- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

Avadel Pharmaceuticals (AVDL): Assessing Valuation Following Turnaround to Net Income

Reviewed by Simply Wall St

Avadel Pharmaceuticals (AVDL) just announced third quarter and nine-month earnings results, showing a move from net losses to net income in both periods compared to last year. This jump highlights ongoing financial improvement and hints at a meaningful turnaround for the company.

See our latest analysis for Avadel Pharmaceuticals.

Shares of Avadel Pharmaceuticals have steadily gathered momentum in recent months, with a 30-day share price return of nearly 34% and a striking year-to-date gain of around 75%. This strong move reflects renewed optimism following the turnaround in earnings. The company’s one-year total shareholder return of 66% suggests that both short-term and long-term investors have been rewarded.

If Avadel’s shift to profitability has you searching for more healthcare stocks with growth stories, take a look at the latest opportunities in our See the full list for free..

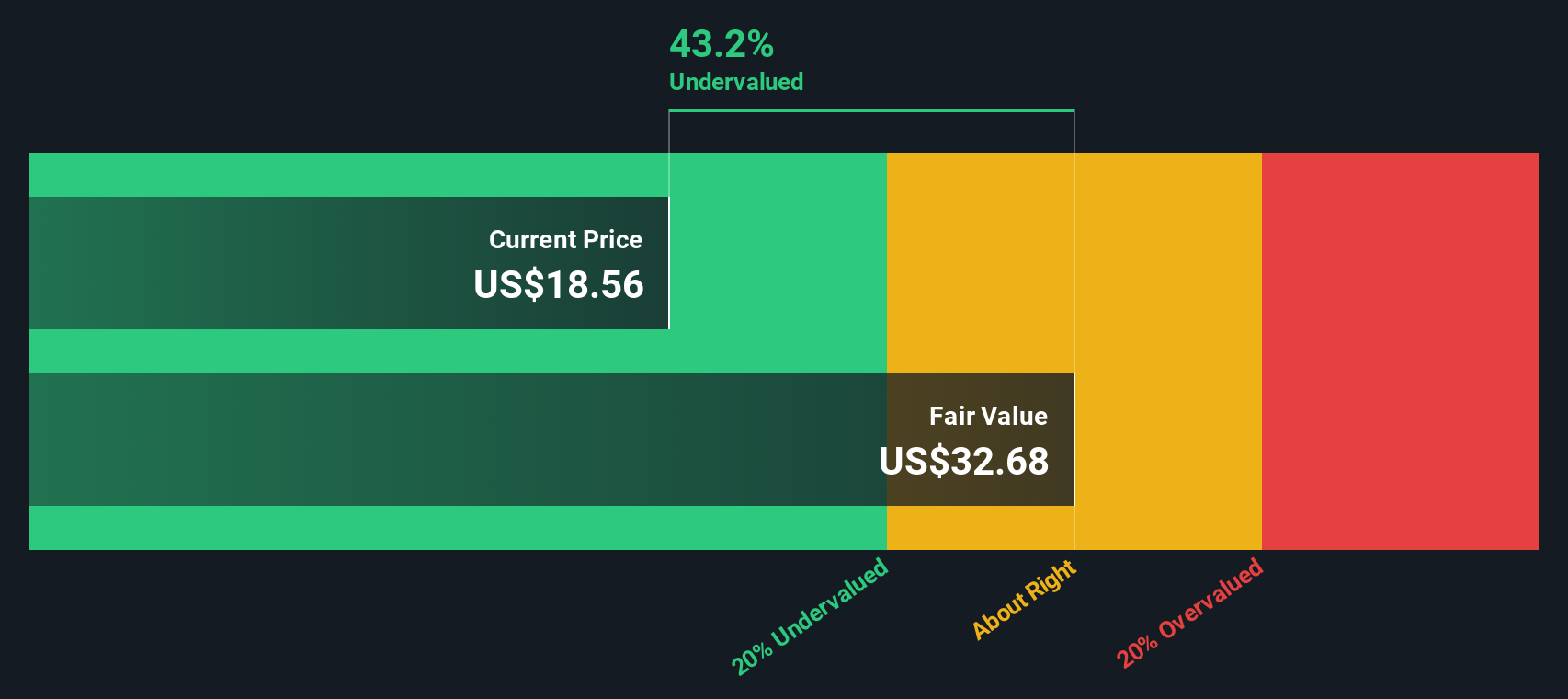

With shares rallying and earnings turning positive, the key question is whether Avadel Pharmaceuticals remains undervalued after its strong run or if the recent gains already reflect its anticipated growth. Could there still be a buying opportunity?

Most Popular Narrative: 1% Overvalued

With Avadel Pharmaceuticals closing at $19.24, the prevailing narrative sees the fair value at $19.13, which is remarkably close to the current market price. The valuation captures investor tensions as acquisition news and growth prospects reshape what is considered a fair price.

LUMRYZ's differentiated, patient-friendly once-at-bedtime dosing profile meets the increasing demand for innovative, convenient therapies from both patients and providers. This provides a sustainable competitive advantage and supports long-term market share gains amid broader industry shifts towards advanced drug delivery platforms, impacting both revenue growth and pricing resilience.

Curious what bold revenue and profit leaps justify this near-market valuation? One future-defining forecast is hiding in plain sight, holding the key to long-term price conviction. Uncover the hidden growth assumptions shaping this contested fair value and find out what the narrative won’t reveal upfront.

Result: Fair Value of $19.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Avadel’s reliance on a single product and the threat of new competing therapies that could quickly shift industry dynamics.

Find out about the key risks to this Avadel Pharmaceuticals narrative.

Another View: Deep Discount According to DCF

While current market conversations center around Avadel Pharmaceuticals trading right near its “about right” fair value, our DCF model tells a very different story. The SWS DCF model places fair value much higher at $32.34 per share. This suggests Avadel could be trading at a steep discount. Could this gap signal a major opportunity, or does it reflect risks the multiples approach might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Avadel Pharmaceuticals Narrative

If you have a different perspective or want to dig into Avadel’s story on your own terms, building your own evidence-backed case is just a few clicks away. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Avadel Pharmaceuticals.

Looking for more standout opportunities?

Don’t let your next big winner pass you by. Expand your search and gain an edge with powerful stock ideas from our hand-picked selections below.

- Tap into game-changing tech by zeroing in on these 27 AI penny stocks, where artificial intelligence is transforming what is possible for rapid growth.

- Build your portfolio’s income stream with these 15 dividend stocks with yields > 3% featuring reliable yields above 3% and potential for payout stability.

- Snag bargains overlooked by the market through these 870 undervalued stocks based on cash flows that offer strong fundamentals at attractive prices, giving savvy investors an advantage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives