- United States

- /

- Biotech

- /

- NasdaqGS:ASND

Assessing Ascendis Pharma (NasdaqGS:ASND) Valuation Following Expanded SKYTROFA Launch for Adult Growth Hormone Deficiency

Reviewed by Simply Wall St

Ascendis Pharma (NasdaqGS:ASND) just announced that its SKYTROFA (TransCon hGH) is now broadly available in the United States, with expanded dosing options for adults with growth hormone deficiency. This development could shift the company’s revenue outlook by increasing market reach.

See our latest analysis for Ascendis Pharma.

After an impressive year for Ascendis Pharma, this expanded SKYTROFA launch is adding to its momentum. The stock has a robust year-to-date share price return of 49%, and a stellar 1-year total shareholder return of 62%. This indicates that market confidence is clearly building on recent product milestones.

If breakthroughs like this have you searching for more innovation stories, it could be a great time to discover See the full list for free.

With such strong recent gains and encouraging fundamentals, investors may be wondering: does Ascendis Pharma’s accelerating growth mean the stock still has room to run, or has the market already priced in those expectations?

Most Popular Narrative: 16.2% Undervalued

Ascendis Pharma is attracting attention with a fair value estimate of $245.61, notably higher than its last close of $205.91. The narrative builds on major commercial advances and momentum from new launches.

Expansion of SKYTROFA into adult growth hormone deficiency and pursuit of further label extensions (pediatric and multiple rare indications), alongside continued dominance in pediatric GHD, broadens the addressable market and enables new recurring revenue streams. This contributes to both revenue growth and improving long-term earnings stability.

Want to see what’s fueling the bold valuation? The secret lies in ambitious revenue targets and a margin leap rarely seen in biopharma. Find out how analysts are forecasting explosive earnings growth that rewrites the company’s long-term story.

Result: Fair Value of $245.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive therapies gaining ground or delays in key regulatory approvals could challenge Ascendis Pharma’s robust growth outlook in the coming years.

Find out about the key risks to this Ascendis Pharma narrative.

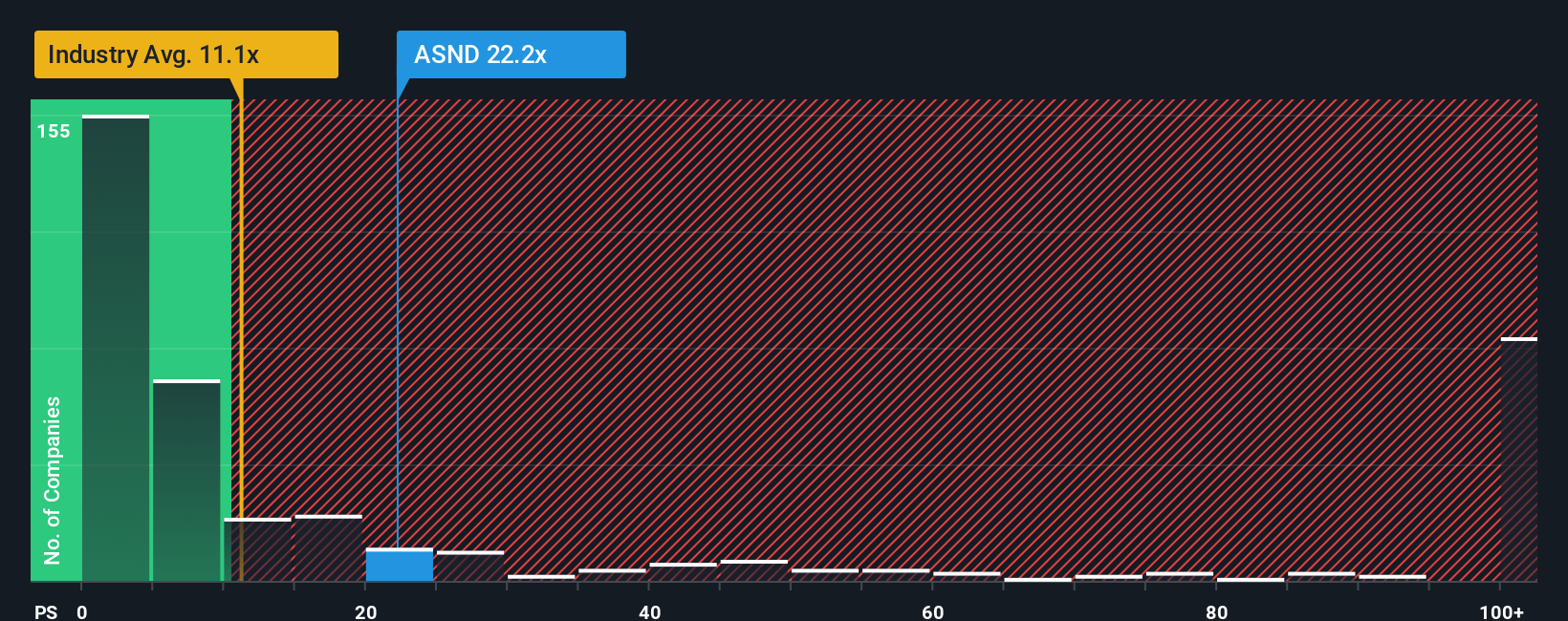

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-sales, Ascendis Pharma’s current ratio is 22x. This is almost double the US Biotechs industry average of 11.3x, but below the peer average of 32.9x. However, it remains well above the fair ratio of 16.4x, suggesting investors are paying a premium for future growth that may or may not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ascendis Pharma Narrative

If you want to dig even deeper or craft your own perspective, you can build a custom Ascendis Pharma story in just a few minutes, your way with Do it your way.

A great starting point for your Ascendis Pharma research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to sharpen your edge? The Simply Wall Street Screener uncovers standout stocks in minutes. Don’t be the one who misses the next big trend; your smartest moves start here.

- Tap into future-defining trends by checking out these 28 quantum computing stocks where quantum computing breakthroughs could reshape entire industries.

- Put your money to work with these 21 dividend stocks with yields > 3% and access companies offering attractive yields above 3% for growing portfolio income.

- Seize emerging market potential by exploring these 26 AI penny stocks packed with AI innovators at the forefront of the technology revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives