- United States

- /

- Biotech

- /

- NasdaqGS:ASND

Is There an Opportunity in Ascendis Pharma After Regulatory Approval Fuels 52% Rally in 2025?

Reviewed by Bailey Pemberton

- Thinking about Ascendis Pharma and wondering if it could be a hidden value play? You are not alone. Investors are always searching for overlooked opportunities, and this biotech could be one to watch.

- The stock has surged 52.2% year-to-date and is up 54.1% over the past year. This indicates strong momentum and a shift in sentiment among investors.

- Recently, headlines around regulatory approvals and new partnerships have added fuel to the rally. These developments reflect growing optimism among market participants. At the same time, volatility has increased as news flow highlights both opportunities and ongoing industry challenges.

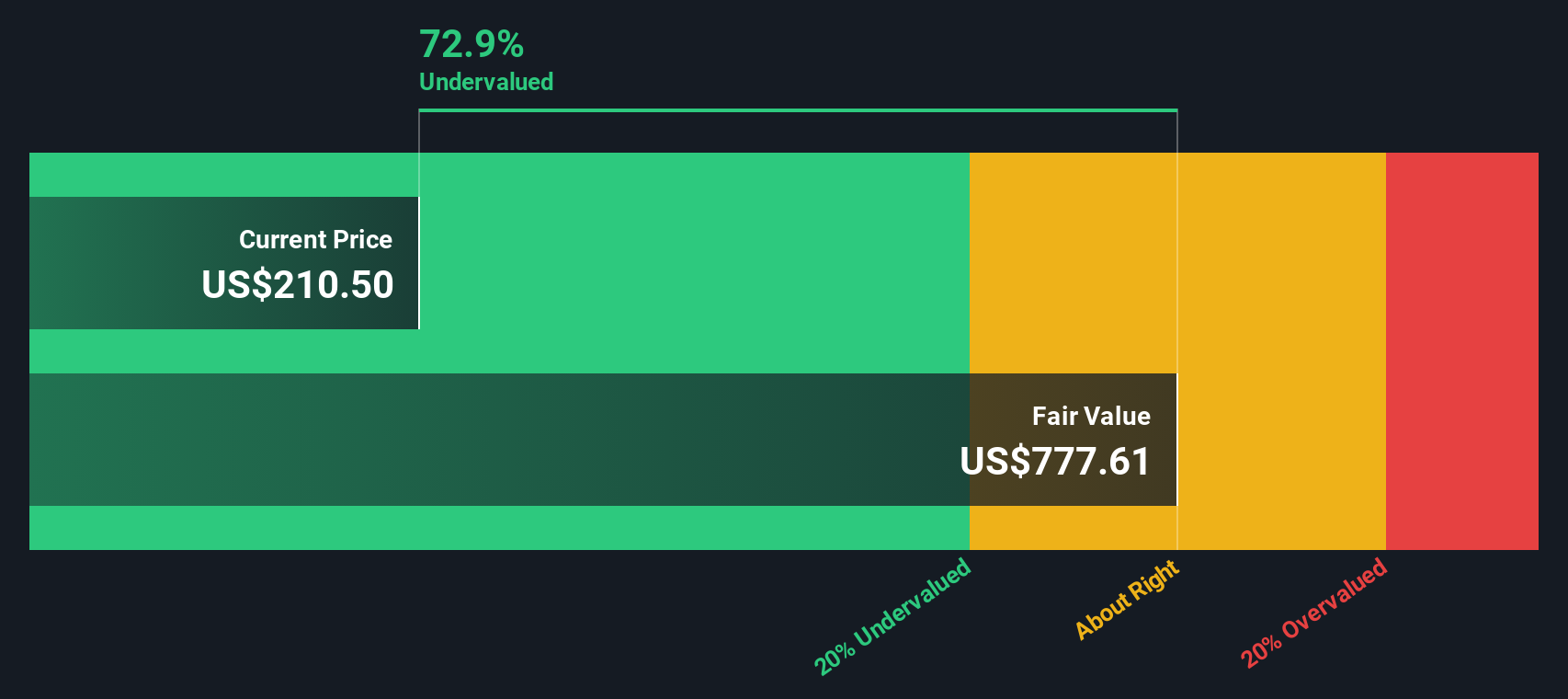

- Ascendis scores a 4 out of 6 on our valuation checks, meaning it appears undervalued in key areas. Let’s break down the numbers by method, but keep an eye out, as there is a smarter way to see valuation that we will reveal at the end.

Approach 1: Ascendis Pharma Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model takes Ascendis Pharma’s estimated future cash flows and discounts them back to today’s value to determine what the company is fundamentally worth. This method is commonly used to estimate intrinsic value by projecting how much cash the business could generate over time.

Currently, Ascendis Pharma’s last twelve months free cash flow sits at €-114 million, reflecting ongoing investment and development typical of growth-stage biotechs. Analyst estimates forecast a dramatic turnaround, with free cash flow expected to climb to €1.23 billion by 2029. Projections over the next decade, blending analyst input for five years with extrapolations thereafter, paint a picture of accelerating growth in operating cash generation.

Based on this 2 Stage Free Cash Flow to Equity analysis, the estimated intrinsic value of Ascendis Pharma’s shares stands at €738.38. Compared to the current market price, this valuation implies the stock is trading at a 71.6% discount to its calculated intrinsic worth. In summary, the DCF suggests that shares are fundamentally undervalued by a wide margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ascendis Pharma is undervalued by 71.6%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

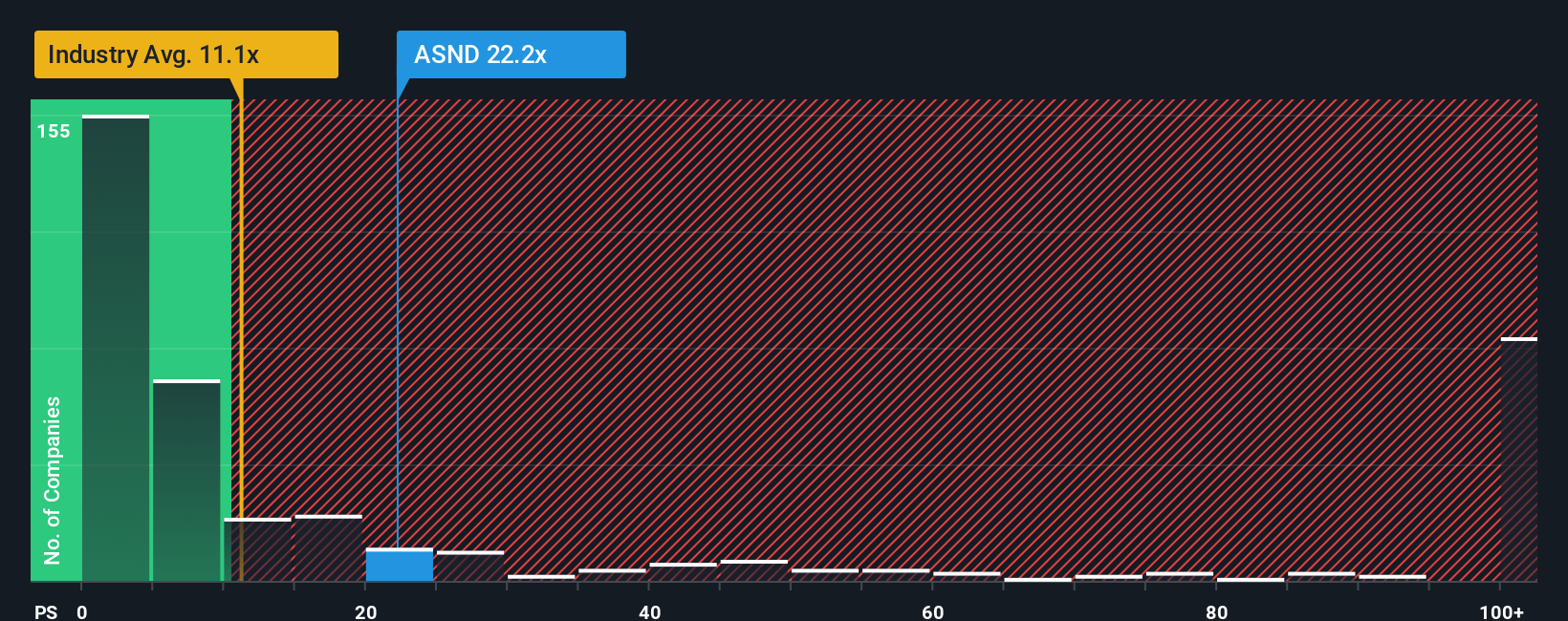

Approach 2: Ascendis Pharma Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred metric for valuing innovative biotech companies like Ascendis Pharma, especially when profitability is not yet established but revenue growth remains a key driver of value. This ratio allows investors to assess how the market values each dollar of sales, making it a useful yardstick when earnings are negative or highly volatile.

What is considered a “fair” P/S ratio can vary based on growth potential and company-specific risks. Companies expected to deliver rapid revenue expansion or enjoying lower risk profiles often command higher multiples, whereas slower or more unpredictable growers typically warrant lower ratios.

Ascendis Pharma currently trades on a P/S ratio of 17.12x. This is above the Biotechs industry average of 13.12x and below the average of its closest peers, which sits at 28.17x. More importantly, Simply Wall St’s proprietary “Fair Ratio” model assigns Ascendis a fair P/S ratio of 15.93x. This reflects factors unique to the company such as its growth outlook, profit margins, industry context, market capitalization, and risk profile.

Unlike traditional peer or sector comparisons, the Fair Ratio consolidates growth, profitability, and risk data. It offers a more individualized and precise benchmark for valuation. For Ascendis Pharma, the actual P/S ratio is just slightly above the Fair Ratio, suggesting the stock is trading close to what would be considered its intrinsic value based on this method.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

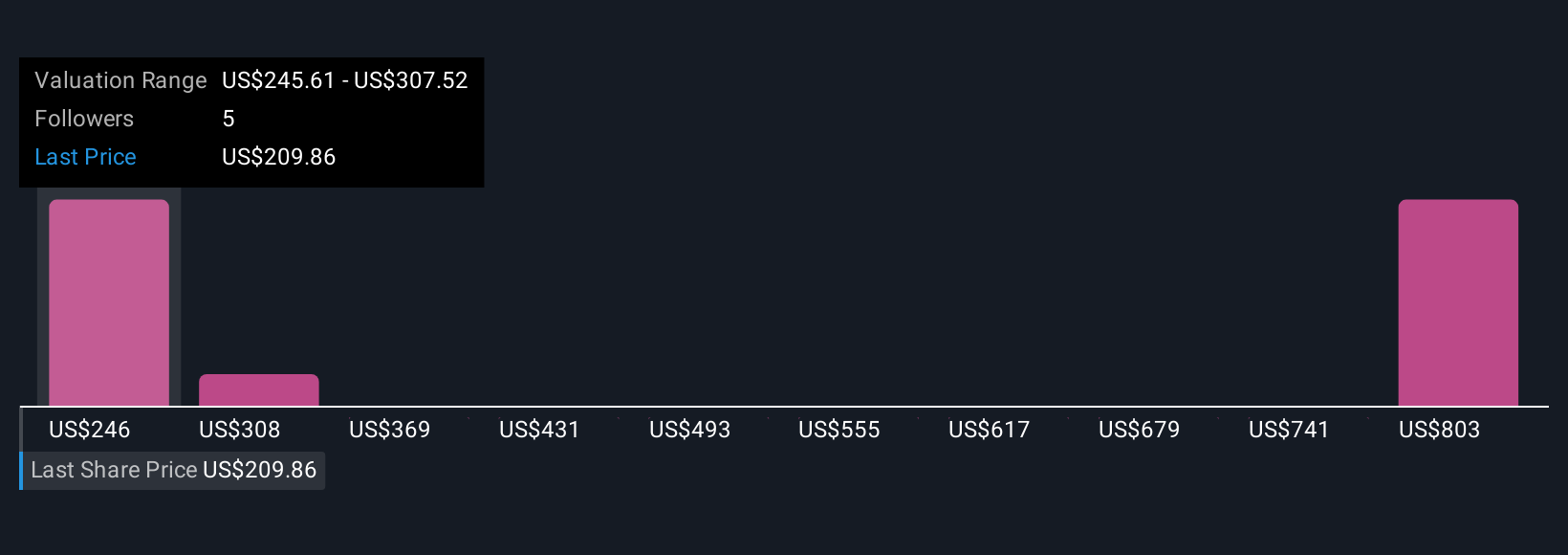

Upgrade Your Decision Making: Choose your Ascendis Pharma Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a straightforward way to attach your own story and assumptions, such as future revenue, earnings, and margins, to a company’s data, showing not just what the numbers are but why you believe they will play out as they do.

A Narrative links your investment perspective directly to a financial forecast and resulting fair value, helping you see how your thesis stacks up against others. This tool is free and accessible to all investors on Simply Wall St's Community page, where millions of investors publish and refine their views in real time.

Narratives are dynamic and automatically update as new information emerges, such as earnings releases or industry news, so your outlook stays relevant and your valuation adjusts with the facts. By comparing your Narrative’s Fair Value to the current Price, you get an objective way to decide when it might be time to buy, hold, or sell.

For example, one investor may expect Ascendis Pharma to reach the analysts’ highest target of $306.97 based on rapid uptake of new therapies and broad label expansion, while another estimates just $202.53, citing regulatory risks and cautious growth. This illustrates how Narratives turn market disagreement into actionable insight.

Do you think there's more to the story for Ascendis Pharma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success