Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

The market has been flat over the last week but is up 33% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 255 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Ascendis Pharma (NasdaqGS:ASND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascendis Pharma A/S is a biopharmaceutical company dedicated to developing therapies for unmet medical needs, with a market cap of $8.63 billion.

Operations: Ascendis Pharma A/S specializes in developing biopharmaceutical therapies, generating €317.63 million from its biotechnology segment. The company focuses on addressing unmet medical needs within the healthcare sector.

Ascendis Pharma's recent strategic moves, including a successful $300 million follow-on equity offering and a significant product submission to the FDA for TransCon hGH, underscore its proactive approach in addressing growth hormone deficiencies across various demographics. The company's R&D dedication is evident with 67.8% projected annual earnings growth and an impressive 39.7% forecasted revenue increase per year, highlighting its potential in the competitive biotech landscape. These developments not only enhance Ascendis' market position but also demonstrate its commitment to expanding treatment options and improving patient outcomes through sustained innovation and strategic market maneuvers.

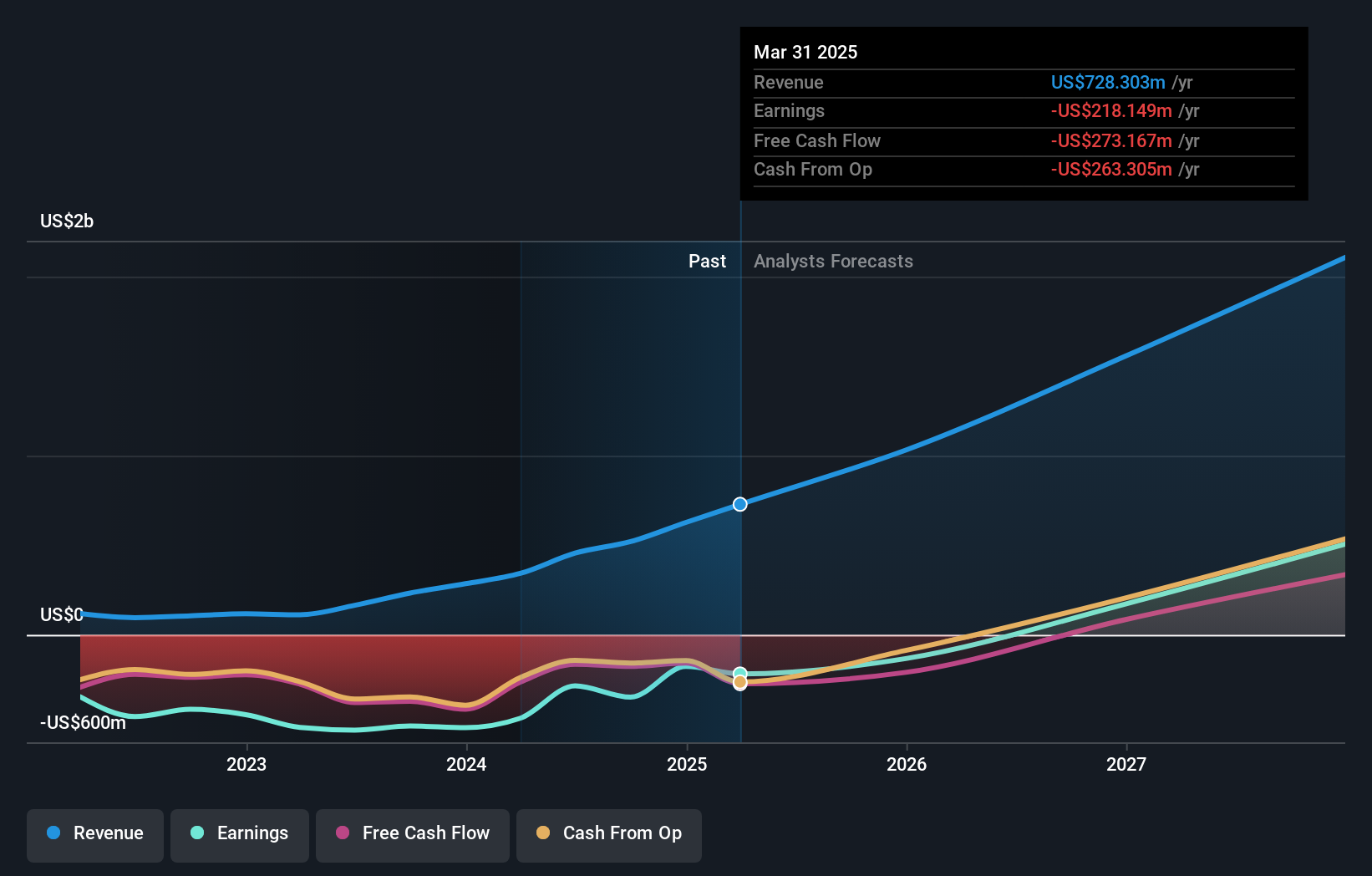

CyberArk Software (NasdaqGS:CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CyberArk Software Ltd., along with its subsidiaries, develops, markets, and sells software-based identity security solutions and services globally, with a market cap of $12.21 billion.

Operations: CyberArk Software Ltd. generates revenue primarily from its security software and services, totaling $860.60 million. The company's operations span the United States, Europe, the Middle East, Africa, and other international markets.

CyberArk Software has demonstrated a robust commitment to enhancing cybersecurity, evidenced by its recent partnership with RBL Finserve and SAP Enterprise Cloud Services to fortify identity security. With an impressive 42.5% projected earnings growth and a revenue increase of 16.5% per year, CyberArk is aligning its strategic initiatives with significant market needs for advanced security solutions. The company raised its 2024 revenue guidance to between $932 million and $942 million, reflecting confidence in continued demand for its comprehensive identity security platforms, which are crucial in today’s digital landscape where data breaches are increasingly common. This proactive approach not only secures CyberArk's position in the tech sector but also underscores its potential to influence future cybersecurity standards globally.

- Unlock comprehensive insights into our analysis of CyberArk Software stock in this health report.

Assess CyberArk Software's past performance with our detailed historical performance reports.

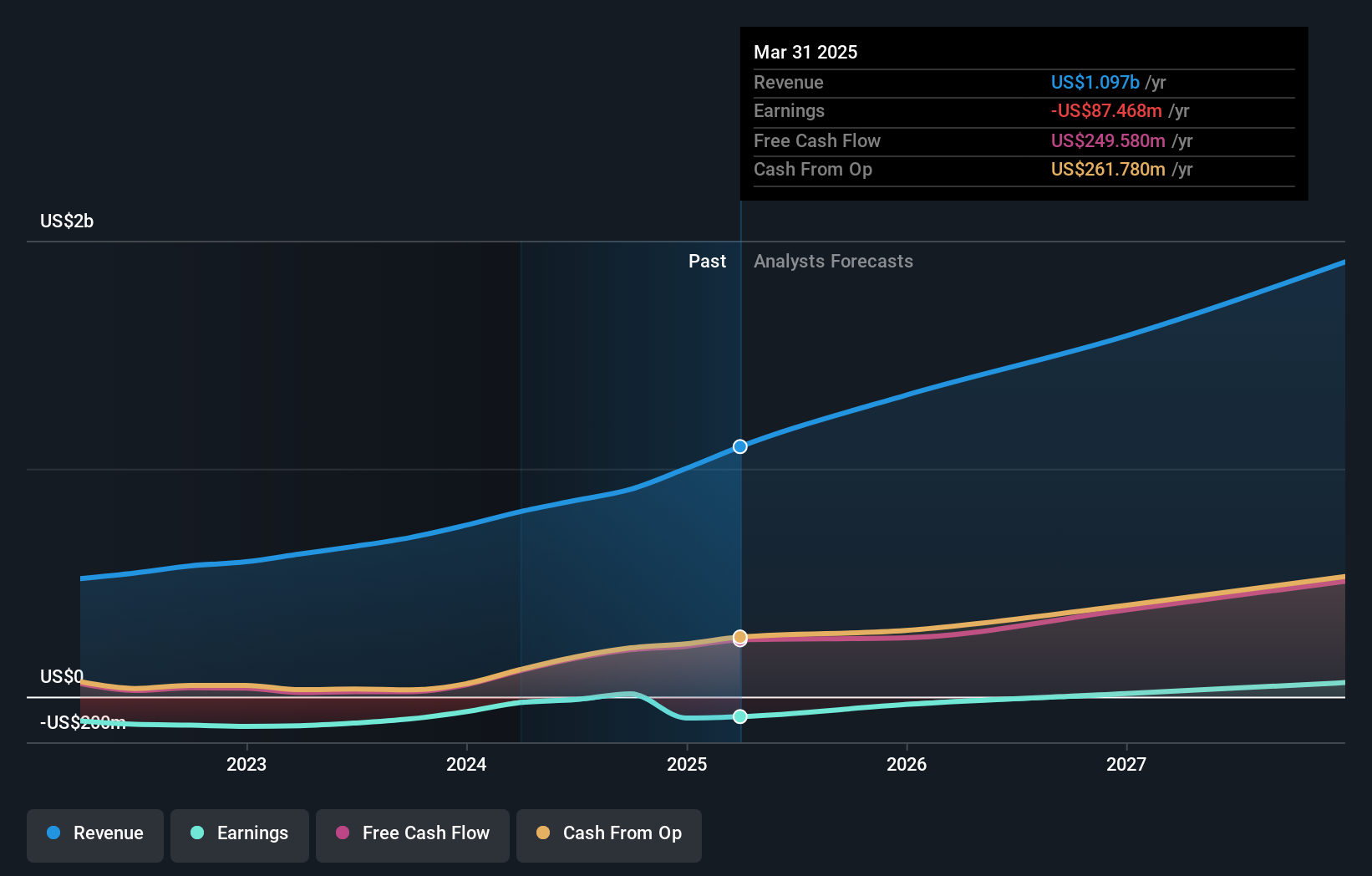

Legend Biotech (NasdaqGS:LEGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Legend Biotech Corporation is a clinical-stage biopharmaceutical company focused on the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally with a market cap of $9.08 billion.

Operations: Legend Biotech Corporation generates revenue primarily from its biotechnology segment, which reported $455.99 million. The company focuses on developing innovative cell therapies for oncology and other medical conditions across multiple regions, including the United States and China.

Legend Biotech's recent advancements in multiple myeloma treatment underscore its innovative edge within the biotech sector, particularly with CARVYKTI® demonstrating a 45% reduction in mortality risk compared to standard therapies. This breakthrough, coupled with a robust R&D commitment—evidenced by significant investment and promising trial outcomes—positions Legend for impactful growth. The company’s strategic focus on advanced cell therapies not only enhances its portfolio but also aligns with broader industry trends towards personalized medicine, potentially setting new standards in cancer treatment efficacy and patient care.

- Click here to discover the nuances of Legend Biotech with our detailed analytical health report.

Evaluate Legend Biotech's historical performance by accessing our past performance report.

Next Steps

- Click here to access our complete index of 255 US High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

A clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally.