- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Ardelyx (ARDX): Forecasted 20% Revenue Growth and Profitability Timeline Shape Investor Expectations Ahead of Earnings

Reviewed by Simply Wall St

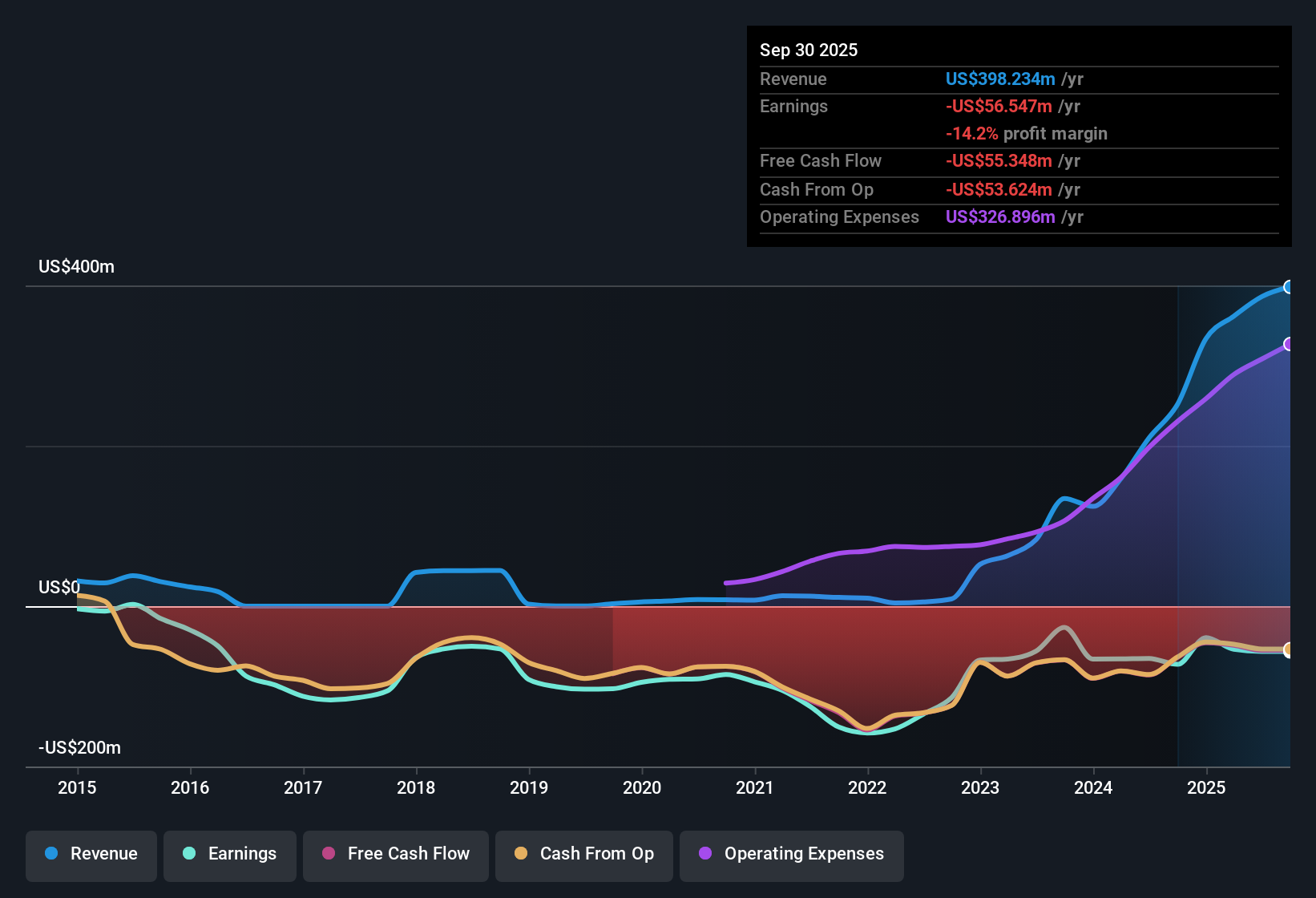

Ardelyx (ARDX) remains unprofitable but has managed to shrink its losses by 20% annually over the past five years, with the company now on track to achieve profitability within the next three years. Earnings are projected to surge 69.83% per year, while revenue is forecast to climb 20.1% annually, which is more than double the pace of the wider US market's expected 10.3% growth. With a net profit margin still in negative territory, investors are likely to focus on the positive outlook for both profit and revenue growth entering this earnings season.

See our full analysis for Ardelyx.Up next, we’ll see how these headline numbers compare to the prevailing narratives, reinforcing some investor expectations while challenging others.

See what the community is saying about Ardelyx

DCF Fair Value Suggests Major Upside

- With the share price at $6.06 and a DCF fair value of $57.12, shares are trading at a substantial discount. This suggests the market may not be pricing in the company’s forecasted path to profitability within the next three years.

- According to the analysts' consensus, Ardelyx’s revenue is projected to grow by 22.2% annually over the next three years, with margins also expected to swing from -14.6% today to 25.4%. This kind of improvement strongly supports the idea that valuation could quickly catch up as these numbers materialize.

- Consensus narrative notes that diversifying through international partnerships and new indications may help lower earnings risk and support resilient growth, adding further backing for the optimistic view on valuation.

- What stands out is how the current discount compared to both peer and industry price-to-sales ratios (3.7x versus 4.3x and 11.2x) may further accelerate rerating potential if new milestones are achieved.

Want to see how analysts and the community connect these numbers to the future? Start with the full consensus narrative for Ardelyx. 📊 Read the full Ardelyx Consensus Narrative.

Profit Margin Turnaround in Focus

- Net profit margin is currently negative but is forecast to improve from -14.6% to 25.4% in the next three years based on analysts’ models.

- Consensus narrative continues to reinforce the notion that expanding market access, international partnerships, and prescription growth are catalyzing this projected margin turnaround.

- Consensus highlights how new partnerships, increased prescriber coverage, and leveraging fixed costs could help drive stronger margins and cash flows as revenues accelerate.

- However, the consensus warns of reliance on major payers like Medicare for key products, which means regulatory setbacks could challenge these margin forecasts if not carefully managed.

Peer Valuation Gap Stands Out

- Ardelyx’s price-to-sales ratio of 3.7x trades notably below both its direct peer average of 4.3x and the broader US biotech industry at 11.2x. This offers meaningful relative value for investors looking for growth at a discount.

- Analysts’ consensus argues that sustained revenue expansion enabled by a broadening product footprint and durable demand for core therapies puts Ardelyx in a strong position for a valuation catch-up compared to peers.

- However, analysts acknowledge that a narrow product base and ongoing reimbursement risk, such as dependence on a single major payer, could limit how quickly this discount closes relative to industry norms.

- Consensus also notes share dilution potential, with shares outstanding expected to grow 1.74% per year, underscoring the importance of monitoring capital structure as the business scales up.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ardelyx on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? In just a few minutes, you can shape your own view and share your perspective. Do it your way

A great starting point for your Ardelyx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Ardelyx’s revenue outlook is strong, reliance on a narrow product base and reimbursement risks could weigh on future financial stability.

If you want to focus on companies with steadier revenue streams and less exposure to single-product risk, use our stable growth stocks screener (2103 results) to spot those delivering consistent, reliable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives