- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Axsome Therapeutics (AXSM): Losses Worsen 24.5% Annually, Testing Bullish Growth Narratives

Reviewed by Simply Wall St

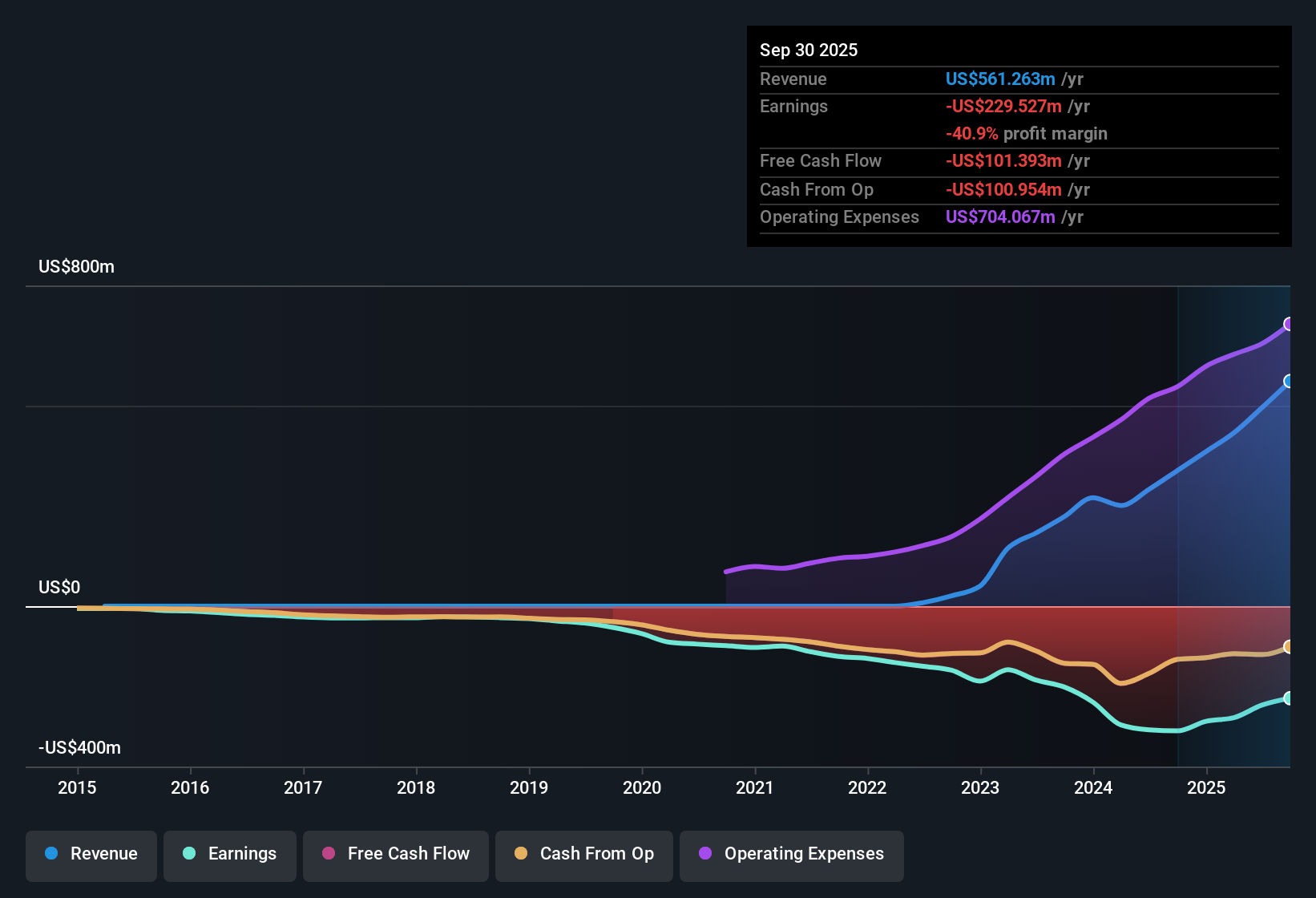

Axsome Therapeutics (AXSM) remains unprofitable, recording annualized losses that have deepened by 24.5% per year over the past five years. Margins remain negative and there has been no recent sign of net margin improvement. Despite the continued losses, shares now trade at $134.99, well below the company’s estimated fair value of $758.62. Analyst forecasts point to annual earnings growth of 67.15% and a return to profitability within three years. Investors are watching closely to see whether Axsome’s projected 33.3% annual revenue growth, which far outpaces the US market’s forecast of 10.5%, can justify the premium valuation and signal a sustainable turnaround.

See our full analysis for Axsome Therapeutics.Next up, we’ll stack these headline numbers against the most widely followed market narratives for Axsome, highlighting where the consensus view might get a reality check or support from the latest figures.

See what the community is saying about Axsome Therapeutics

Heavyweight R&D Spending Meets Aggressive Pipeline Launches

- Axsome’s ongoing R&D and commercial investments have driven expenses sharply higher, with the latest quarter reflecting $48 million in net losses and a cash balance of $303 million, down from $315.4 million previously.

- Analysts' consensus view highlights the company’s pipeline momentum, noting:

- Multiple late-stage programs such as AXS-05, AXS-12, and AXS-14 offer revenue diversification potential as Axsome capitalizes on global CNS trends.

- However, heavy dependence on only a handful of lead products, including Auvelity and Sunosi, means that near-term scaling comes with high SG&A expenses and margin pressure.

Payer Pressures and Discounts Cloud Margins

- Gross-to-net discounts remain elevated, with rates in the mid-50% range for Auvelity and Sunosi and in the low 80% for SYMBRAVO. This signals persistent pricing and reimbursement headwinds that could constrain future net sales despite growing product adoption.

- Analysts' consensus view underscores the tension:

- Broader payer coverage and formulary wins have expanded commercial potential (Auvelity now has access to 83% of covered lives), but competitive forces and payer pressure continue to threaten revenue stability and long-term margin growth.

- Commercial underperformance for these core products would intensify earnings volatility given their outsized role in the company’s revenue base.

Premium Valuation Hinges on Rapid Growth

- Axsome trades at 13.6x Price-To-Sales, which is a notable premium to peers (9.5x) and the US pharmaceuticals industry (4.2x). The current valuation is still far below its DCF fair value estimate of $758.62 but well above current analyst targets at $178.25.

- Analysts' consensus view points out that for current optimism to hold:

- Revenue must accelerate to $1.7 billion with a substantial margin turnaround by 2028 to justify these valuation levels, far outpacing industry averages and reflecting both pipeline success and strong commercial execution.

- If launches or margin improvements falter, Axsome’s premium compared to peers could quickly erode, putting downward pressure on the stock despite its long-term growth story.

See how analysts weigh all these growth drivers, risks, and valuation themes in their full narrative for Axsome Therapeutics. 📊 Read the full Axsome Therapeutics Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Axsome Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells another story? Share your perspective and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axsome Therapeutics.

See What Else Is Out There

Axsome’s premium valuation and reliance on a handful of flagship drugs leave it vulnerable if growth or margins fall short of expectations.

If you want exposure to stocks with more attractive pricing and upside potential, check out these 839 undervalued stocks based on cash flows that stand out based on their fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives