- United States

- /

- Biotech

- /

- NasdaqGS:AUTL

A Fresh Look at Autolus Therapeutics (AUTL) Valuation Following Earnings, Obe-cel Expansion, and Anticipated ASH Data

Reviewed by Simply Wall St

Autolus Therapeutics (AUTL) just released its latest quarterly earnings and is drawing increased investor attention thanks to several key developments. The company continues to expand commercial access for Obe-cel, reports strong manufacturing results, and anticipates new data at the upcoming ASH conference.

See our latest analysis for Autolus Therapeutics.

Autolus Therapeutics has seen a burst of activity lately, from broadening commercial access and updating its leadership team to advancing its clinical programs. Despite this momentum, the stock’s 1-year total shareholder return sits deep in the red at -55.5%, and is down nearly 48% year-to-date on a share price basis. This reflects both lingering risk concerns and the long road ahead for its pipeline to drive upside. Short-term volatility, including a recent 7% daily gain, suggests that investors remain responsive to fresh data and earnings news.

Curious what other healthcare innovators are doing? Discover new opportunities with our latest See the full list for free.

With shares trading at a significant discount to analyst price targets and major catalysts on the horizon, investors have to consider: is Autolus undervalued in light of its pipeline and progress, or is the market rightfully cautious about future growth?

Most Popular Narrative: 85.8% Undervalued

With analysts’ consensus suggesting a fair value of $9.62 for Autolus Therapeutics, sharply higher than its last close of $1.37, this narrative frames the upside in the latest assumptions and catalysts shaking up expectations.

Robust early uptake and positive physician feedback on AUCATZYL, combined with expanding treatment center coverage (targeting 60+ authorized centers by year-end) and 90% of U.S. medical lives insured, position Autolus to capture a larger share of the growing demand for advanced cancer therapies, supporting sustainable increases in top-line revenue.

What’s fueling this massive gap between market price and narrative fair value? Revenue projections that could turn heads, margin leap assumptions, and a blockbuster target market are all in the mix. Discover the outsize bets and growth leaps at the heart of this forecast.

Result: Fair Value of $9.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in European market access and persistently high manufacturing costs could present challenges for Autolus's revenue growth and slow its path to profitability.

Find out about the key risks to this Autolus Therapeutics narrative.

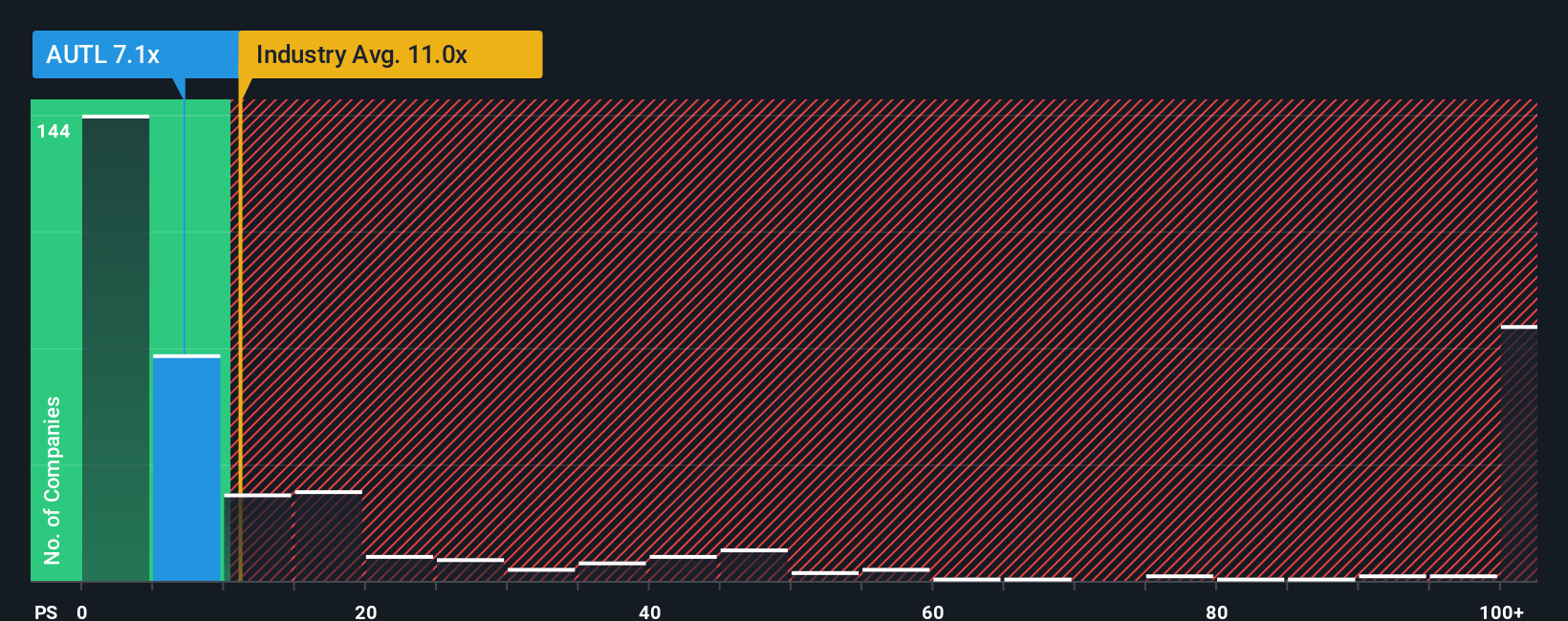

Another View: The Price-to-Sales Comparison

Looking at valuation another way, Autolus trades at a price-to-sales ratio of 7.1x. That is much lower than the peer average of 33x and also below the US Biotechs industry average of 11.1x. However, the fair ratio our model suggests, just 0.1x, shows that plenty of valuation risk still lingers for investors. Does this mean the discount is a true opportunity, or could the market eventually adjust the ratio downward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Autolus Therapeutics Narrative

If you see the story differently or want to dive into the numbers on your own, you can build your personal narrative in just a few minutes. Do it your way

A great starting point for your Autolus Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

The right stock can change your portfolio trajectory. Get ahead of the curve by using these purpose-built screens to spot tomorrow’s standouts before everyone else does.

- Catch the major upside early by checking out these 3593 penny stocks with strong financials with strong financials and real momentum potential.

- Fuel your search for high-yield payouts with these 16 dividend stocks with yields > 3% offering attractive, consistent dividend returns above the industry average.

- Tap into the future of medicine by reviewing these 31 healthcare AI stocks and see which innovators are pushing healthcare boundaries using AI technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUTL

Autolus Therapeutics

A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives