- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Assessing Axsome Therapeutics (AXSM) Valuation Following Recent Momentum and Growth Milestones

Reviewed by Simply Wall St

Axsome Therapeutics (AXSM) shares have seen a steady climb over the past month, rising 14%, and are up 32% over the past 3 months. Investors are paying close attention to this momentum, particularly in light of recent positive revenue and net income growth.

See our latest analysis for Axsome Therapeutics.

Axsome’s recent share price strength caps off a strong year for shareholders, with a 52.9% year-to-date share price return and an impressive 47.77% total shareholder return over the past year. The momentum follows upbeat clinical milestones and robust top-line growth, which suggests that confidence is building among investors for both near-term prospects and the company’s long-term vision.

To keep your finger on the pulse of healthcare innovation, now is the perfect moment to discover See the full list for free.

But with shares rallying and optimism running high, is Axsome Therapeutics truly undervalued at current levels, or is the market already factoring in the company’s anticipated growth prospects? This presents a potential dilemma for would-be investors.

Most Popular Narrative: 24.5% Undervalued

Axsome Therapeutics’ fair value estimate from the most widely followed narrative comes in well above its last close, suggesting significant upside potential if the company's bold projections materialize. This sets the stage for a deeper look into the catalysts driving this high conviction view.

Axsome's portfolio is expanding with the launch of SYMBRAVO for migraine and ongoing robust growth of Auvelity and Sunosi. This reflects increased societal prioritization of mental health and CNS disorders, which could drive further top-line revenue growth as these long-term demand trends play out globally.

Curious about what’s fueling this ambitious price target? This narrative relies on aggressive growth in key products and a profitability turnaround that could transform the company’s profile. The key factors include bold analyst forecasts and margin improvements that few expect. Click to uncover the numbers behind the optimism.

Result: Fair Value of $176.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intense competition in CNS therapies could challenge Axsome’s ability to deliver on the optimistic growth projections for the future.

Find out about the key risks to this Axsome Therapeutics narrative.

Another View: Is the Market's Premium Justified?

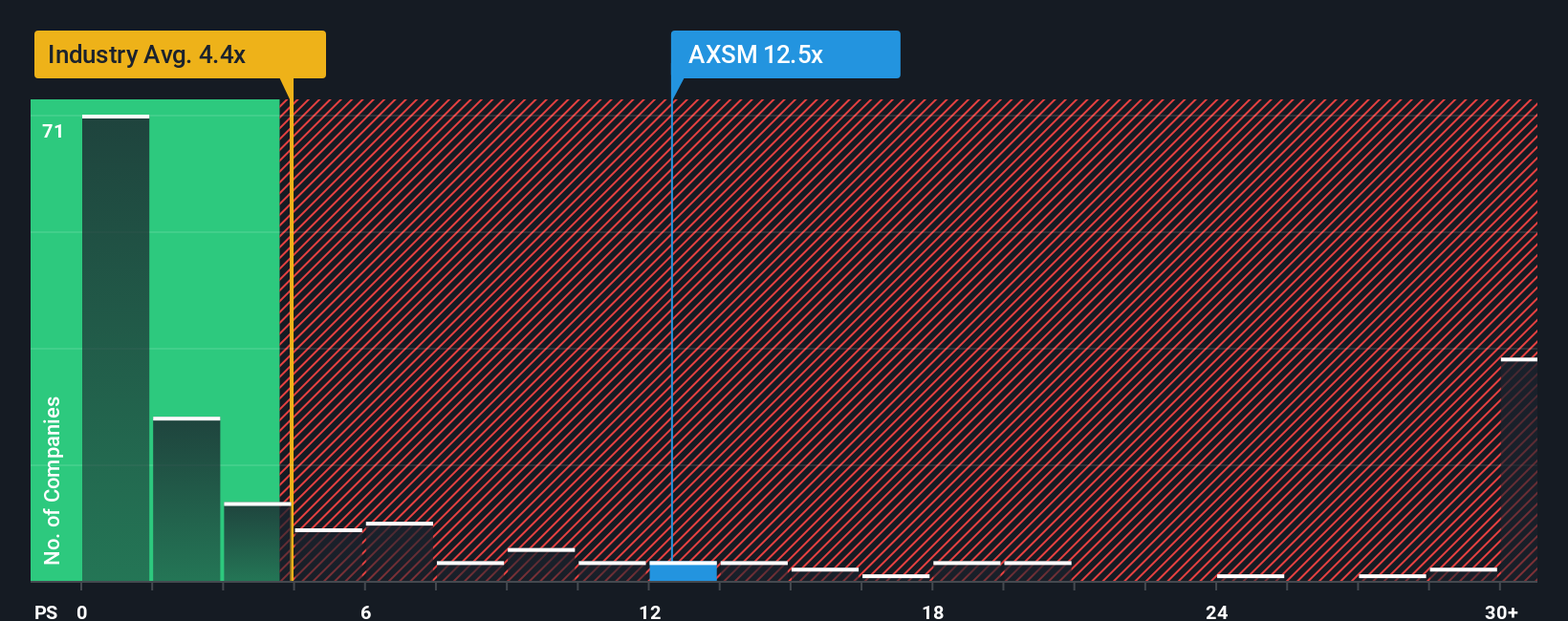

Looking from a multiples perspective, Axsome trades at a price-to-sales ratio of 13.5x, notably higher than its pharmaceutical peers at 5.8x and the broader US industry at 4.5x. While this highlights the market’s optimism about rapid growth, it also signals higher valuation risk if expectations are not met. Could current momentum carry the price even higher, or is there room for correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axsome Therapeutics Narrative

If you see things differently or want to dig into the numbers yourself, it's easy to build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axsome Therapeutics.

Looking for More Investment Ideas?

Don’t let great opportunities slip past you. Take charge of your portfolio, spot trends before the crowd, and uncover high-potential companies tailored to your interests.

- Unlock potential by targeting next-generation healthcare breakthroughs and game-changing treatments using these 34 healthcare AI stocks.

- Boost your search for future leaders by choosing from these 26 AI penny stocks, a selection of companies advancing the field of artificial intelligence.

- Maximize returns with steady payouts by checking out these 21 dividend stocks with yields > 3%, where you’ll find companies offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives