- United States

- /

- Biotech

- /

- NasdaqGS:ARQT

Arcutis Biotherapeutics (ARQT): Projected 24% Annual Revenue Growth Shapes Value Narrative Ahead of Earnings

Reviewed by Simply Wall St

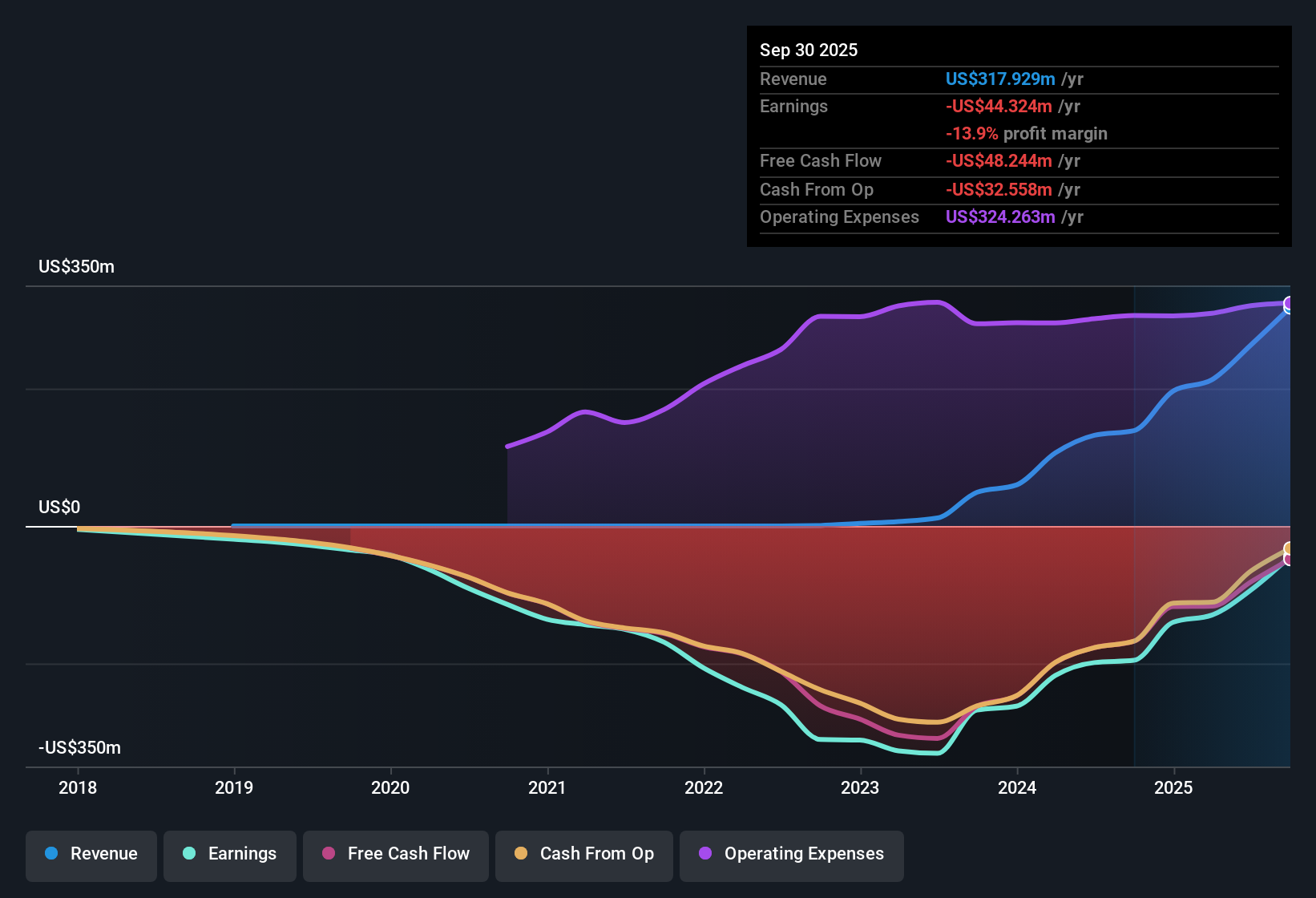

Arcutis Biotherapeutics (ARQT) remains unprofitable but has managed to shrink its losses over the last five years, recording a 3.3% annual rate of improvement. The company’s revenue is projected to grow at 24% per year, notably faster than the US market average of 10.2%. With a negative net profit margin but a favorable Price-to-Sales Ratio of 9.7x, trading well below biotech peers and the broader industry, Arcutis offers a compelling risk and reward setup focused squarely on strong growth and relative value arguments.

See our full analysis for Arcutis Biotherapeutics.Now, let’s see how these headline results stack up against the market’s favorite narratives and whether the numbers reinforce or challenge the story so far.

See what the community is saying about Arcutis Biotherapeutics

ZORYVE Expansion Drives Growth Runway

- Analysts predict Arcutis’s revenue will climb by 37.0% per year over the next three years, primarily on deepening penetration of ZORYVE into large, underserved groups like pediatric atopic dermatitis and scalp psoriasis.

- Analysts' consensus view highlights two key drivers supporting the bullish case for top-line growth:

- The company benefits from rising demand for innovative non-steroidal treatments and is expanding its addressable market by adding new ZORYVE indications and forging strategic partnerships. Management believes this should lead to revenue and margin improvement through diversification and operating leverage.

- Ongoing R&D investment, coupled with societal trends such as the shift away from chronic steroid use and a growing population of dermatologic patients, supports a longer-term expansion arc for Arcutis. As new channels and payers adopt ZORYVE, this strengthens the durability of growth beyond initial launch windows.

- While bullish expectations focus on rapidly expanding sales, analysts are also tracking whether Arcutis can efficiently convert its specialty position and new partnerships into sustained margin improvement and reduced earnings volatility.

Margin Reversal Hinges on Single Product Risk

- Profit margin is currently -35.4% but is expected by analysts to rebound sharply, reaching +35.0% within three years as operating leverage and revenue mix improve.

- Analysts' consensus view draws attention to a major risk around ZORYVE concentration:

- With most revenue tied to a single franchise, any stumble in ZORYVE’s uptake, greater than expected payer resistance, or competitive encroachment could undermine the explosive profit rebound currently forecasted. This is particularly important given a limited internal pipeline and high ongoing R&D and SG&A spend, which continue to pressure cash flow.

- Bears point out that persistent negative margins and the threat of generic or biosimilar competitors could force Arcutis into dilutive capital raises or increased debt, both of which would erode future earnings per share and dampen the path to sustainable profitability if not offset by ongoing margin gains.

Discounted Valuation Versus Biotech Peers

- The company’s Price-to-Sales Ratio of 9.7x stands below the average for both peers (14.3x) and the overall US biotech industry (11.4x), reflecting a relative value discount even as revenue growth outpaces the sector.

- Analysts' consensus narrative underscores the investor debate over current versus fair value:

- While some see room for valuation multiples to rise as Arcutis delivers on growth targets and margin recovery, others remain cautious. Current unprofitability and the over-reliance on one product keep the stock at a discount to sector averages despite the promise of accelerating sales and an analyst price target of 28.13, about 11% above the present share price of 25.29.

- This discounted multiple may entice value-focused investors, but only if Arcutis can deliver both geographic and portfolio diversification, improving its risk profile in line with positive revenue and margin projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arcutis Biotherapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the data? Shape your perspective into a personalized narrative in just a few minutes. Do it your way

A great starting point for your Arcutis Biotherapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

While Arcutis is growing revenue quickly, its heavy reliance on a single product and ongoing margin pressures make its path to stable profitability uncertain.

If you want to focus on companies delivering consistent revenue and earnings growth without these risks, check out stable growth stocks screener (2121 results) for reliable performers that do not rely on single product bets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARQT

Arcutis Biotherapeutics

A biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives