- United States

- /

- Biotech

- /

- NasdaqGS:ASND

Did a Fatal Adverse Event Just Shift Ascendis Pharma's (ASND) Yorvipath Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, an FDA adverse event report disclosed the death of a patient who had been treated with Ascendis Pharma’s hypoparathyroidism drug, Yorvipath, in a case complicated by multiple health issues and medications.

- This update has raised important questions about the safety profile of Yorvipath and the extent of possible regulatory scrutiny, even though the causal relationship remains undetermined.

- We will explore how heightened regulatory concerns around Yorvipath’s safety profile could influence Ascendis Pharma’s investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Ascendis Pharma Investment Narrative Recap

At its core, the investment thesis for Ascendis Pharma revolves around accelerating global commercialization of Yorvipath and Skytrofa, backed by pipeline expansion from the TransCon platform. The recent FDA adverse event report referencing a Yorvipath-treated patient has heightened regulatory uncertainty, but there is currently no established causal link that materially impacts the company’s biggest near-term catalyst, the continuation of its broad label approvals and international launches.

The company’s late-stage pipeline remains active, including its recent submission of a Marketing Authorisation Application for TransCon CNP in Europe for achondroplasia, an announcement that underscores management’s focus on regulatory milestones as key growth catalysts. The context of this pipeline progress, alongside concerns raised by recent safety reports, frames the short-term balance between commercial momentum and regulatory vigilance.

However, it is important to highlight that, in contrast to the company’s global expansion efforts, investors should keep in mind...

Read the full narrative on Ascendis Pharma (it's free!)

Ascendis Pharma's narrative projects €2.2 billion revenue and €826.6 million earnings by 2028. This requires 63.9% yearly revenue growth and a €1,097.8 million earnings increase from €-271.2 million.

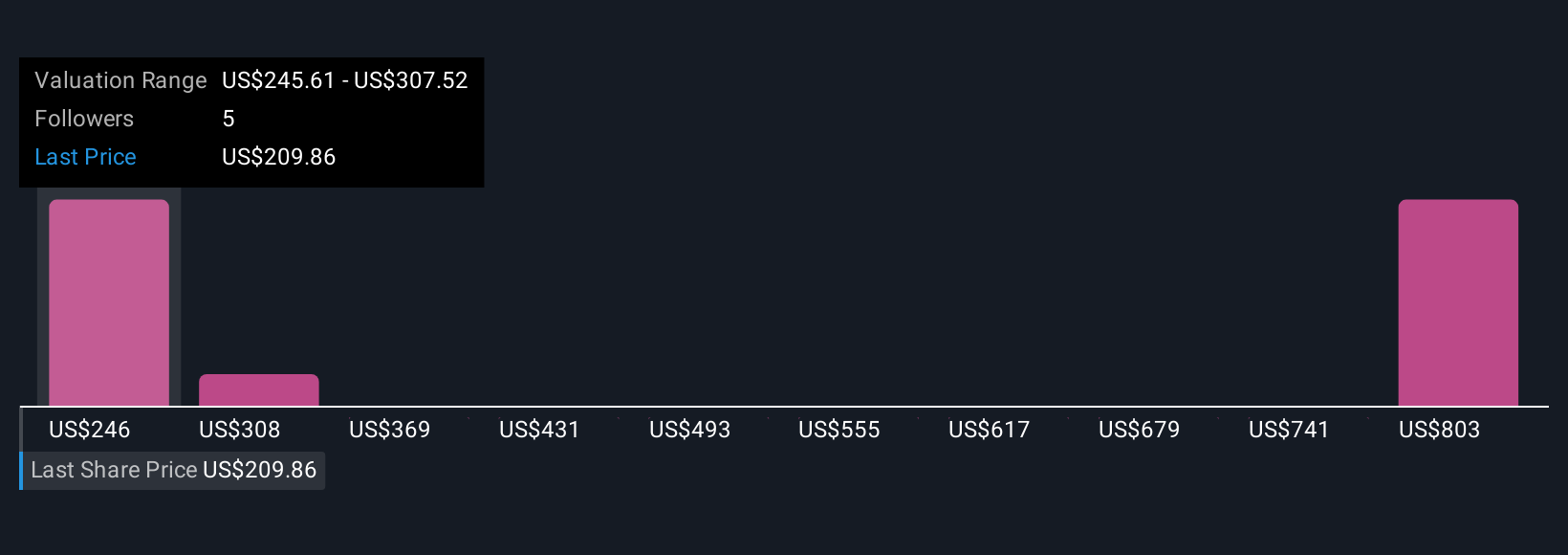

Uncover how Ascendis Pharma's forecasts yield a $245.61 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Ascendis Pharma ranging from US$193 to US$772 per share. With regulatory developments in focus, investors may benefit from understanding why opinions differ so widely on the potential revenue and risk trajectory for the business.

Explore 4 other fair value estimates on Ascendis Pharma - why the stock might be worth just $193.36!

Build Your Own Ascendis Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascendis Pharma research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ascendis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascendis Pharma's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives