- United States

- /

- Pharma

- /

- NasdaqGM:AVDL

A Look at Avadel Pharmaceuticals (AVDL) Valuation Following Strong 2024 Performance

Reviewed by Simply Wall St

Avadel Pharmaceuticals (AVDL) stock has caught some attention recently as investors digest the company’s latest moves and strong year-to-date performance. Shares are up nearly 95% this year, which reflects heightened interest in their portfolio.

See our latest analysis for Avadel Pharmaceuticals.

Momentum around Avadel Pharmaceuticals has been building noticeably, with the stock’s 1-month share price return of 14% and an impressive 95% year-to-date gain signaling renewed optimism. This is likely driven by confidence in its pipeline progress and upcoming milestones. In the bigger picture, the company’s 94% one-year total shareholder return reflects that this rally is not just a recent blip, but part of a more sustained recovery and growth story.

If Avadel’s breakout year has you curious about what else the sector has to offer, you can discover more opportunities with our healthcare stocks screener. Here’s the full list: See the full list for free.

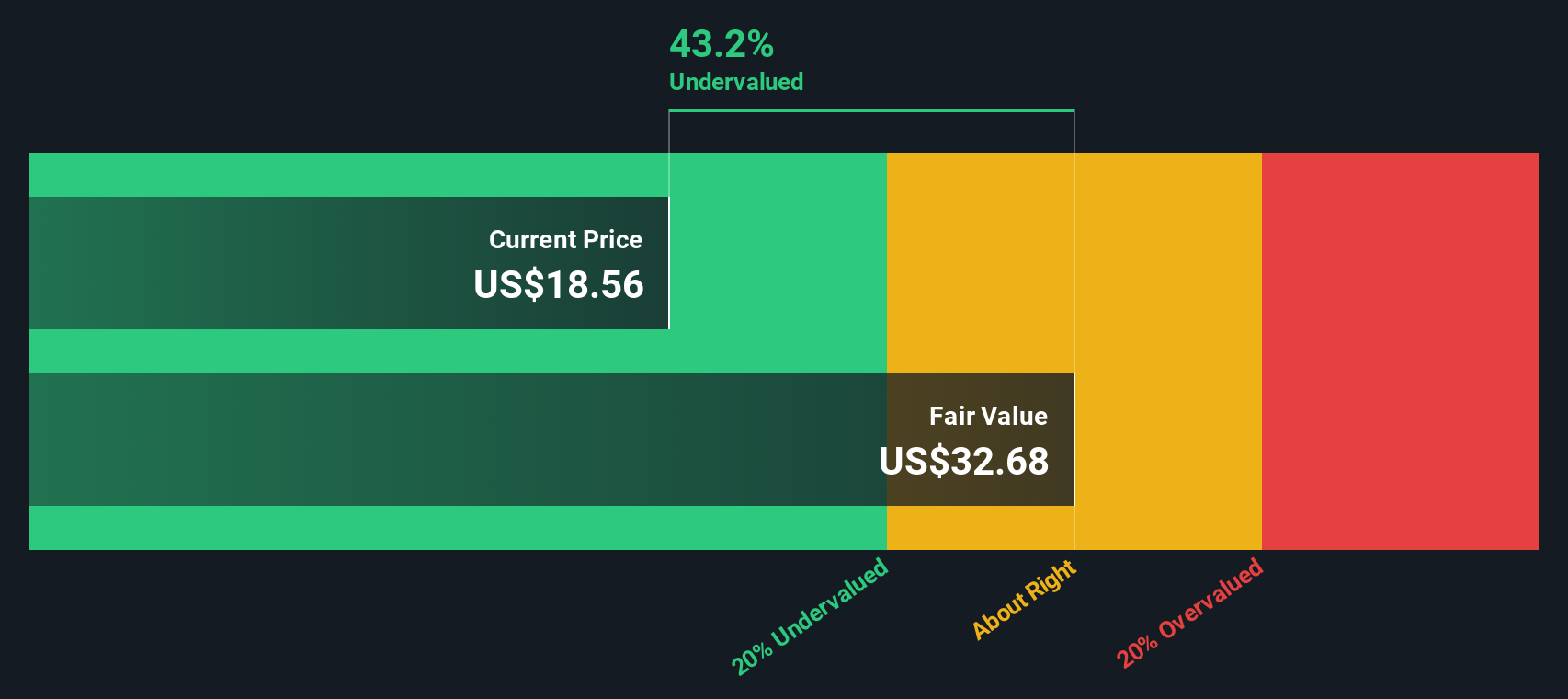

With shares soaring nearly double in 2024, the big question is whether Avadel Pharmaceuticals remains undervalued with room to run, or if the current price already reflects all the future growth the market expects.

Most Popular Narrative: Fairly Valued

Avadel Pharmaceuticals trades just above the most popular narrative's fair value of $21.06, with the last close at $21.49. This view reflects updated profit outlooks and acquisition prospects that have brought analyst targets closer to current market pricing. This highlights how fresh events are shaping valuation thinking.

“LUMRYZ's strong year-over-year growth in both patient count and net revenue, driven by robust adoption and prescriber expansion, signifies effective capitalization on the increasing prevalence and awareness of sleep disorders amid an aging population. This points to continued substantial revenue and earnings upside as this trend accelerates.”

Want a peek at the core financial assumptions fueling this fair value? The formula behind it hints at sharp profit improvements, ambitious revenue targets, and future multiples that would stand out even among sector leaders. Unlock exactly which forecasts and growth levers drive this number by reading the full narrative now.

Result: Fair Value of $21.06 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks remain, such as heavy reliance on LUMRYZ and growing competition from new sleep disorder therapies, which could challenge Avadel's growth outlook.

Find out about the key risks to this Avadel Pharmaceuticals narrative.

Another View: Discounted Cash Flow Model Suggests More Upside

While multiples-based analysis suggests Avadel Pharmaceuticals is fairly valued or even expensive, our SWS DCF model presents a different story. The model pegs fair value at $32.36 per share, about 33 percent above current prices. This implies the company could be undervalued if those long-term forecasts hold up. Are the market's cautious assumptions missing the full upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avadel Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avadel Pharmaceuticals Narrative

If you have a different take on Avadel Pharmaceuticals' outlook or want to dig into the details yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Avadel Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best opportunities pass you by. Expand your radar and act now to find the next standout investment using these targeted strategies:

- Catch the potential for explosive returns with these 3564 penny stocks with strong financials that combine strong growth outlooks and compelling fundamentals.

- Boost your portfolio’s income by tapping into these 15 dividend stocks with yields > 3% offering reliable yields above 3 percent and consistent payout histories.

- Stay ahead of market trends and tap into the artificial intelligence boom through these 25 AI penny stocks poised for high-impact innovation and rapid expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AVDL

Avadel Pharmaceuticals

Operates as a biopharmaceutical company in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026