- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Is Arrowhead Pharmaceuticals Fairly Priced After Its 90% Year to Date Share Surge in 2025?

Reviewed by Bailey Pemberton

Trying to decide whether to buy, hold, or sell Arrowhead Pharmaceuticals? You’re not alone. The stock’s journey lately has caught the attention of investors looking for signs of growth and compelling value. Over the last year, Arrowhead’s share price has soared an impressive 87.4%, with a massive 90.1% climb year-to-date. That is quite a leap for a company that, just three years ago, looked to be treading water, with only a 12.5% gain in that period and a five-year return still sitting at -35.7%.

So, what has been fueling these moves? Much of the optimism in recent months traces back to Arrowhead’s pipeline updates and collaborative research agreements with major pharmaceutical players. These developments have signaled to the market that Arrowhead’s RNA-based drug platform may be on the cusp of translating into meaningful clinical and commercial success. As enthusiasm has grown, so too has its stock price, though last week the price pulled back by 4.2% after a sharp rally throughout the month of May.

With all this volatility, valuation becomes a crucial consideration. Arrowhead currently scores a 5 out of 6 on our value checklist, suggesting the company is undervalued by most conventional measures. But what does that mean for you as an investor? Up next, we will break down the ways analysts typically assess a stock’s value. Then, stick around for one approach that may give you an even clearer perspective on Arrowhead's potential.

Approach 1: Arrowhead Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Arrowhead Pharmaceuticals, this approach uses a 2 Stage Free Cash Flow to Equity model based on analyst forecasts and further extrapolations.

Currently, Arrowhead reports a free cash flow of -$225.3 million, with analysts expecting continued negative cash flows for the next several years. Estimates project free cash flow to reach -$258.4 million in 2026 and improve to $189.2 million by 2030. Beyond that, Simply Wall St further extrapolates growth in free cash flows out to 2035, suggesting a significant turnaround in the company's operating cash generation.

Using these inputs, the calculated intrinsic value lands at $57.85 per share. Compared with the recent share price, this implies Arrowhead is trading at a 35.4% discount. This suggests it may be undervalued based on future cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arrowhead Pharmaceuticals is undervalued by 35.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Arrowhead Pharmaceuticals Price vs Sales

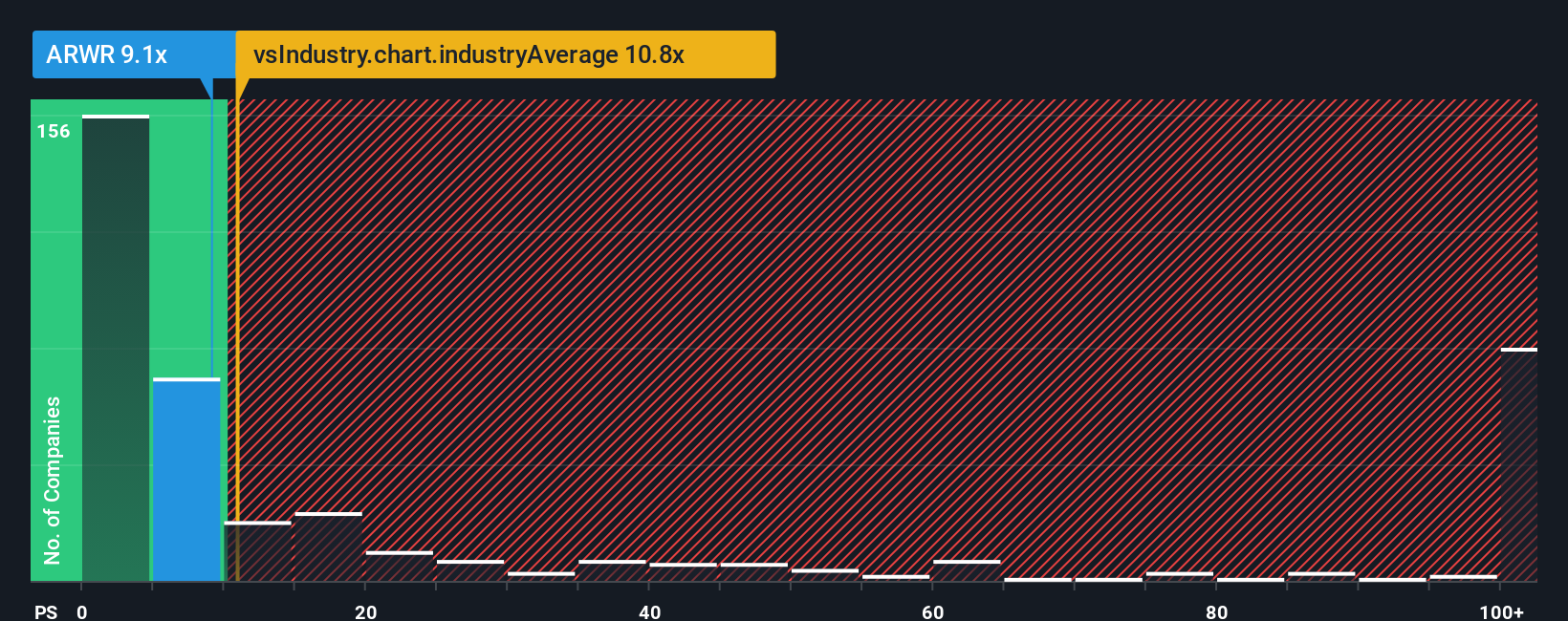

The Price-to-Sales (P/S) ratio is often the preferred valuation multiple for companies like Arrowhead Pharmaceuticals that are not yet consistently profitable. Since earnings are negative, P/S provides a clearer picture of how the market values each dollar of sales, regardless of the company's current profit or loss position.

Determining what constitutes a "normal" or "fair" P/S ratio depends on several factors, including a company's growth outlook and its perceived risk. Fast-growing or lower-risk companies typically command higher P/S multiples, reflecting investor optimism about future sales expansion and business stability.

Arrowhead’s current P/S ratio is 9.0x. When compared to the Biotechs industry average of 10.8x and its peer average of 11.3x, Arrowhead trades at a modest discount. However, a simple comparison to industry or peer averages does not tell the full story.

This is where Simply Wall St’s "Fair Ratio" comes into play. The Fair Ratio estimates what the company’s P/S multiple should be by factoring in its growth prospects, profit margins, market capitalization, business risks, and sector specifics. Because it is tailored to Arrowhead’s specific circumstances rather than broad averages, the Fair Ratio presents a more nuanced view of fair value for investors.

Currently, Arrowhead’s Fair Ratio is 9.2x, while the actual P/S is 9.0x. The difference is less than 0.10, suggesting that the current market price is closely aligned with its underlying business fundamentals based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arrowhead Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story or perspective behind a stock, combining what you believe about a company’s outlook with your assumptions for fair value, future revenue, earnings, and margins. By connecting the company’s story to its financial forecasts and resulting fair value, Narratives give you a practical and holistic tool for making investment decisions.

Narratives are easy to create and access using the Simply Wall St Community page, where millions of investors compare, refine, and update their perspectives. This feature helps you decide when to buy or sell by directly comparing your (or the community’s) Fair Value estimate to the actual market price. Since Narratives update dynamically as new news or earnings are released, your insights stay current.

For example, with Arrowhead Pharmaceuticals, some investors are highly bullish and set a Narrative Fair Value as high as $80 per share based on expectations of strong clinical success and expanding partnerships. Others take a more cautious stance with a fair value closer to $17, reflecting concerns about clinical risks or reliance on milestone payments. Narratives let you transparently see and adjust for these differing viewpoints, so your investment decision is grounded in both the numbers and the story you believe.

Do you think there's more to the story for Arrowhead Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives