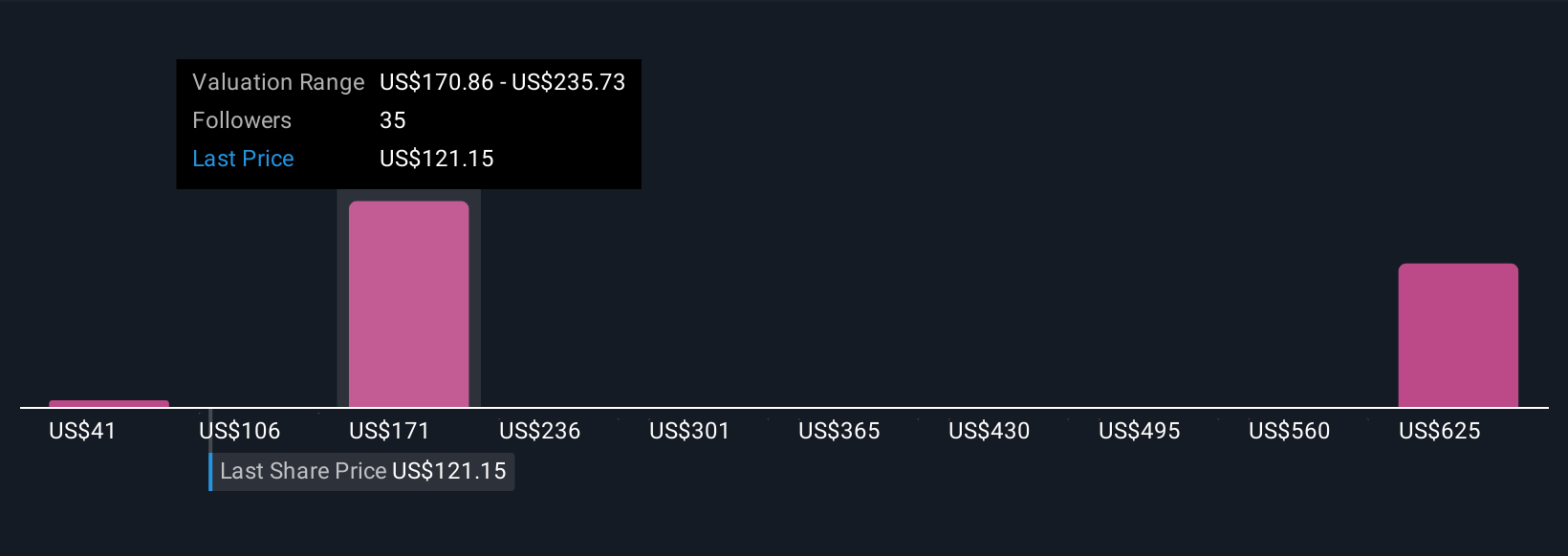

For example, one recent Narrative for Axsome Therapeutics projects robust CNS pipeline success and margin growth, leading to a fair value of $200 per share. In contrast, a more conservative outlook, factoring in commercial risks and competition, gives a fair value as low as $144. This highlights how different investors can interpret the same company in varying ways and derive their own fair values based on their research and confidence in the business’s future.

Do you think there's more to the story for Axsome Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives