- United States

- /

- Pharma

- /

- NasdaqGS:ARVN

Investors bid Arvinas (NASDAQ:ARVN) up US$225m despite increasing losses YoY, taking five-year CAGR to 10%

It hasn't been the best quarter for Arvinas, Inc. (NASDAQ:ARVN) shareholders, since the share price has fallen 27% in that time. But the silver lining is the stock is up over five years. However we are not very impressed because the share price is only up 64%, less than the market return of 102%. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 47% decline over the last three years: that's a long time to wait for profits.

Since the stock has added US$225m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Arvinas

Arvinas wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Arvinas saw its revenue grow at 36% per year. Even measured against other revenue-focussed companies, that's a good result. While long-term shareholders have made money, the 10% per year gain over five years fall short of the market return. That's surprising given the strong revenue growth. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

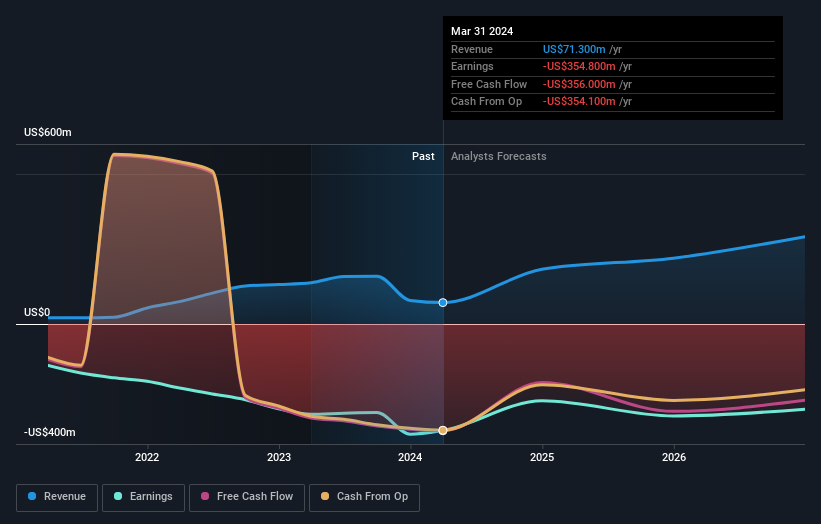

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Arvinas is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Arvinas shareholders have received a total shareholder return of 46% over one year. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Arvinas , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARVN

Arvinas

A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

Flawless balance sheet with limited growth.