- United States

- /

- Biotech

- /

- NasdaqGS:ASND

How Investors Are Reacting To Ascendis Pharma (ASND) Achieving First Positive Operating Income and Pooled Data Milestone

Reviewed by Sasha Jovanovic

- Ascendis Pharma reported third-quarter 2025 results showing revenue of €213.63 million and a net loss of €60.99 million, with improved financial performance, global expansion of key products like YORVIPATH and Skytrofa, and ongoing regulatory progress for its pipeline therapy TransCon CNP.

- A new pooled analysis revealed sustained three-year improvements in renal function and safety for adults with hypoparathyroidism treated with TransCon PTH, emphasizing the clinical value supporting product uptake and broader label potential.

- We'll explore how Ascendis Pharma's first positive operating income in Q3 2025 impacts its investment narrative and outlook for sustained growth.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ascendis Pharma Investment Narrative Recap

To be a shareholder in Ascendis Pharma, you need confidence in its ability to deliver sustained revenue growth from its endocrinology therapies, especially as the company pushes for broader commercialization and label expansion in major global markets. While strong Q3 2025 financial results and positive operating income support the outlook for near-term growth, the key catalyst, potential approval for TransCon CNP in achondroplasia, remains unchanged, with regulatory risk and pipeline execution still the biggest factors to watch.

Among recent announcements, the three-year clinical data on TransCon PTH stands out, reinforcing the clinical reputation behind YORVIPATH’s global rollout and helping support its adoption by providers and payers. This type of label-supporting evidence directly bolsters the commercial argument as the company navigates regulatory and competitive challenges around its core endocrinology franchise.

But despite these advances, investors should not lose sight of the significant risks that come with ongoing high operating and R&D costs, as even robust revenue growth can quickly lose its shine if...

Read the full narrative on Ascendis Pharma (it's free!)

Ascendis Pharma's narrative projects €2.2 billion in revenue and €826.6 million in earnings by 2028. This requires 63.9% yearly revenue growth and an earnings increase of €1.10 billion from the current level of €-271.2 million.

Uncover how Ascendis Pharma's forecasts yield a $258.77 fair value, a 27% upside to its current price.

Exploring Other Perspectives

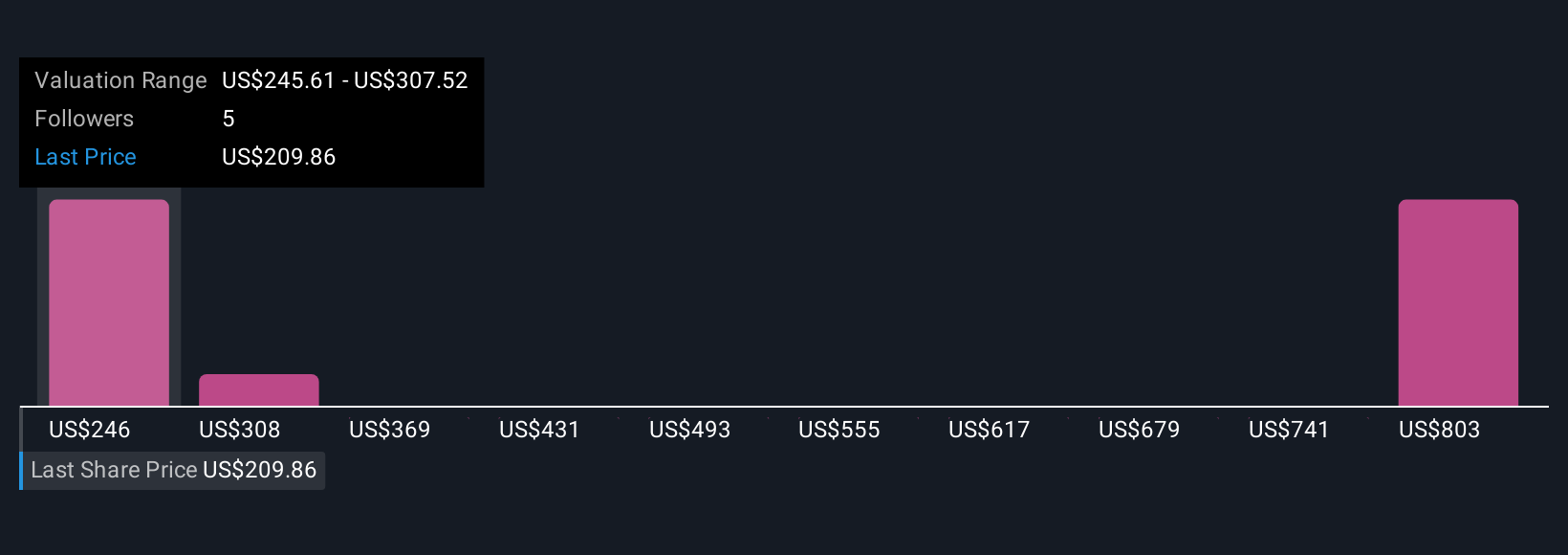

Simply Wall St Community members provided four independent fair value estimates between €193.36 and €620.99 for Ascendis Pharma shares. Rapid global uptake of YORVIPATH, supported by improved clinical data, is top of mind for many contributors as they weigh future growth scenarios.

Explore 4 other fair value estimates on Ascendis Pharma - why the stock might be worth 5% less than the current price!

Build Your Own Ascendis Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascendis Pharma research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ascendis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascendis Pharma's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives